Barkin says Fed 'some time' to assess slowdown in economy amid normalizing growth

- Bitcoin Poised For ‘Boring’ 2025 Close – Here’s When BTC’s Real Test Will Come

- TradingKey 2025 Markets Recap & Outlook | Global Central Banks 2025 Recap and 2026 Outlook: Navigating Post-Easing Recovery and Diverging Paths

- Gold Price Hits New High: Has Bitcoin Fully Declined?

- Gold jumps above $4,440 as geopolitical flare, Fed cut bets mount

- Breaking: Gold rises to record high above $4,500 on safe-haven flows

- US Q3 GDP Released, Will US Stocks See a "Santa Claus Rally"?【The week ahead】

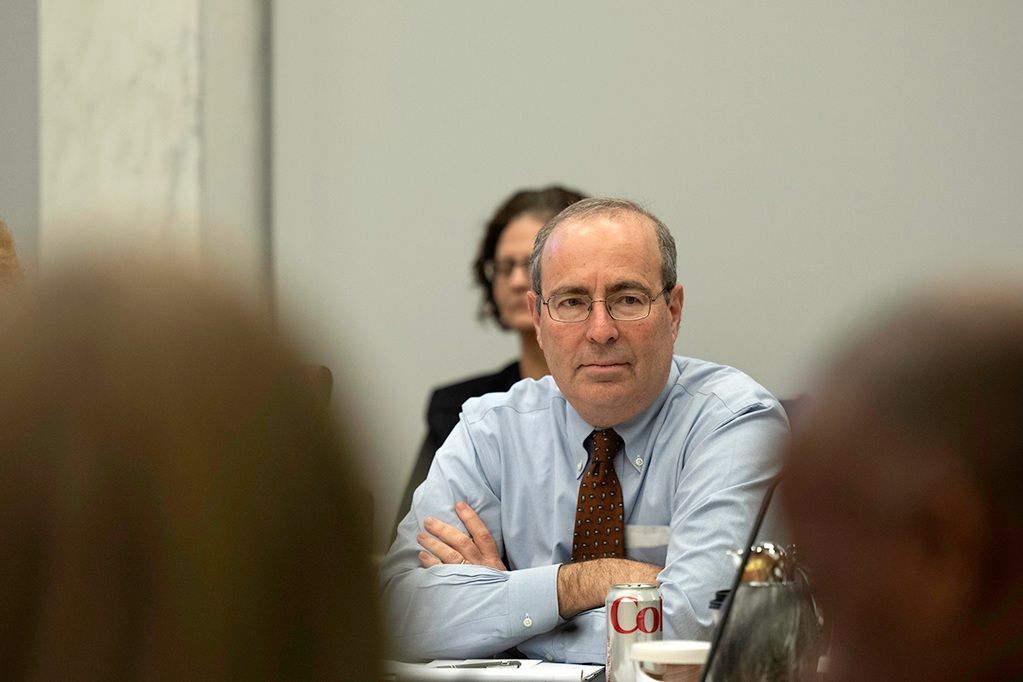

Investing.com -- Richmond Fed president Thomas Barkin on Thursday downplayed calls for urgent rate-cutting action, and said the Fed has time to wait to assess the pace of slowing in the economy.

The Fed has "some time" to assess whether this is an economy that's "gently moving into a normalizing state ... or one where you really do have to lean into it," Barkin said Thursday at a virtual event put on by the National Association for Business Economics.

The Richmond fed president also poured cold water on recent fears the labor market is signalling economic doom ahead, noting that the slowing wage growth points to normalizing in the labor market.

The Fed, however, would be worried if job growth started to disappear, but that doesn't appear to be an immediate concern.

"What I hear from folks on the ground in the labor market is that people are cutting back on hiring, but not firing," Barkin added.

On the inflation front, Barkin said he was "pretty optimistic" that incoming data over the next few months would show good readings.

In a sign that the market concerns about an impending recession is cooling, Barkin flagged the recent dip in bets on a 50 basis points cut in September suggests that the market is returning to the Fed's view that the economic growth is slowing rather than at risk of falling off a cliff.

Bets on a 50bps cut in September fell to 56% from 72% a day earlier, according to Investing.com's Fed Rate Monitor Tool.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.