Dogecoin Whales Vanish: Large Transactions Drop By 88%

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold slumps below $5,100 as US Dollar gains

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

On-chain data shows that large Dogecoin transactions have seen a sharp drop recently, a sign that whales are no longer active on the network.

Dogecoin Whale Activity Has Plunged Since Mid-November

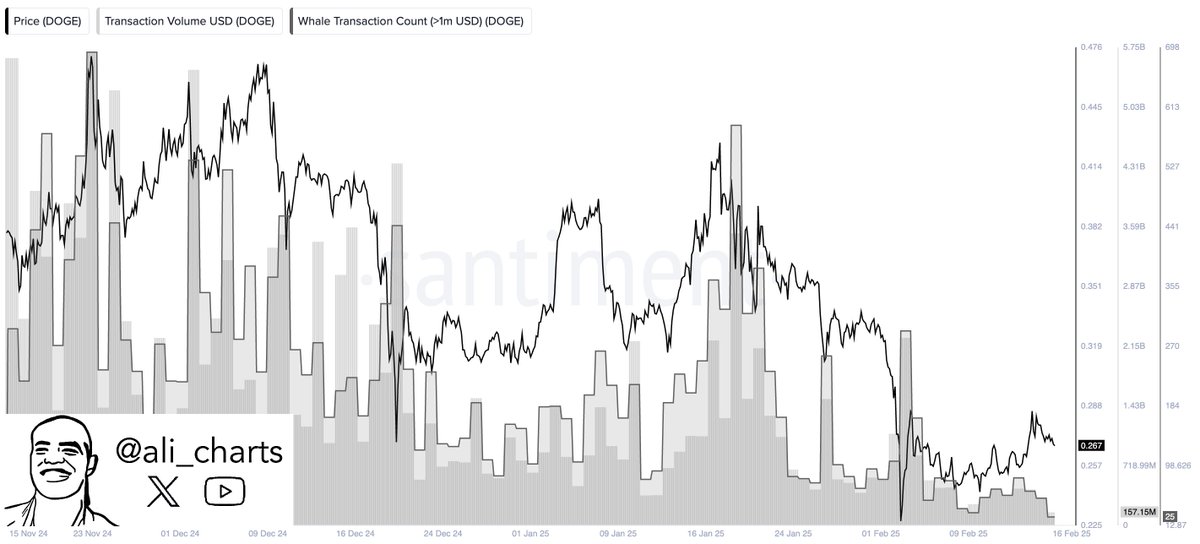

As pointed out by analyst Ali Martinez in a new post on X, the Whale Transaction Count has declined for Dogecoin recently. The “Whale Transaction Count” here refers to an indicator created by the on-chain analytics firm Santiment that keeps track of the total number of DOGE transfers carrying a value of more than $1 million.

Generally, only the whale entities are capable of making single-transaction moves this large, so the metric’s value is assumed to correlate to the activity of this cohort.

When the value of the Whale Transaction Count is high, it means the whales are making a large number of transfers. Such a trend suggests these humongous investors have an active interest in trading the asset. On the other hand, the indicator being low implies this group may not be paying much attention to the meme coin as its members aren’t participating in any notable transaction activity.

Now, here is a chart that shows the trend in the Whale Transaction Count for Dogecoin over the last few months:

As is visible in the above graph, the Dogecoin Whale Transaction Count shot up to a high level back in November, meaning that the network was receiving a high amount of activity from the whales.

Since the peak in mid-November, though, the indicator has been following an overall downward trajectory. Today, the blockchain is witnessing just 25 daily transactions from the whales, which represents a decline of nearly 88% compared to the high.

Evidently, the recent downturn in the meme coin’s price has coincided with this cooldown in whale interest. Given this pattern, the metric could be to keep an eye on in the near future, as any changes in it might imply a new outcome for DOGE. Naturally, prolonged inactivity from the group could mean further bearish action for the asset, while a surge could lead to a rally.

The low Whale Transaction Count isn’t the only bad sign that Dogecoin has seen recently, as Martinez has explained in another X post that the cryptocurrency has witnessed a death cross between the MVRV Ratio and its 200-day moving average (MA).

The Market Value to Realized Value (MVRV) Ratio here is an on-chain metric that basically tells us about the profit-loss status of the Dogecoin investors. As DOGE’s price has declined recently, investor profitability has dropped, which has resulted in a plunge in the MVRV Ratio.

With this plummet, the indicator has gone under its 200-day MA. “The last two times this happened, prices dropped 26% and 44%,” notes the analyst.

DOGE Price

At the time of writing, Dogecoin is trading at around $0.264, up nearly 6% in the last seven days.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.