- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold slumps below $5,100 as US Dollar gains

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

AUD/USD once plunged to 0.5914, hitting a five-year low since March 2020, following the rollout of reciprocal tariffs by the U.S. government on 9 April. This has laid bare the great impact on Aussie dollar of global trade disputes, especially the Sino-U.S. trade conflict. Concerns over a global recession, decreasing Chinese demand for iron ores, coal, and agricultural products, along with the depreciation of Chinese yuan are expected to weigh on AUD.

As a turnaround, a number of relief signals have been released to the market. Within 24 hours after the enacting, President Trump announced a 90-day pause of the reciprocal tariffs. Three days later, on 12 April, the U.S. decided to spare from reciprocal tariffs electronic products like smartphones and laptops, which are the largest U.S. imports from China.

Consequently, the AUD/USD staged a sharp rally by rising 400 points to above 0.6300, reclaiming the 0.6 level in a V-shaped turnaround.

Still, it is advisable that investors remain vigilant on the recent AUD rally, considering that the simiconductor industry as the core of the technology sector is unlikely to be generally exempted from the tariffs. Meanwhile, the temporary relief may forebode a long-term conflict landscape of the Sino-U.S. trade tentions.

AUD/USD:

According to the NAB Forex Strategy Team's forecasts released in early 2025, the Australian dollar may experience mild appreciation later this year, despite ongoing short-term pressures.NAB forecasts the AUD/USD stabilizing around 0.65 by mid-year, with potential to reach 0.67 by December. However, they caution that downside risks remain significant, particularly in the event of a slowdown in China or unexpected shifts in U.S. Federal Reserve policy.

Major support levels at: 0.6180, 0.6000, 0.5910

Major resistance levels at: 0.6380, 0.6430, 0.6580

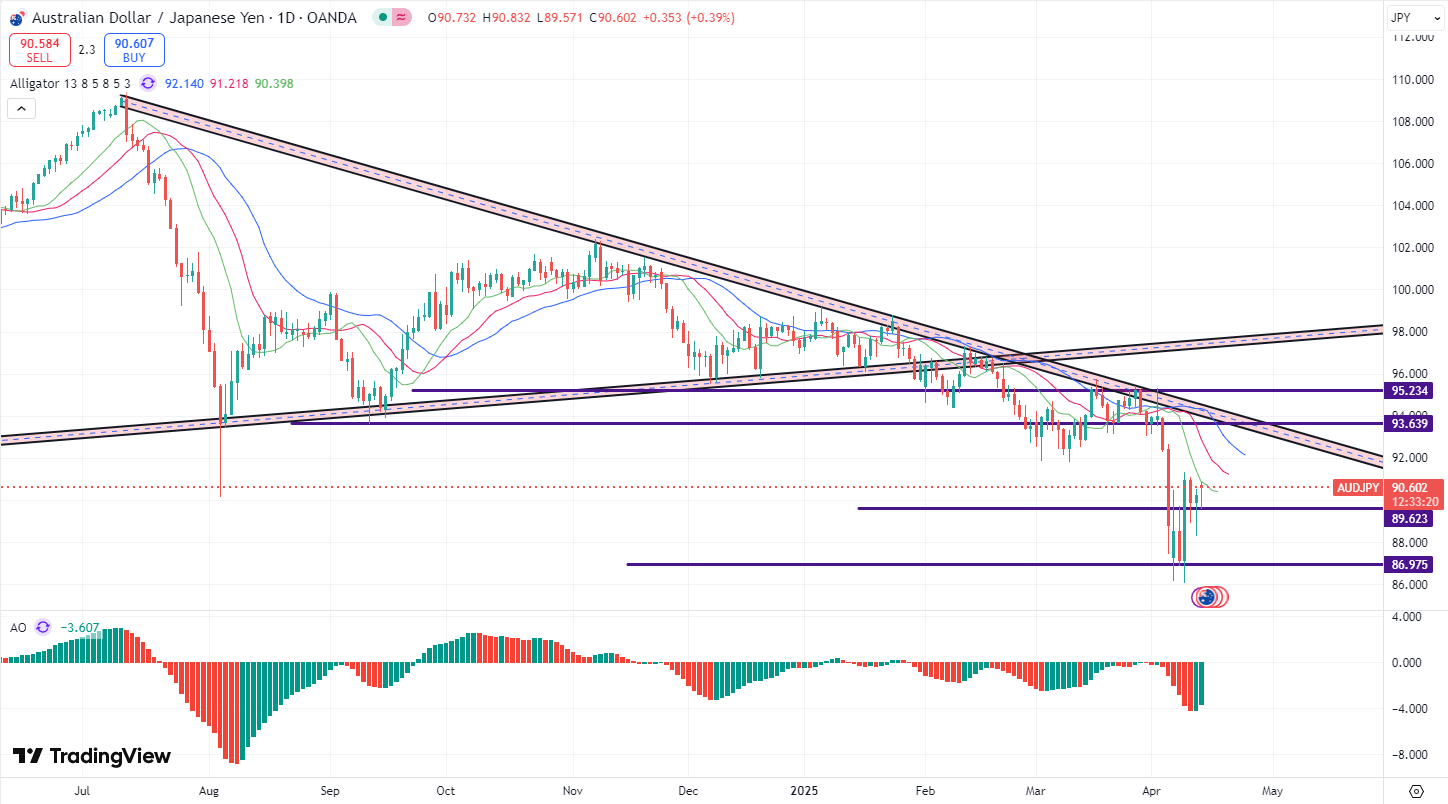

AUD/JPY:

The AUD/JPY is seen as an important indicator of market sentiment. Their exchange rate is anticipated to rise if trade tension continues to subside. However, capital tends to flow back to the yen if the trade conflict between the United States and China worsens. Given the Japanese Central Bank's tightening of monetary policy, the AUD/JPY is still expected to be declining in the mid-term.

Citigroup analysts highlight that, from a tactical perspective, significant risk rallies in bear markets could provide more favorable positions to enter cross-yen short selling trades (AUD/JPY excluded).

Major support levels at: 89.6, 86.2, 84.6

Major resistance levels at: 93.6, 95.3, 97.5

Read more

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.