AUD/JPY falls below 97.50 as Australia’s PMI data show slowing growth

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

AUD/JPY depreciates after the release of the Purchasing Managers’ Index figures on Tuesday.

Australia’s S&P Global Composite PMI dropped to 52.1 in September from 55.5 previously, its lowest level in three months.

The BoJ sees a moderate economic recovery but flags weaknesses and global trade risks.

AUD/JPY continues to lose ground for the third successive session, trading around 97.30 during the Asian hours on Tuesday. The currency cross depreciates as the Australian Dollar (AUD) loses ground following the release of the preliminary Australia’s S&P Global Purchasing Managers’ Index (PMI) data.

Australia’s S&P Global Composite PMI fell to 52.1 in September, from 55.5 prior, marking the lowest reading in three months. Manufacturing and services both noted slowing growth amid weaker new business inflows and lower goods orders at the fastest pace in eight months.

The preliminary S&P Global Services PMI showed a modest slowdown to 52 in September, from 55.8 in August. Meanwhile, the Manufacturing PMI fell to 51.6 from 53.0 previously.

The Reserve Bank of Australia (RBA) remains vigilant to shifts in the economic outlook, though recent data have largely met expectations. RBA Governor Michele Bullock told parliament on Monday that labor market conditions have eased slightly, with unemployment ticking higher. However, the market remains tight and near full employment.

The Bank of Japan (BoJ) decided to keep its interest rate at 0.5% unchanged for a fifth straight meeting last week, as widely expected. The Japanese central bank said the economy is recovering moderately but highlighted areas of weakness and risks from global trade policies.

Traders will likely watch Japan’s Jibun Bank PMI data for September due on Wednesday. Attention will shift toward the BoJ Monetary Policy Meeting Minutes and Tokyo Consumer Price Index data, due later in the week, to gain further clues on the policy path.

Australian Dollar Price Today

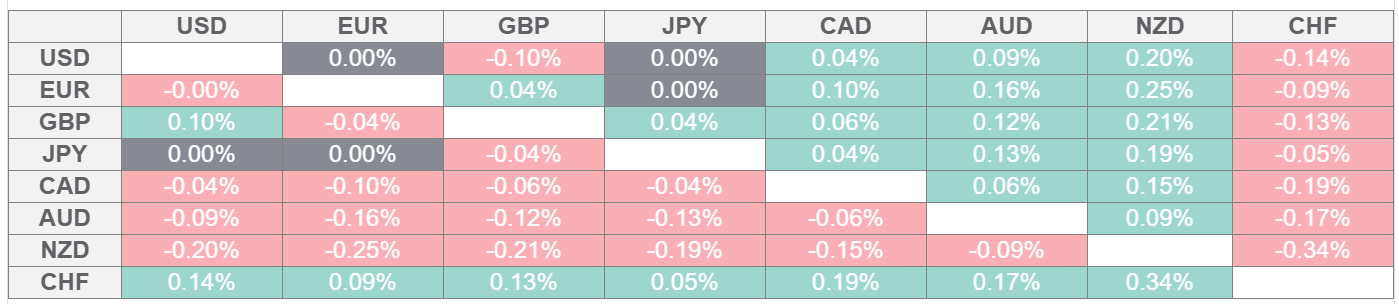

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.