Australian Dollar steadies as traders adopt caution due to ongoing US-China feud

Australian Dollar maintains its position amid escalating US-China trade tensions.

US officials condemned China’s plans to limit rare earth exports, describing them as economic coercion.

The US Dollar weakened amid the ongoing government shutdown and growing expectations of further interest rate cuts.

The Australian Dollar (AUD) moves little against the US Dollar (USD) on Friday, after registering losses in the previous session. The AUD/USD pair may lose ground as the AUD could struggle due to escalating United States (US)-China trade tensions. It’s important to note that any shift in China’s economy can influence the Aussie Dollar, given the close trade relationship between China and Australia.

US Trade Representative Jamieson Greer and Treasury Secretary Scott Bessent criticized China’s plans to restrict rare earth exports, calling them “economic coercion” and “a global supply chain power grab.” Bessent warned, “If China wants to be an unreliable partner to the world, then the world will have to decouple.” However, both officials left room for negotiation, expressing uncertainty over whether China would actually follow through with the export controls announced last week, per BBC.

The AUD faced challenges as September’s jobs data quickly boosted the chance of a November cut in the 3.65% cash rate to 76%, from under 50% prior. The Australian Bureau of Statistics (ABS) reported on Thursday that the Employment Change came in at 14.9K in September, against the market expectations of 17K. The previous reading was -11.8K (revised from -5.4K). Meanwhile, the Unemployment Rate rose to 4.5%, jumping to a near four-year high. The figure came in above the market consensus and the previous 4.3%.

US Dollar extends losses due to government shutdown, Fed rate cut bets

The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is extending its losses for the fourth successive session and trading around 98.20 at the time of writing. The Greenback declines due to the ongoing US government shutdown and increased likelihood of US interest rate cuts.

The US federal government shutdown will continue into next week after the Senate once again failed to pass a Republican bill to extend funding and end the stalemate, marking the tenth unsuccessful attempt on Thursday, the 16th day of the impasse.

US Federal Reserve (Fed) Governor Christopher Waller stated on Thursday that he supports another interest rate cut at this month’s upcoming policy meeting. Meanwhile, the Fed’s newest governor, Stephen Miran, reiterated his call for a more aggressive rate-cut trajectory for 2025 than that favored by his colleagues.

Federal Reserve Chair Jerome Powell stated on Tuesday that the central bank is on track to deliver another quarter-point interest-rate reduction later this month, even as a government shutdown significantly reduces its read on the economy. Powell highlighted the low pace of hiring and noted that it may weaken further.

The CME FedWatch Tool indicates that markets are now pricing in nearly a 97% chance of a Fed rate cut in October and an 83% possibility of another reduction in December.

China’s Consumer Price Index (CPI) declined 0.3% year-over-year (YoY) in September. The market consensus was for a 0.1% decline in the reported period, following a fall of 0.4% in August. Meanwhile, the monthly inflation rose to 0.1%, weaker than the expected 0.2%. China’s Producer Price Index (PPI) fell 2.3% YoY, following a 2.9% fall prior, as expected.

RBA Assistant Governor (Financial Markets) Christopher Kent spoke at the CFA Society Australia Investment Conference 2025 late Wednesday that financial conditions are less restrictive after recent rate cuts. Kent also added that the cash rate is now within a wide, uncertain neutral range, with the central bank reassessing its outlook with incoming data and risks.

The Reserve Bank of Australia (RBA) Assistant Governor Sarah Hunter said on Wednesday that recent data has been a little stronger than expected, adding that inflation is likely to be stronger than forecast in the third quarter (Q3). Hunter highlighted that uncertainty about the global outlook remains elevated and stated that the board will adjust policy as appropriate as new information comes to hand. Expected consumer momentum to soften a little in Q3, she added.

The RBA Minutes of its September monetary policy meeting showed on Monday that board members agreed that policy was still a little restrictive but difficult to determine. The RBA Meeting Minutes also noted that economic risks persist, with consumption remaining weak amid softer job and wage growth. Monthly CPI data for housing and services suggest that Q3 inflation may exceed forecasts. The RBA board emphasized that future policy decisions will continue to be cautious and strongly driven by incoming data.

Australian Dollar remains below 0.6500 due to prevailing bearish bias

AUD/USD is trading around 0.6480 on Friday. Technical analysis on the daily chart suggests an ongoing bearish bias as the pair is moving within a descending channel pattern. Additionally, the 14-day Relative Strength Index (RSI) remains below the 50 level, strengthening the bearish bias.

On the downside, the AUD/USD pair may find its initial support at the lower boundary of the descending channel around 0.6440, followed by the four-month low of 0.6414, recorded on August 21. Further support lies at the five-month low of 0.6372.

The AUD/USD pair may target the primary barrier at the nine-day Exponential Moving Average (EMA) of 0.6515, followed by the 50-day EMA at 0.6548. A break above these levels would improve the short- and medium-term price momentum and lead the pair to test the descending channel’s upper boundary around 0.6580.

AUD/USD: Daily Chart

Australian Dollar Price Today

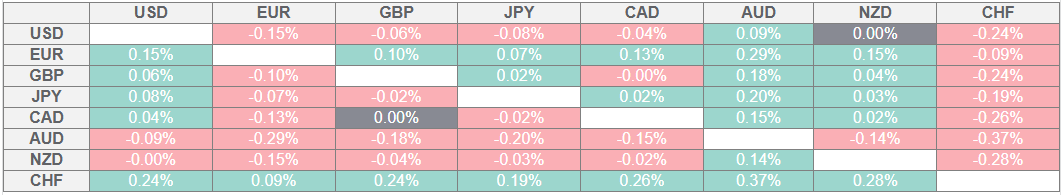

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.