AUD/USD jumps to near 0.6670 as the Australian Dollar capitalizes on risk-on market mood.

Fed dovish expectations have boosted demand for risk-sensitive assets.

The RBA is unlikely to cut interest rates in September’s monetary policy meeting.

The AUD/USD pair posts a fresh 10-month high near 0.6670 during the European trading session on Friday. The Aussie pair strengthens as the Australian Dollar (AUD)outperforms its peers amid cheerful market sentiment.

Australian Dollar Price Today

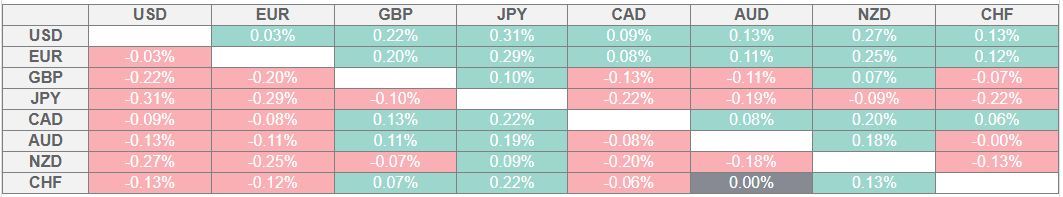

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

S&P 500 futures are marginally down during the European trading session, but gained 0.85% on Thursday.

The appeal of risk-sensitive assets has increased amid firm expectations that the Federal Reserve (Fed) will cut interest rates in its monetary policy announcement on Wednesday.

According to the CME FedWatch tool, traders see a 7.5% chance that the Fed will cut interest rates by 50 basis points (bps) to 3.75%-4.00% on September 17, while the rest point a standard 25-bps interest rate reduction.

Fed dovish speculation has been fuelled by weakening United States (US) labor market conditions. The US Department of Labor showed on Thursday that Initial Jobless Claims rose to 263K in the week ending September 5, the highest level seen in four years.

In Friday’s session, investors will focus on the preliminary US Michigan Consumer Sentiment Index and Consumer Inflation Expectations data for September.

At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades cautiously near its Thursday’s low around 97.60.

In Australia, Consumer Inflation Expectations for the forward one-year has come in higher at 4.7% on an annualized basis in September against the prior reading of 3.9%. De-anchoring consumer inflation expectations could force traders to reassess speculation about whether the Reserve Bank of Australia (RBA) will reduce interest rates in the policy meeting on September 30.

“We continue to expect just one more cut in November but no change at the RBA’s September meeting,” analysts at CommonWealth Bank said, News.com.au reported.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.