SEC Lawsuit Concluded! What's Next for Ripple? Is Now the Right Time to Buy XRP?

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

TradingKey - Ripple (XRP) CEO Brad Garlinghouse recently announced that the U.S. SEC has dropped its appeal against the company, marking the final chapter in their five-year legal battle. With regulatory uncertainty now resolved, the question remains: Is Ripple poised for a bright new future, or will this development trigger a "buy the rumor, sell the news" scenario?

This article analyzes Ripple's fundamentals, the lawsuit's outcome, future prospects, and whether now is a right time to invest in XRP.

Founded in 2012 by Ripple Labs, the Ripple network and its native token XRP aim to address inefficiencies in traditional cross-border payment systems such as SWIFT. Compared to legacy infrastructure, Ripple offers several key advantages:

Feature | Ripple (XRP) | Traditional Cross-Border Payments |

Transaction Speed | 3-5 seconds | 1-5 business days |

Cost per Transaction | $0.00001 | $25-$50 |

Transparency | Real-time blockchain tracking | Opaque, manual verification |

Availability | 24/7 operation | Limited to banking hours |

Settlement | Instant | Delayed |

Energy Efficiency | Low-carbon (consensus mechanism) | High-carbon (banking infrastructure) |

Scalability | 1,500 TPS | Dozens of TPS |

Ripple vs. Traditional Payment Systems – Source: TradingKey.

Unlike decentralized cryptocurrencies such as Bitcoin (BTC) or Litecoin (LTC), XRP is a centralized token with a fixed supply of 100 billion coins, all of which were pre-mined at launch. Ripple Labs holds approximately 60% of the total supply with the remaining tokens released through market sales and incentive programs.

XRP's edge in cross-border payments stems from its innovative technologies:

Component | Key Technology | Functionality |

Core Protocol | Ripple Protocol Consensus Algorithm (RPCA) | Enables mining-free, high-speed (3-5s) validation for financial-grade transactions |

Consensus Mechanism | Unique Node List (UNL) | Pre-selected validators (banks/institutions) vote to confirm transactions, eliminating energy-intensive mining |

Ledger Structure | XRP Ledger (XRPL) | Immutable ledger updated every 3-5 seconds (no traditional blockchain "chain" structure) |

Node Types | Validators (vote) & Tracking Nodes (sync data) | Institutional validators handle consensus; tracking nodes provide query services |

Cross-Chain Interoperability | Interledger Protocol (ILP) | Connects banks, payment networks, and blockchains, using XRP as a bridge asset for instant multi-currency swaps |

Ripple’s network boasts partnerships with over 300 financial institutions, including American Express, Santander, Standard Chartered, SBI Holdings, and the Bank of Japan, as well as payment providers such as MoneyGram and TransferGo.The company has also collaborated with governments— including Bhutan and Montenegro—on CBDC development.

The XRPL ecosystem is thriving:

DeFi Expansion: 2024’s Hooks sidechain enabled DeFi app development, with 1,500+ apps/exchanges built on XRPL.

Stablecoin Launch: Ripple USD (RLUSD), released in December 2024, reached a $170M market cap within four months.

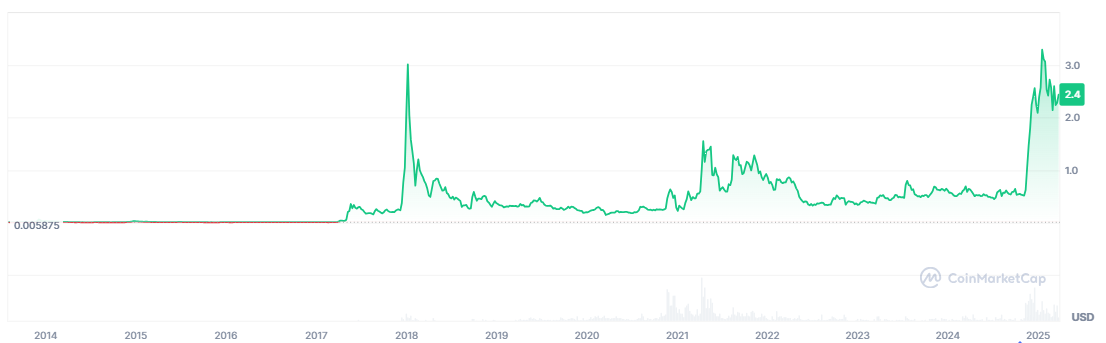

- 2013: Debuted at ~$0.005; market cap <$5M.

- 2014: Crashed to $0.002 after Mt. Gox collapse.

- 2017: Surged 500% to $0.04 after SBI investment; peaked at $3.30 during the crypto bull run (briefly overtaking Ethereum in market cap).

- 2018-2020: Bear market drove prices down 90% to $0.28.

- 2020: SEC lawsuit triggered a 60% drop; XRP languished for years.

- 2023: Judge Torres ruled that programmatic XRP sales do not constitute securities, prompting the price to jumped 75% in a single day to $0.82.

- 2025: Trump’s pro-crypto stance helped propel XRP to a new ATH of $3.40 ahead of his inauguration.

XRP Price Chart (2013-2025) – Source: CoinMarketCap.

With the SEC case resolved, Ripple enters a new phase. Key catalysts to watch:

1. U.S. Market Expansion

Garlinghouse noted that 95% of Ripple’s clients are based overseas due to regulatory hurdles posed by the SEC.With the legal battle now resolved, the company plans to expand its focus to the U.S. payments and securities sectors.

2. XRP ETF Potential

Under Trump’s pro-crypto policies, analysts give a 65-82% chance of approval for an XRP spot ETF, according to data from Bloomberg and Polymarket. Ripple executives have also hinted at progress during private meetings.

3. Strategic Reserve Status

Trump’s proposed plan to include XRP in U.S. crypto reserves could significantly boost institutional adoption and demand.

4. Fed Rate Cuts

As the fourth-largest cryptocurrency by market capitalization, XRP may benefit from the anticipated 50 basis point rate cuts expected in 2025.

As a leader in cross-border payments with over 300 institutional partners, Ripple is well-positioned for growth in the post-lawsuit era. With potential for ETF approval, reserve asset status, and macroeconomic tailwinds, XRP could reach new all-time highs in both price and market capitalization. However, investors should remain cautious of volatility—while the long-term outlook is promising, short-term swings are likely.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.