Chainlink Price Forecast: LINK surges on Department of Commerce partnership to bring economic data on-chain

Chainlink price today: $24.7

- Chainlink partnered with the US Department of Commerce to integrate macroeconomic data on-chain.

- The announcement follows Commerce Secretary Howard Lutnick's comment that the Department will make economic data available on blockchains.

- LINK could rally to $30.8 if it holds an ascending trendline support and clears the $27.4 resistance.

Chainlink (LINK) is up nearly 4% on Thursday after announcing a partnership with the US Department of Commerce (DOC) to launch six economic data points across ten blockchains, including Ethereum, Avalanche and Solana.

Chainlink partners with US Department of Commerce

Chainlink has partnered with the US Department of Commerce to help foster the integration of economic data on-chain, a statement on Thursday reveals.

The collaboration will bring US macroeconomic data on-chain from the Bureau of Economic Analysis (BEA) using Chainlink's Data Feeds.

The Department stated that it has published an official hash of its second-quarter GDP data to Bitcoin, Ethereum, Solana, TRON, Stellar, Avalanche, Arbitrum One, Polygon PoS, and Optimism. Crypto exchanges Coinbase, Gemini and Kraken reportedly helped facilitate the initiative.

"It's only fitting that the Commerce Department and President Donald Trump, the Crypto-President, publicly release economic statistical data on the blockchain," said US Secretary of Commerce Howard Lutnick in a Thursday statement.

The DOC also stated that it plans to showcase a proof of concept for government-wide adoption of blockchain technology, building on President Trump's push to make the US the world's crypto capital.

Chainlink integrated six major economic data points on-chain, including the Real Gross Domestic Product (GDP) level, the Personal Consumption Expenditure (PCE) index, and the Real Final Sales to Private Domestic Purchasers level, along with their respective percentage changes.

In a slight deviation from the Department of Commerce's statement, Chainlink stated that the data will be updated on a monthly or quarterly basis and is available across ten blockchains, including Ethereum, Arbitrum, Avalanche, Base, Optimism, Linea and others, with plans to distribute the information across more networks over time.

"We are making America's economic truth immutable and globally accessible like never before, cementing our role as the blockchain capital of the world," Lutnick added.

Chainlink highlighted that putting official US government data on-chain could give rise to a wide range of blockchain applications, including automated trading strategies, increased composability of tokenized assets, the issuance of new types of digital assets and real-time prediction markets for crowdsourced intelligence, among others.

The development comes days after Lutnick stated during a cabinet meeting that the Department will issue key statistics on blockchain networks.

Meanwhile, real estate asset manager Caliber (CWD) has approved a digital asset treasury strategy that focuses on acquiring LINK.

LINK bounces off trendline support, could tackle $27 resistance

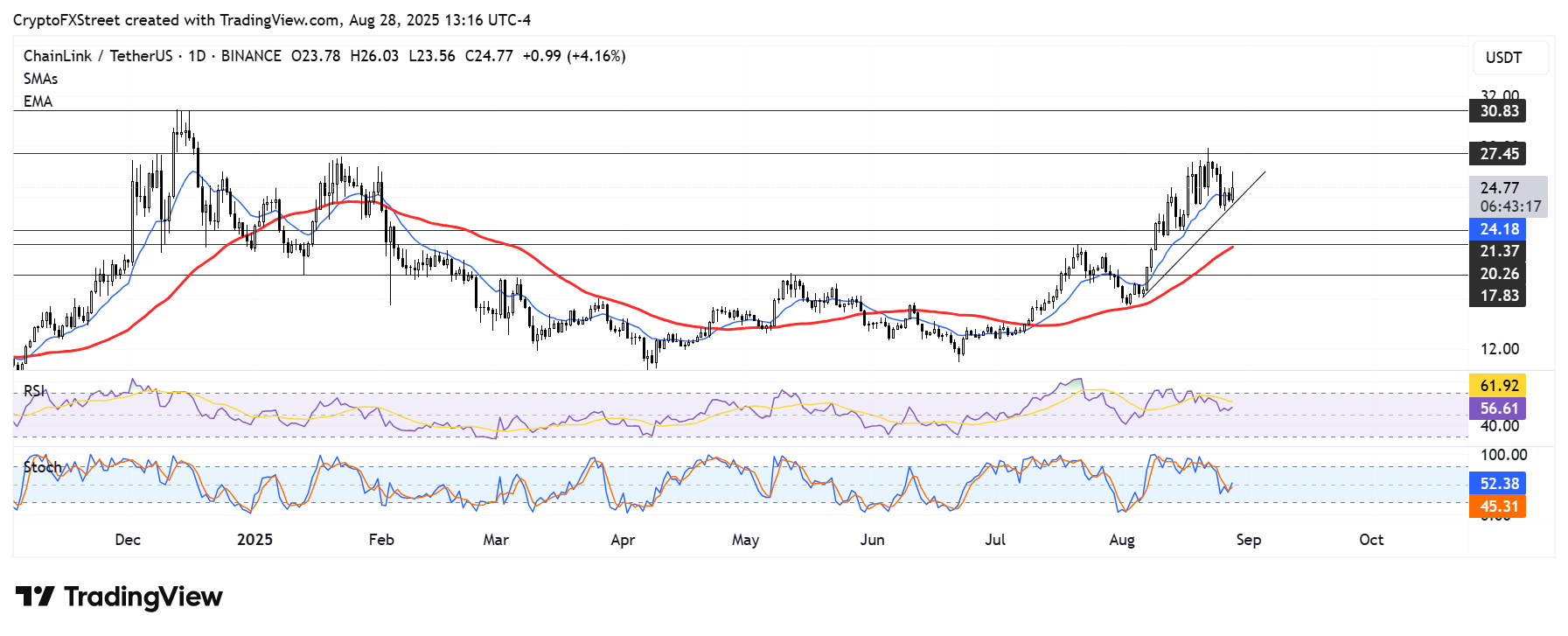

After bouncing off an ascending trendline extending from August 6, LINK is up 4% and has crossed above the 14-day Exponential Moving Average (EMA).

On the upside, the oracle-based token could rally to the $30.8 psychological level if it clears the resistance at $27.4. However, a decline below the ascending trendline support could send LINK to $21.3.

LINK/USDT daily chart

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are hovering slightly above their neutral levels, indicating a mild dominance in bullish momentum.