Here is what you need to know on Monday, October 20:

Major currency pairs remain relatively calm on Monday following the previous week's volatile action. The economic calendar will not offer any high-impact macroeconomic data releases. Hence, investors will remain focused on headlines surrounding the trade relations between the United States (US) and China.

During the Asian trading hours, the data from China showed that the Gross Domestic Product (GDP) grew at an annual rate of 4.8% in the third quarter. This print followed the 5.2% expansion recorded in the previous quarter and came in line with the market expectation. In the meantime, Retail Sales increased by 3% on a yearly basis in September, while Industrial Production expanded by 6.5% in the same period. Finally, the People’s Bank of China (PBOC), China's central bank, announced that it left the one-year and five-year Loan Prime Rates unchanged at 3.00% and 3.50%, respectively, as anticipated.

Following a three-day slide, the US Dollar (USD) Index closed in positive territory on Friday. The index struggles to gather bullish momentum to start the week and moves sideways at around 98.50. Meanwhile, US stock index futures rise between 0.35% and 0.55%, reflecting an improving risk mood. US President Donald Trump said over the weekend that he wants China to buy soybeans at least in the amount they were buying before. Trump added that he believes China will make a deal on soybeans.

US Dollar Price Today

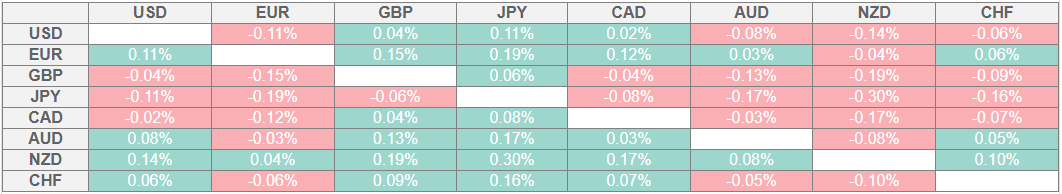

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

After setting a new record-high of $4,380 on Friday, Gold staged a deep correction in the second half of the day and lost more than 1.5%. Nevertheless, XAU/USD still gained nearly 6% for the week. Early Monday, Gold stays in a consolidation phase at around $4,250.

NZD/USD clings to moderate daily gains above 0.5700 in the early European session on Monday. The data from New Zealand showed that the Consumer Price Index (CPI) rose 1% on a quarterly basis in the third quarter. This print followed the 0.5% increase recorded in the second quarter and matched analysts' estimate.

GBP/USD holds steady above 1.3400 in the European session on Monday after closing virtually unchanged on Friday. On Wednesday, the UK's Office for National Statistics (ONS) will release the CPI data for September.

The Bank of Canada (BoC) will release the Business Outlook Survey later in the day. USD/CAD fluctuates in a narrow range above 1.4000 in the European session on Monday after ending the fourth consecutive week in positive territory.

EUR/USD lost about 0.3% on Friday and snapped a three-day winning streak on Friday. The pair struggles to find direction early Monday and holds above 1.1650.

Bank of Japan (BoJ) Board Member Hajime Takata said on Monday that Japan has already roughly achieved the BoJ's price target and argued that the BoJ must respond to the fact that headline inflation has exceeded 2% for a while now. USD/JPY holds its ground and trades comfortably above 150.50 in the European morning on Monday.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.