Forex Today: Mood improves on US-China trade deal optimism

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

Here is what you need to know on Monday, October 27:

Markets turn risk-positive to start the week as investors grow optimistic about the United States (US) and China reaching a trade deal heading into the highly-anticipated meeting between US President Donald Trump and Chinese President Xi Jinping. The economic calendar will not feature any high-tier data releases on Monday.

Following a meeting with top Chinese officials late last week, US Treasury Secretary Scott Bessent said that China is ready to make a trade deal to avert a new 100% tariff on Chinese imports. Bessent further noted that a framework is prepared for the Trump-Xi meeting, and added that they are anticipating that they will get "some kind of a deferral" on the rare earth export controls that China intended to apply.

US Dollar Price Last 7 Days

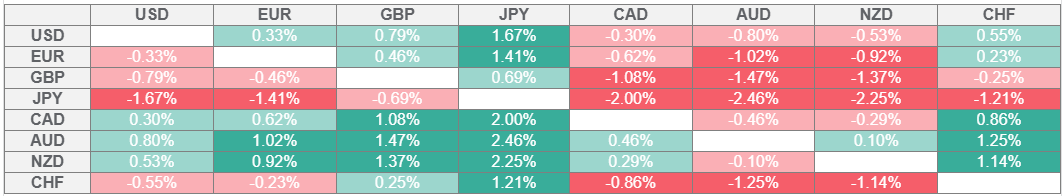

The table below shows the percentage change of US Dollar (USD) against listed major currencies last 7 days. US Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Reflecting the improving risk mood, US stock index futures rise between 0.6% and 1.1% in the European morning on Monday. On Friday, the data from the US showed that the annual inflation, as measured by the change in the Consumer Price Index (CPI), edged higher to 3% in September from 2.9% in August. This reading came in below the market expectation of 3.1%. After ending the previous week in positive territory, the US Dollar (USD) Index fluctuates in a tight channel, slightly below 99.00, in the early European session.

Gold lost more than 3% last week and opened with a bearish gap. At the time of press, XAU/USD was trading below $4,100, losing nearly 1% on a daily basis.

EUR/USD holds above 1.1600 early Monday. Later in the week, the Federal Reserve (Fed) and the European Central Bank (ECB) will both announce monetary policy decisions.

USD/JPY continues to stretch higher after gaining nearly 1.5% last week and trades above 153.00. Japanese Chief Cabinet Secretary Minoru Kihara repeated on Monday that it is important for currencies to move in a stable manner, reflecting fundamentals.

GBP/USD closed the sixth consecutive trading day in negative territory last Friday and touched its weakest level since mid-October below 1.3290. The pair holds its ground on Monday and clings to moderate gains above 1.3300.

USD/CAD stays under modest bearish pressure in the European morning and trades below 1.4000. The Bank of Canada is expected to lower the policy rate by 25 basis-points to 2.25% on Wednesday.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.