Forex Today: US Dollar consolidates gains ahead of key data

- Silver Price Forecast: XAG/USD surges to record high above $56 amid bullish momentum

- Fed Chair Candidate: What Would a Hassett Nomination Mean for U.S. Stocks?

- After the Crypto Crash, Is an Altcoin Season Looming Post-Liquidation?

- The 2026 Fed Consensus Debate: Not Hassett, It’s About Whether Powell Stays or Goes

- U.S. PCE and 'Mini Jobs' Data in Focus as Salesforce (CRM) and Snowflake (SNOW) Report Earnings 【The week ahead】

- AUD/USD holds steady below 0.6550 as traders await Australian GDP release

Here is what you need to know on Wednesday, November 5:

The US Dollar (USD) stabilizes in the European morning on Wednesday after gathering strength against its major rivals for five consecutive trading days. In the second half of the day, the ADP Employment Change and the ISM Services PMI data for October will be watched closely by market participants.

US Dollar Price This week

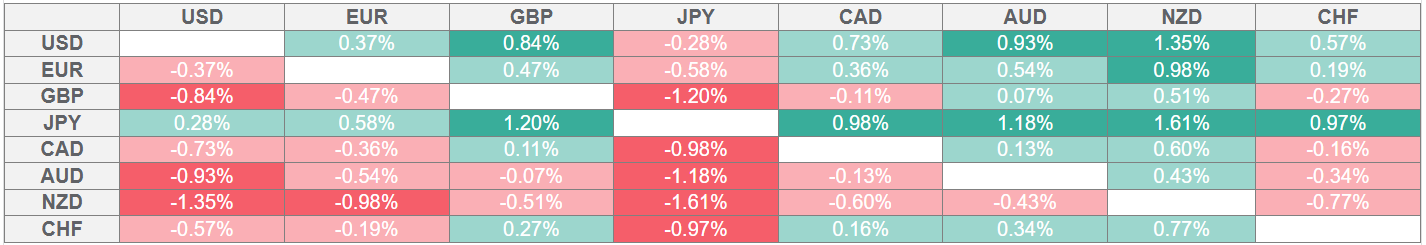

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

On Tuesday, the Senate, once again, failed to pass the temporary funding will. In turn, the government shutdown entered its 36th day, becoming the longest in US history. Wall Street's main indexes suffered large losses and the USD Index climbed to its highest level since early August above 100.20. Early Wednesday, the USD Index fluctuates in a narrow channel slightly above 100, while US stock index futures trade mixed.

The Chinese Finance Ministry announced early Wednesday that they will lift some tariffs on US agricultural goods from November 10, and that they will suspend 24% tariffs on US imports for a year. In the meantime, US President Donald Trump noted that he met with Swiss officials to discuss trade and other issues and announced additional trade talks, signaling possible progress on the tariff dispute.

EUR/USD lost more than 0.3% on Tuesday and closed near 1.1480 on Tuesday. The pair struggles to gather recovery momentum early Wednesday and moves sideways below 1.1500.

The data from New Zealand showed that the Unemployment Rate edged higher to 5.3% in the third quarter from 5.2%, as anticipated. After losing more than 1% on Tuesday, NZD/USD holds steady at around 0.5650 in the European morning on Wednesday.

USD/JPY extended its slide after closing in negative territory on Tuesday and briefly dipped below 153.00 in the Asian session on Wednesday. The pair staged a rebound afterward and was last seen trading flat on the day at around 153.50.

GBP/USD came under heavy bearish pressure on Tuesday after finance minister Rachel Reeves hinted at higher taxes in her pre-budget speech. After losing nearly 1% and touching its weakest level since mid-April at 1.3010, the pair finds it difficult to gain traction early Wednesday and remains well below 1.3050.

Gold failed to stabilize above $4,000 and lost more than 1.5% on Tuesday. XAU/USD finds a foothold early Wednesday and clings to strong daily recovery gains at around $3,970.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.