Bitcoin's Accumulation Trend Score dropped to 0.21, suggesting a movement into the distribution stage.

The latest US economic data triggered notable sell-offs in both the stock and crypto markets.

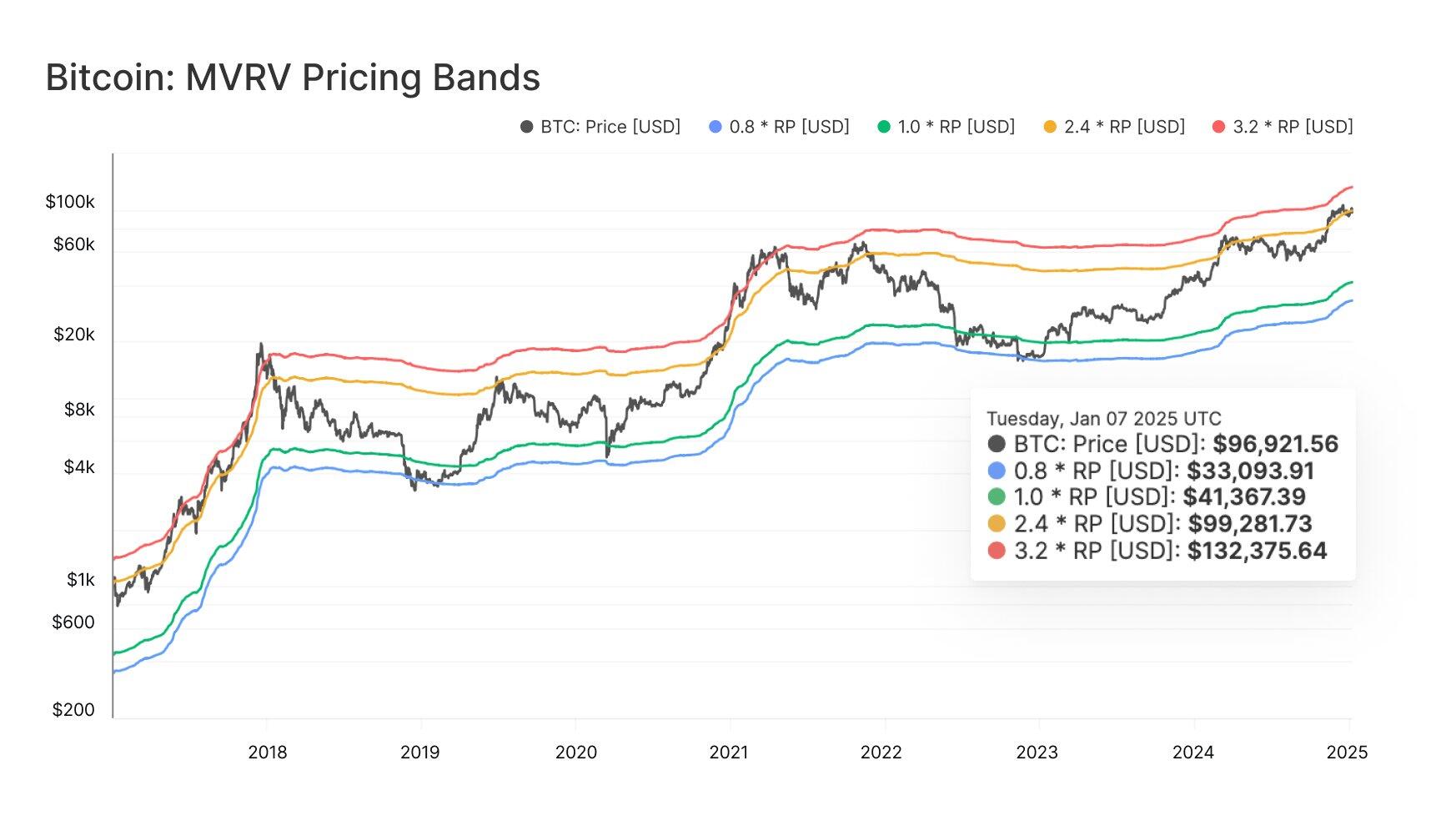

BTC's MVRV ratio indicates that Bitcoin is yet to reach "extreme euphoria" in the current market cycle.

Bitcoin (BTC) experienced a 2% decline on Wednesday as the cryptocurrency market grapples with recent losses. On-chain data has indicated a shift in the accumulation of the leading cryptocurrency, suggesting that holders are increasingly selling their assets. Despite this shift towards distribution, Bitcoin's Market Value to Realized Value (MVRV) ratio suggests that the current market cycle has not yet reached its peak.

Bitcoin declines to $94K, stirs mixed sentiment among investors

Bitcoin stretched its decline into Wednesday, falling toward $94,000 and sparking over $134 million in liquidations, per Coinglass data.

