Ethereum Blockchain’s Q1 2024 Success: Unveiling The Factors Behind The $370M Profit Surge

Not only has Ethereum (ETH) seen an impressive rise of nearly 100% in the first quarter of 2024 in terms of price action, but the Ethereum blockchain has also generated substantial profits of up to $369 million during this period. This unexpected profitability has raised questions about how a blockchain like Ethereum can be profitable.

Ethereum Revenue Potential

As noted in a recent analysis by the on-chain data platform Token Termina, the collection of transaction fees is a critical aspect of Ethereum’s business model.

All network users are required to pay fees in ETH when interacting with applications on the blockchain, which serves as an important source of revenue for Ethereum.

Once transaction fees are paid, a portion of the ETH is burned and permanently removed from circulation. This process, commonly referred to as “ETH buyback,” benefits existing ETH holders, as the reduction in supply increases the scarcity and value of the remaining ETH tokens. Thus, the daily burning of ETH contributes to the economic benefit of those holding Ethereum.

In contrast to the burning of ETH, Ethereum also issues new ETH tokens as rewards to the network’s validators for each new block added to the blockchain.

These rewards are similar to traditional stock-based compensation and are designed to incentivize validators to secure and maintain the network’s integrity.

Nonetheless, it’s important to note that the issuance of new ETH tokens dilutes the holdings of existing ETH holders.

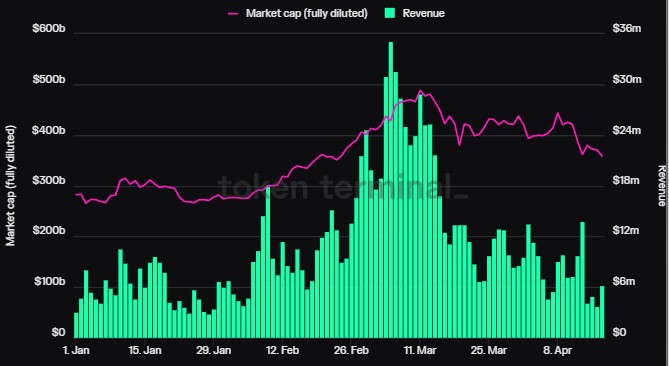

According to Token Terminal, the difference between the daily USD value of the burned ETH (revenue) and the newly issued ETH (expenses) represents the daily earnings for existing ETH holders, essentially the Ethereum blockchain owners. This calculation allows for the determination of Ethereum’s profitability on a day-to-day basis.

Reduced Transaction Costs Drive $3.3 Billion Growth

In addition to the overhauled revenue model implemented by the Ethereum blockchain, the launch of the much-anticipated Dencun upgrade to the Ethereum ecosystem at the end of the first quarter of 2024 brought significant changes, including the introduction of a revolutionary data storage system called blobs.

This upgrade has reduced congestion on the Ethereum network and significantly reduced transaction costs on Layer 2 networks such as Arbitrum (ABR), Polygon (MATIC), and Coinbase’s Base.

Implementing the Dencun upgrade, alongside the adoption of blobs and Layer 2 networks, has significantly impacted Ethereum’s revenue.

According to Token Terminal data, the blockchain’s revenue has witnessed an 18% annualized increase, amounting to an impressive $3.3 billion. These revenue gains can be attributed to reduced transaction costs, making Ethereum a more attractive platform for users and developers.

Despite the positive revenue growth, it is essential to acknowledge the impact of market corrections and dampened investor interest in the second quarter of 2024.

Over the past 30 days, Ethereum’s revenue has declined by over 52%. This downturn can be attributed to the broader market dynamics and the temporary decrease in investor enthusiasm.

Examining the data over the past 30 days, Ethereum’s market cap (fully diluted) has decreased by 15.2% to $358.47 billion. Similarly, the circulating market cap has declined by 15.2% to reach the same value.

Additionally, the token trading volume over the past 30 days has declined 18.6%, totaling $586.14 billion.

ETH is trading at $3,042, up 0.4% in the last 24 hours. It remains to be seen whether these changes and the reduction in fees will have the same effect in the second quarter of the year, and how this, coupled with a potential increase in trading volume, can push the ETH price to higher levels.

Featured image from Shutterstock, chart from TradingView.com

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.