- Tesla Stock Hits Record High as Robotaxi Tests Ignite Market. Why Is Goldman Sachs Pouring Cold Water on Tesla?

- Gold Price Hits New High: Has Bitcoin Fully Declined?

- Gold jumps above $4,440 as geopolitical flare, Fed cut bets mount

- U.S. November CPI: How Will Inflation Fluctuations Transmit to US Stocks? Tariffs Are the Key!

- US Q3 GDP Released, Will US Stocks See a "Santa Claus Rally"?【The week ahead】

- December Santa Claus Rally: New highs in sight for US and European stocks?

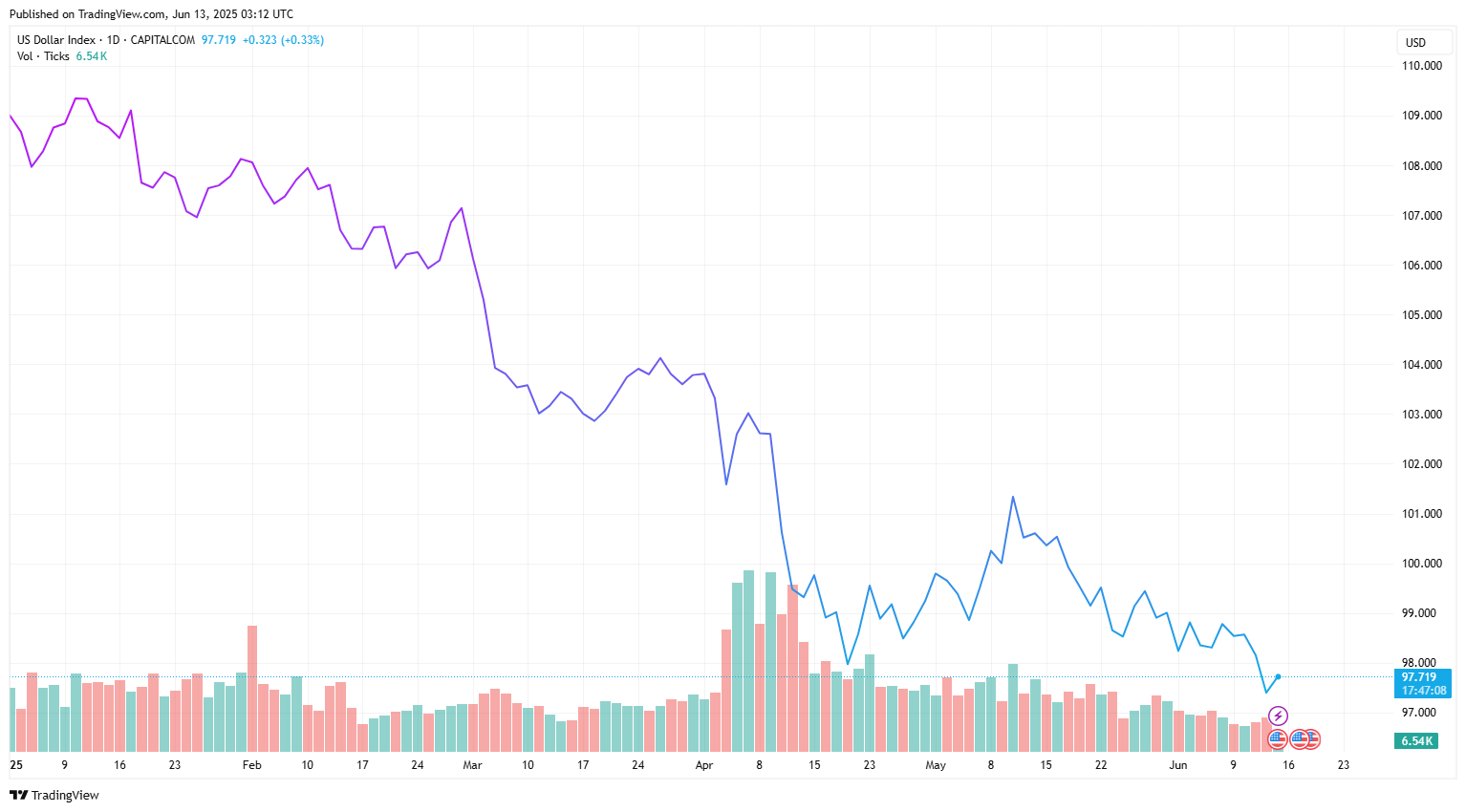

The U.S. Dollar Index (DXY), which measures the greenback's value against six major currencies, hit a two-year low of 97.193 during early Asian trading on Friday. It has since recovered and is trading at 97.6 at the time of writing.

Expectations of a Fed rate cut and trade risk aversion are taking a heavy toll on the dollar.

Soft U.S. inflation data and producer price index (PPI) data this week have heightened expectations that the Fed will cut interest rates by 25 basis points in September. The Fed is scheduled to hold its next policy meeting on June 18.

The U.S. and China have announced a framework for an agreement on bilateral tariffs. But investor doubts about the durability of a modest U.S.-China trade deal, coupled with Trump’s threat to impose unilateral tariffs on most trading partners starting June 9, have undermined investor confidence in the ability of U.S. negotiators to reach a major deal.

Meanwhile, even though underlying inflation in the U.S. has been slower than expected for the fourth straight month, there are concerns that the U.S. could see a surge in inflation and begin a slide into recession amid Trump’s sweeping import tariffs.

Goldman Sachs economists estimate that U.S. inflation will rise to around 4% later this year, with tariffs accounting for about half of that.

Concerns about the outlook for the U.S. economy have fueled selling of the dollar and pushed the dollar index to a two-year low.

The dollar has fallen more than 9% so far in 2025. Wall Street strategists warn that the dollar still has room to fall further, in line with the view of speculative traders tracked by the U.S. Commodity Futures Trading Commission (CFTC), who hold about $12.2 billion in bets that the dollar will depreciate further.

Source: TradingView

Source: TradingView

On Thursday, President Trump announced that he would expand steel tariffs to a range of imported home appliances, including dishwashers, washing machines, refrigerators, etc., and the tariffs will take effect later this month.

Helen Given, a foreign exchange trader at Monex Inc., said Trump's renewed tariff threats have raised concerns about the U.S. economy, gradually leading to increased bets on the Federal Reserve to ease policy. She also said the dollar index could fall further by 5% to 6% this year.

Meanwhile, Paul Tudor Jones, founder of macro hedge fund Tudor Investment Corp., said the dollar could fall 10% in a year as he expects short-term interest rates to fall "substantially" next year.

Read more

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.