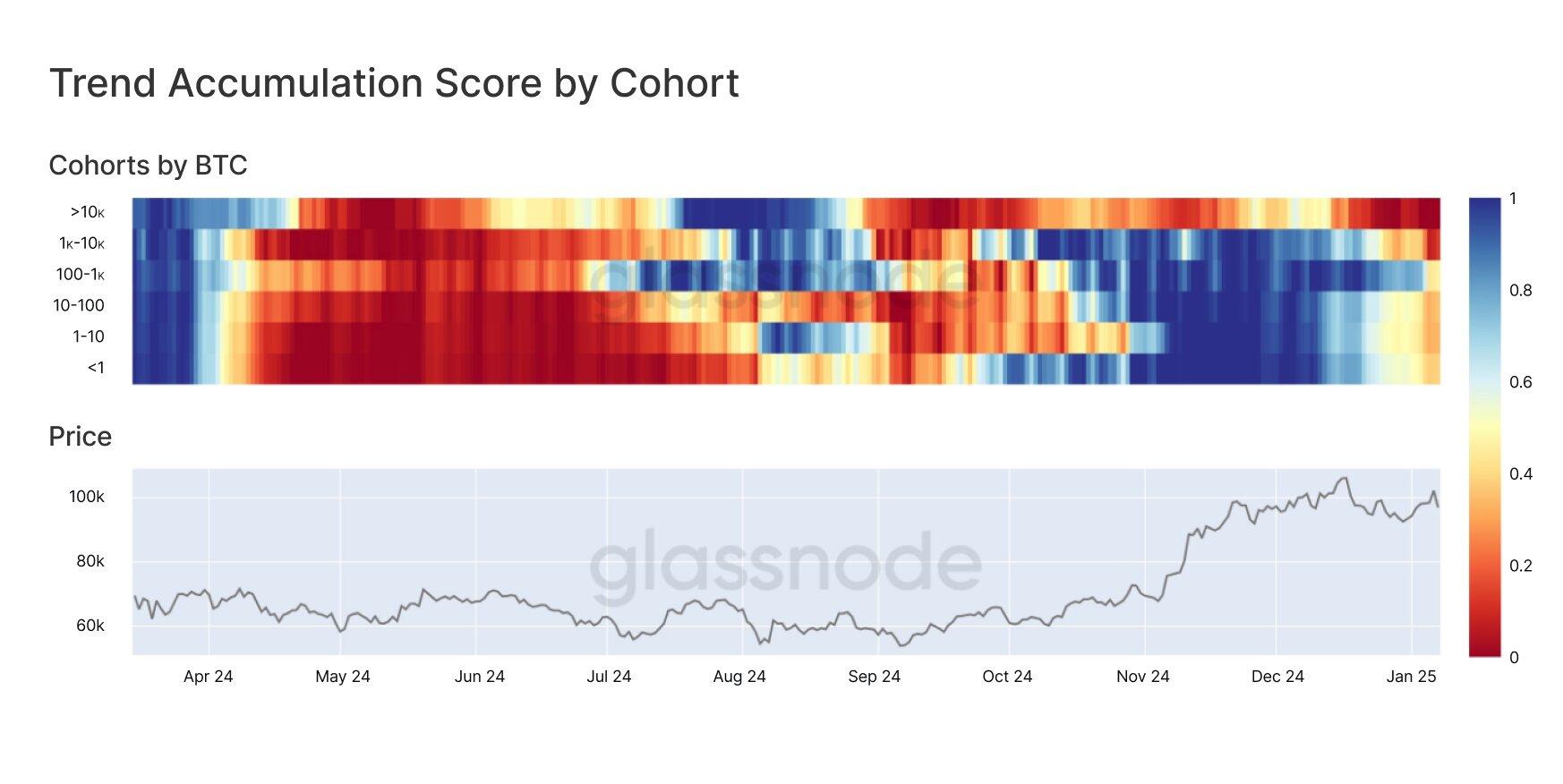

On-chain data from Glassnode revealed that Bitcoin's Accumulation Trend Score dropped to near 0, indicating a shift in the market toward a distribution phase.

The metric approached a score close to 1 across most cohorts of holders during the rally between November and December, signaling steady accumulation. However, investors across all cohorts have slowly increased distribution in the past few days, with ultra-large holders leading the charge.

Bitcoin Trend Accumulation Score by Cohort. Source: Glassnode

The selling pressure may have been fueled by headwinds from stronger-than-expected US ISM Services Purchasing Managers Index (PMI) and job openings reported by the US Bureau of Labor Statistics for November 2024.

Likewise, Crypto analyst Markus Thielen stated in a recent memo that global liquidity shifts could threaten Bitcoin's bullish momentum.

"Following the Trump re-election, the strengthening US dollar has tightened dollar-denominated liquidity, signaling the potential for a consolidation phase in the near term," Thielen wrote.

He noted that Bitcoin and risk assets may experience a temporary consolidation caused by the appreciation of the US dollar. This is also visible in the decline across the US stock market, signaling its growing correlation with Bitcoin.

Despite the recent sell-side pressure after Bitcoin reached an all-time high above $108,000, the top crypto may still have potential for higher price appreciation before the cycle ends.

Bitcoin's Market Value to Realized Value (MVRV) ratio, which indicates the average profit or loss for all investors, has not yet reached the level of 3.2, which signifies "extreme euphoria," according to Glassnode data. For Bitcoin (BTC) to enter this state of extreme euphoria in the current cycle, it would need to reach a price of $132,000.

Bitcoin MVRV Pricing Bands. Source: Glassnode

"BTC price has historically spent only ~5% of trading days above the 3.2 MVRV level," wrote Glassnode analysts. "This highlights how rare such peaks are and reinforces why it's often considered an 'extreme euphoria' zone."

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.