Crypto Gainers: MemeCore, Pump.fun rally as World Liberty Financial struggles

- MemeCore hit an all-time high with a 34% jump on Thursday.

- Pump.fun token gains traction amid new creator fee model.

- World Liberty Financial token tanks below listing price on Binance.

MemeCore (M), Pump.fun (PUMP) has outperformed the broader cryptocurrency market in the last 24 hours, while the US President Trump’s World Liberty Financial (WLFI) drops below its listing price on Binance. The technical outlook for the crypto gainers puts key resistance levels at focus, while the WLFI token struggles for a concrete ground.

MemeCore hits record high

MemeCore edges higher by 1% at press time on Friday, building on the 34% jump from the previous day. The uptrend in the meme coin has expanded for eight days, after reaching a record high of $1.50 on Thursday.

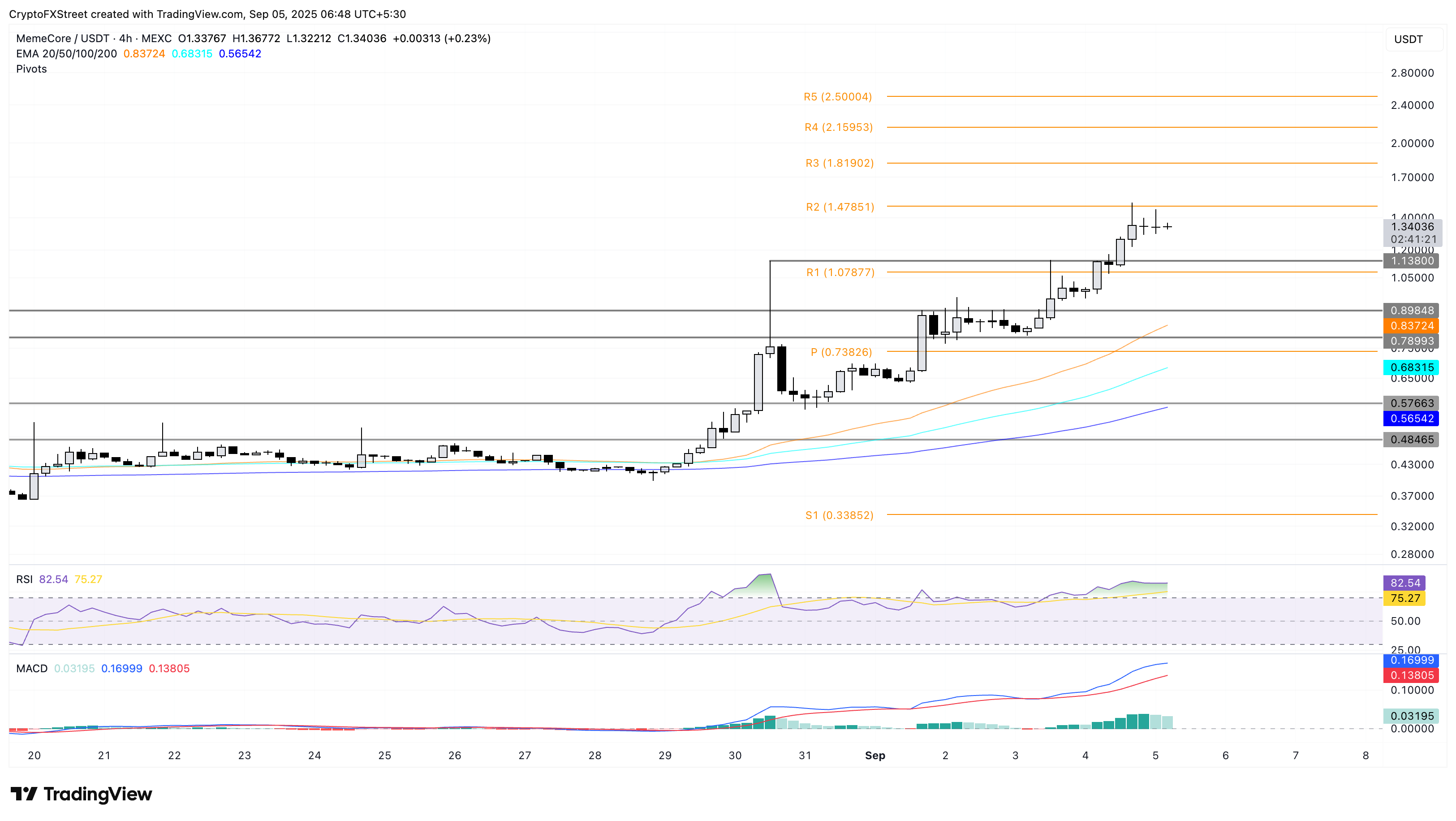

The bullish run faces opposition at the $1.47 level, aligning with the R2 pivot level on the 4-hour chart. A decisive close above this level could stretch the uptrend to $1.81, aligning with the R3 pivot level.

The momentum indicators on the same chart indicate a bullish bias as the Moving Average Convergence Divergence (MACD) and its signal line extend the uptrend. Additionally, the Relative Strength Index (RSI) at 83 hovers into the overbought zone, indicating heightened buying pressure.

M/USDT 4-hour price chart.

Looking down, MemeCore could retest the $1.13 support level, marked by the Saturday high, if the uptrend reverses on the downside.

Pump.fun eyes further gains as bullish momentum builds

Pump.fun extends the uptrend for the fifth consecutive day, with a 2% surge so far on Friday. The launchpad token gains traction with the new creator fee model that has renewed interest in Solana-based meme coins.

PUMP edges above the R2 pivot level at $0.004335, and a successful close above this could target the R3 pivot level at $0.004952.

Adding to the upside chances, the MACD indicator displays an uptrend in the MACD and signal lines, indicating a steady bullish momentum. Still, the RSI at 67 remains volatile under the overbought boundary, posing a risk of potential reversal.

PUMP/USDT 4-hour price chart.

Looking down, a failure to keep buoyant above $0.004335 could dump the PUMP token to $0.003849.

World Liberty Financial token risks further losses

World Liberty Financial token trades below $0.20, extending the downfall for the fourth consecutive day after reaching a record high of $0.47 on Monday. Despite the proposal to buy back and burn tokens with 100% of the WLFI treasury liquidity fees, the token fails to regain strength and has dropped below its listing price on Binance.

WLFI token market data. Source: CoinMarketCap

The Etherscan data highlights 47 million WLFI tokens burned on Wednesday, while the declining trend has dropped the market capitalization of WLFI to $4.5 billion.

As the declining trend continues, the WLFI token could risk further losses below the record low of $0.16 from the previous day.