Australian Dollar extends losses following Consumer Inflation Expectations data

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

The Australian Dollar declines possibly due to dampened risk sentiment amid escalating tensions between Israel and Iran.

Australia’s Consumer Inflation Expectations came in at 5% in June, above the previous 4.1% rise.

The US Dollar faces challenges as softer CPI data increased the odds of a Fed rate cut in September.

The Australian Dollar (AUD) edges lower against the US Dollar (USD) on Thursday, extending its losses for the second consecutive day. However, the AUD/USD pair may appreciate as softer US inflation data have boosted bets of a Federal Reserve (Fed) rate cut in September.

United States (US) President Donald Trump posted on Truth Social, saying that the trade deal with China is done and added that it is subject to his and Chinese President Xi Jinping's final approval. "We are getting a total of 55% tariffs, China is getting 10%. Relationship is excellent! Thank you for your attention to this matter," Trump said on Wednesday. Any economic change in China could impact AUD as China and Australia are close trade partners.

China will grant only six-month rare-earth export licenses for US automakers and manufacturers, which suggests that China wants to have control over critical minerals as leverage in future talks, per the Wall Street Journal (gated).

The risk-sensitive AUD may find challenges as the tensions escalate between Israel and Iran, after the United States advised some Americans to leave the Middle East. President Trump said on Wednesday that the US would not permit Iran to have a nuclear weapon, per Reuters. Moreover, CBS News senior White House correspondent Jennifer Jacobs reported that US officials have been told that Israel is fully ready to launch an operation into Iran.

Australian Dollar depreciates despite weaker US Dollar amid softer inflation data

The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is extending its losses for the second successive day and trading lower at around 98.30 at the time of writing. The Greenback depreciates as cooler-than-expected US inflation in May has increased the odds of the Fed rate cuts.

The US Consumer Price Index (CPI) rose 2.4% YoY in May, slightly above 2.3% prior but below the market expectations of a 2.5% increase. The core CPI, which excludes volatile food and energy prices, climbed 2.8% YoY in May, compared to the consensus of 2.9%.

On Wednesday, President Trump stated that he would like to extend the trade talks deadline, but doesn't think it will be necessary. Trump further stated that he will set unilateral tariff rates within two weeks.

The US Court of Appeals for the Federal Circuit extended an earlier, temporary respite on Tuesday for the government as it presses a challenge to a lower court ruling last month that blocked the tariffs. The federal appeals court has ruled that President Trump’s broad tariffs can remain in effect while legal appeals continue, per Bloomberg.

China's Trade Balance (CNY) arrived at CNY743.56 billion in May, expanding from the previous surplus of CNY689.99 billion. Meanwhile, Exports rose 6.3% YoY against 9.3% in April. The country’s imports fell 2.1% YoY in the same period, from a 0.8% rise recorded previously.

Australia’s Trade Balance posted a 5,413M surplus month-over-month in April, below the 6,100M expected and 6,892M (revised from 6,900M) in the previous reading. Exports declined by 2.4% MoM in April, against a 7.2% rise prior (revised from 7.6%). Meanwhile, Imports rose by 1.1%, compared to a decline of 2.4% (revised from -2.2%) seen in March. China’s Caixin Services PMI rose to 51.1 in May as expected, from 50.7 in April.

Australian Dollar tests 0.6500 within crucial support zone

The AUD/USD pair is trading around 0.6500 on Tuesday. The daily chart’s technical analysis suggests a potential weakening of the bullish bias as the pair attempts to break below the lower boundary of the ascending channel. Additionally, the pair is slightly positioned above the nine-day Exponential Moving Average (EMA); breaking below would weaken the short-term price momentum. However, the 14-day Relative Strength Index (RSI) is remaining above the 50 mark, indicating a bullish bias.

The AUD/USD pair may target an immediate barrier at a seven-month high of 0.6538, which was reached on June 5. Further advances could prompt the pair to explore the region around the eight-month high at 0.6687, aligned with the upper boundary of the ascending channel around 0.6720.

On the downside, the initial support appears at the nine-day EMA of 0.6492, aligned with the ascending channel’s lower boundary around 0.6490. A break below this crucial support zone could weaken the bullish bias and lead the AUD/USD pair to test the 50-day EMA at 0.6419.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

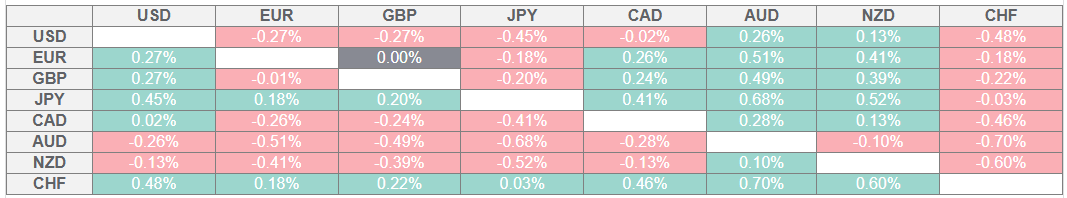

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.