Forex Today: Relentless Gold rally continues, focus shifts to PMI data

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- Ethereum Price Forecast: ETH faces heavy distribution as price slips below average cost basis of investors

Here is what you need to know on Tuesday, September 23:

Gold (XAU/USD) continues to push higher early Tuesday and notches a new all-time-high above $3,750 after rising more than 1.5% on Monday. The economic calendar will feature preliminary September Manufacturing and Services Purchasing Managers' Index (PMI) data from Germany, the Eurozone, the UK and the US on Tuesday. Later in the American session, Federal Reserve (Fed) Chairman Jerome Powell will deliver a speech on the economic outlook at the Greater Providence Chamber of Commerce 2025 Economic Outlook Luncheon.

The renewed selling pressure surrounding the US Dollar and escalating geopolitical tensions on news of Russian forces taking control of the settlement of Kalynivske, in Ukraine's Dnipropetrovsk region, allow XAU/USD to extend its rally. At the time of press, Gold was trading at around $3,755.

The USD Index lost more than 0.3% on Monday and erased a small portion of the gains it recorded in the second half of the previous week. In the absence of high-tier data releases, mixed comments from Fed officials made it difficult for the USD to stay resilient against its rivals. Additionally, the bullish opening in Wall Street put additional weight on the currency's shoulders. Early Tuesday, the USD Index moves sideways below 97.50, while US stock index futures trade flat. S&P Global Composite PMI is forecast to show an ongoing expansion in the private sector's economic activity at a healthy pace in early September.

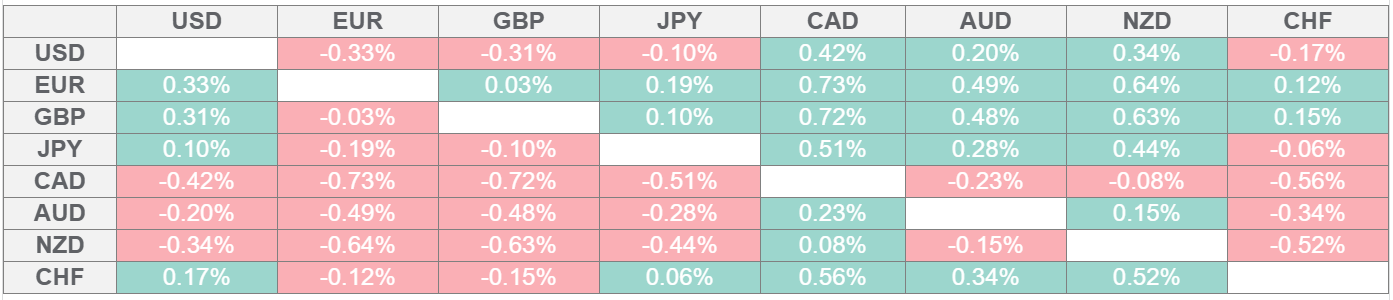

US Dollar Price This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the Euro.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

EUR/USD rose about 0.5% on Monday before entering a consolidation phase at around 1.1800 in the European morning on Tuesday. European Central Bank policymaker Piero Cipollone will participate in a fireside chat at Bloomberg's Future of Finance conference in Frankfurt, Germany.

GBP/USD snapped a three-day losing streak on Monday and stabilized above 1.3500 early Tuesday.

USD/JPY fluctuates in a tight channel below 148.00 in the European session after posting small losses on Monday.

USD/CAD keeps its footing and trades at a fresh weekly high above 1.3830 on Tuesday. Bank of Canada (BoC) Governor Tiff Macklem will speak later in the American session.

The data from Australia showed early Tuesday that the flash September S&P Global Manufacturing PMI and Services PMI declined to 51.6 and 52, respectively. AUD/USD stays under modest bearish pressure and trades below 0.6600.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.