Australian Dollar advances after the release of the Monthly Consumer Price Index on Wednesday.

Australia’s Monthly Consumer Price Index climbed by 3.0% YoY in August, following the previous increase of 2.8%.

Fed Chair Jerome Powell signaled that additional rate cuts remain possible if the FOMC determines more accommodation is necessary.

The Australian Dollar (AUD) appreciates against the US Dollar (USD) on Wednesday, following the release of Australia’s Monthly Consumer Price Index (CPI), which climbed by 3.0% year-over-year in August, following a 2.8% increase reported in July.

Australia’s preliminary S&P Global Composite PMI fell to 52.1 in September, from 55.5 prior, marking the lowest reading in three months. Manufacturing and services both noted slowing growth amid weaker new business inflows and lower goods orders at the fastest pace in eight months. The preliminary S&P Global Services PMI showed a modest slowdown to 52 in September, from 55.8 in August. Meanwhile, the Manufacturing PMI fell to 51.6 from 53.0 previously.

The White House announced that Australian Prime Minister Anthony Albanese and US President Donald Trump will hold their first in-person meeting in Washington, D.C. on October 20 to discuss the Aukus nuclear submarine pact.

Reserve Bank of Australia (RBA) Governor Michele Bullock told parliament on Monday that labor market conditions have eased slightly, with unemployment ticking higher. Bullock noted that recent rate cuts should support household and business spending, while stressing that the RBA must stay vigilant to changing conditions and be ready to respond if needed.

Australian Dollar advances despite a stable US Dollar

The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is gaining ground and trading around 97.30 at the time of writing. However, the Greenback faced challenges following the release of US S&P Global PMI figures for September on Tuesday.

US S&P Global Composite PMI ticked down to 53.6 from 54.6 in August, pointing to a private sector that seems to be struggling to strengthen further. Manufacturing PMI eased to 52.0 from 53, signalling waning momentum in the sector. Services PMI slipped to 53.9 from 54.5, suggesting demand there may be easing.

Fed Chair Jerome Powell said on Tuesday that a weaker labor market is outweighing concerns about stubborn inflation, leading to an interest rate cut at its September meeting last week. However, Powell further stated that he is comfortable with the current policy path, though he indicated the possibility of further cuts should the FOMC see the need to be more accommodative.

Fed Bank of Cleveland President Beth Hammack warned on Monday that inflation pressures will likely persist for the time being, noting challenges on both sides of the Fed's mandate to both control inflation and support the labor market.

Richmond Fed President Thomas Barkin noted on Monday that tariff policies tend to result in higher prices for consumers, noting that the primary point of concern for businesses remains cloudy trade policy, not high interest rates.

The White House announced that US companies will take control of TikTok’s algorithm, while Americans will occupy six of the seven board seats for its US operations. White House Press Secretary Karoline Leavitt said the agreement could be finalized “in the coming days,” though Beijing has not yet commented.

The Reserve Bank of Australia (RBA) rate cuts. Markets now price just a 20% chance of a September cut, while odds for November stand at 70%, with above-target inflation keeping policymakers cautious.

Australian Dollar moves above 0.6600 to test nine-day EMA barrier

AUD/USD is trading around 0.6610 on Wednesday. Technical analysis on the daily chart shows that the pair remains slightly below the ascending channel pattern, indicating a weakening of a bullish bias. However, the 14-day Relative Strength Index (RSI) maintains its position slightly above the 50 level, suggesting that bullish sentiment still has play.

The AUD/USD pair is testing its immediate barrier at the nine-day Exponential Moving Average (EMA) of 0.6611, followed by the lower boundary of the ascending channel around 0.6640. A rebound to the channel would support the short-term price momentum and lead the AUD/USD pair to approach the 11-month high of 0.6707, recorded on September 17, followed by the ascending channel’s upper boundary around 0.6730.

On the downside, the AUD/USD pair may find its initial support at the crucial level of 0.6600, aligned with the 50-day Exponential Moving Average (EMA) at 0.6551. A break below the support zone would weaken the medium-term price momentum and put downward pressure on the pair to navigate the region around the three-month low at 0.6414, which was recorded on August 21.

AUD/USD: Daily Chart

Australian Dollar Price Today

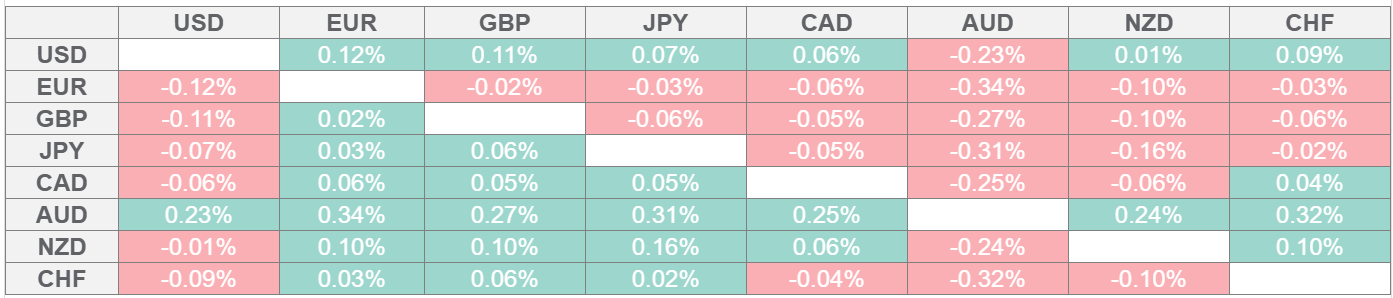

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Euro.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.