Chainlink holds near three-year high fueled by EU tokenized securities partnership

- International Oil Prices Retreat Rapidly; G-7 to Discuss Emergency Oil Reserve Release

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Gold slumps below $5,100 as US Dollar gains

- Gold slumps to near $5,050 on oil-driven inflation fears, stronger US Dollar

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

- US Dollar Index gathers strength to near 99.00 on Middle East tensions, robust US services data

Chainlink price trades slightly down on Tuesday after rallying more than 33% the previous day.

Chainlink announced on Monday a partnership with 21x for Europe’s first tokenized securities trading and settlement system.

On-chain data suggest further gains ahead as LINK’s daily trading volume and the number of active addresses reach record levels.

Chainlink (LINK) price trades slightly down around $25.50 on Tuesday following a 33% rally that was spurred by its partnership with Frankfurt-based fintech 21X for Europe’s first tokenized securities trading and settlement system. The technical outlook and on-chain metrics suggest further gains ahead, as LINK’s daily trading volume and the number of active addresses reach record levels.

Chainlink announces partnership with 21X

Chainlink announced on Monday that Frankfurt-based fintech company 21X would adopt the Chainlink standard, adding to the project’s growing list of partnerships and integrations. This announcement led Chainlink prices to rally more than 33% on Monday.

“We’re excited to announce Europe’s first tokenized securities trading & settlement system—21X,” said Chainlink in its Twitter post on Monday.

We're excited to announce Europe’s first tokenized securities trading & settlement system—21X (@tradeon21x)—is adopting the #Chainlink standard.

— Chainlink (@chainlink) December 2, 2024

Price Feeds will underpin 21X’s trading engine & CCIP will connect it to assets across the onchain economy: https://t.co/ACGrBKuduL pic.twitter.com/BYKSBGUFp8

LINK’s on-chain metrics show bullish outlook

Delving deeper into the on-chain metrics supports LINK’s bullish outlook. Santiment’s Daily Active Addresses index, which tracks network activity over time, rose from 4,999 on Sunday to 138,851 on Tuesday, the highest level since mid-January 2023. This indicates that demand for LINK’s blockchain usage is increasing, which bodes well for Chainlink’s price outlook.

[15.28.01, 03 Dec, 2024]-638688276379027182.png)

Chainlink’s daily active addresses chart. Source: Santiment

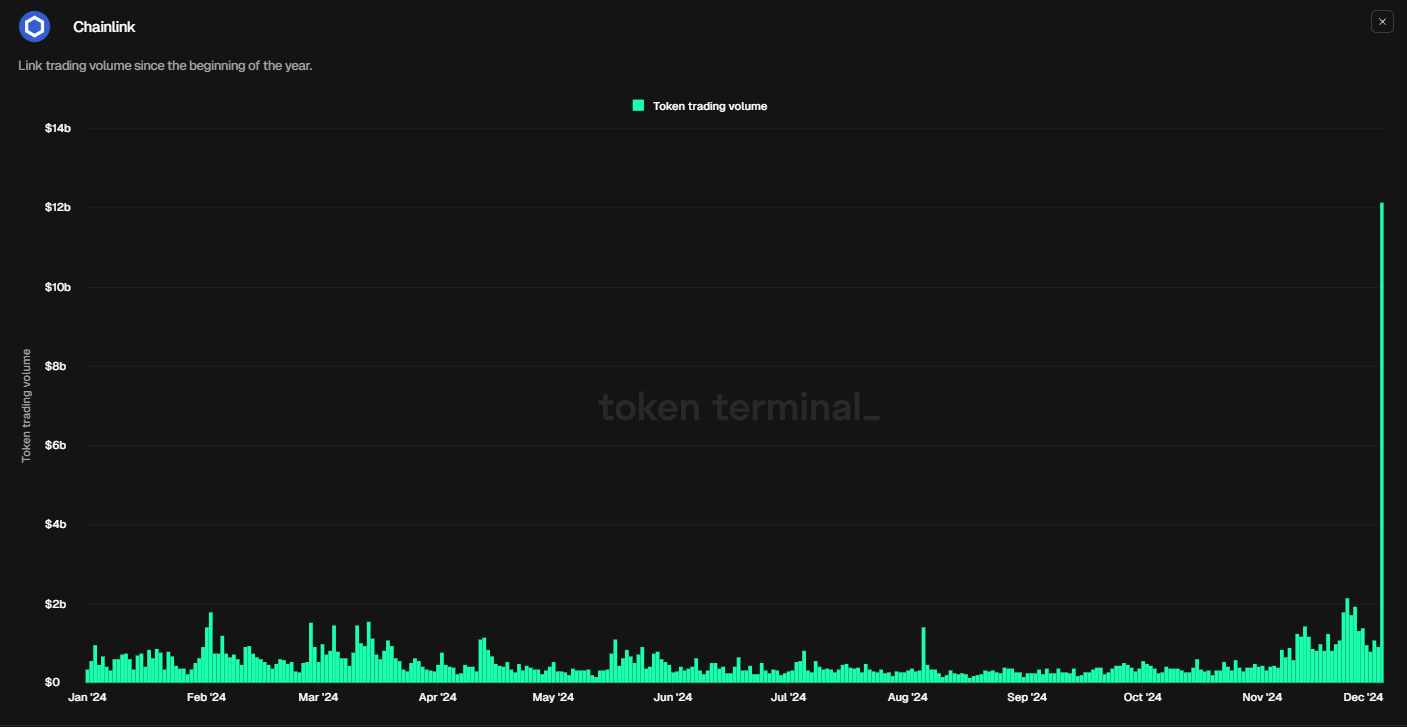

Another aspect bolstering the platform’s bullish outlook is a recent surge in traders’ interest and liquidity in the LINK’s chain. Token Terminal’s data shows that LINK’s daily trading volume reached $12.15 billion on Monday, the highest daily volume so far this year.

LINK daily trading volume chart. Source: Token Terminal

Chainlink Price Forecast: Bulls eye $38

Chainlink price surged 5.6% last week, closing above the ascending trendline drawn by connecting multiple weekly high levels from early November 2021. At the start of this week, the upward trend extended, rallying 36.5% until Tuesday, breaking above the weekly resistance of $22.56.

If LINK price continues to increase, it could extend the rally by 54% to retest its November 2021 high of $38.31.

The weekly chart’s Relative Strength Index (RSI) stands at 73, trading slightly above its overbought level of 70. Traders should be cautious because the chances of a price pullback are increasing. Still, the RSI is still pointing upwards, so there is the possibility that the rally continues and the indicator remains above the overbought level.

LINK/USDT weekly chart

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.