Copper prices steady as refining constraints and tariff fears persist

- The Copper price remains firm as refining constraints pose a risk to the electronics industry.

- Copper trades at $5.50, still 10% above its level on Monday, as concerns about tariffs persist.

- Tariff-driven supply risks raise alarm across the construction sector.

Copper futures are trading near $5.50 per pound on Friday, slipping from Tuesday’s high of $5.70 on the daily timeframe. Despite the modest decline, prices remain 10% higher than Monday’s close, underscoring persistent concerns over supply disruptions tied to incoming United States (US) trade tariffs.

The 50% tariff on Copper imports, announced on Wednesday and set to take effect on August 1, is aimed at consolidating the US Copper industry and reducing reliance on imported refined products.

The tariff announcement has driven the premium between US Copper futures and London Metal Exchange (LME) prices to a record 25%, as foreign benchmarks weakened and US prices surged.

This divergence reflected market expectations that Copper inflows into the US would slow after threats initially emerged in February.

Traders accelerated shipments in recent months to get ahead of the August enforcement window. The front-loading of imports temporarily increased US stockpiles but is now expected to fade, potentially leading to domestic shortages later this quarter.

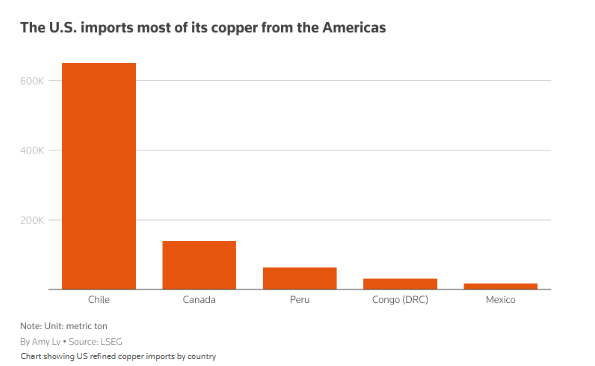

According to a Reuters report on Thursday, the United States imports nearly 50% of its Copper consumption, with Chile accounting for the bulk of refined Copper shipments.

Analysts warn that the US lacks sufficient refining infrastructure to absorb the supply gap. New capacity could take years to develop, suggesting that downstream industries, particularly construction and electronics, may face rising input costs and delivery lags.

The daily chart below shows Copper trading within a long-term ascending channel, with strong volume supporting the recent breakout.

The Relative Strength Index (RSI) has eased from overbought levels but remains elevated, signaling continued bullish bias.

Immediate support lies at $5.03, followed by deeper support at $4.62 (78.6% Fib) and $4.29 (61.8% Fib), where prior consolidation zones could act as buffers in the event of a pullback.

As the August 1 deadline approaches, Copper markets are likely to remain volatile.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.