US Dollar Index falls below 98.00 as softer inflation data boost odds of Fed rate cuts

The US Dollar Index depreciates amid rising odds of the Fed rate cut in September.

The US Consumer Price Index climbed 2.4% YoY in May, below the expected 2.5% rise.

Trump said that the trade deal with China is finalized, but it remains subject to final approval from both leaders.

The US Dollar Index (DXY), which measures the value of the US Dollar (USD) against six major currencies, is extending its losses for the second successive day and trading lower at around 98.00 during the Asian hours on Thursday. The Greenback faces challenges as cooler-than-expected US inflation in May has increased the odds of the Fed rate cut in September.

The US Consumer Price Index (CPI) rose 2.4% year-over-year in May, slightly above 2.3% prior but below the market expectations of a 2.5% increase. The core CPI, which excludes volatile food and energy prices, climbed 2.8% YoY in May, compared to the consensus of 2.9%.

US President Donald Trump posted on Truth Social on Wednesday, saying that the trade deal with China is done and added that it is subject to his and Chinese President Xi Jinping's final approval. Trump also said that "We are getting a total of 55% tariffs, China is getting 10%. Relationship is excellent! Thank you for your attention to this matter!" He also stated that he is willing to extend the trade talks deadline, but doesn't think it will be necessary. He further said that he will set unilateral tariff rates within two weeks.

China will grant rare-earth export licenses to US automakers and manufacturers but only for six months to maintain control over critical minerals as leverage in future talks, per the Wall Street Journal (gated).

The US Dollar may gain ground from safe-haven flows amid escalating tensions in the Middle East. The United States (US) advised some Americans to leave the region. President Trump said on Wednesday that the US would not permit Iran to have a nuclear weapon, per Reuters. Moreover, CBS News senior White House correspondent Jennifer Jacobs reported that US officials have been told that Israel is fully ready to launch an operation into Iran.

US Dollar PRICE Today

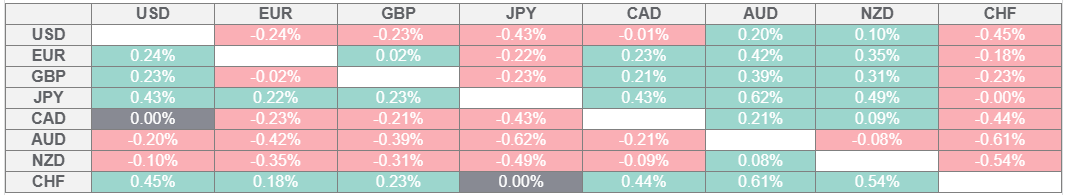

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.