Forex Today: US Dollar finds support ahead of consumer confidence data

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Here is what you need to know on Friday, September 12:

The US Dollar (USD) stabilizes following Thursday's decline as market focus shifts to the University of Michigan's (UoM) preliminary Consumer Sentiment Index data for September. Market participants will also pay close attention to comments from European Central Bank (ECB) officials now that the quiet period is over after Thursday's policy announcements.

US Dollar Price This week

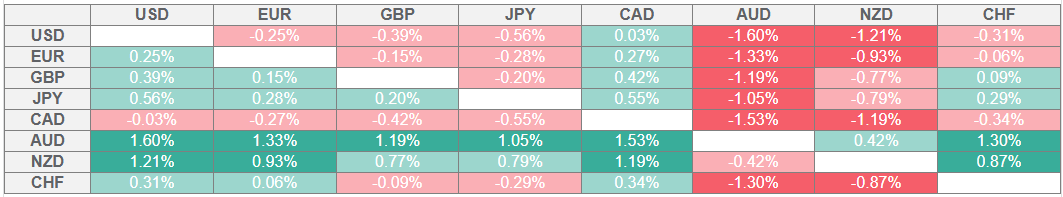

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the Australian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The ECB left key rates unchanged, as widely anticipated, after the September meeting. While speaking at the post-meeting press conference, ECB President Christine Lagarde refrained from offering any fresh hints regarding the rate outlook, reiterating that they are not on a predetermined path. After declining toward 1.1660, EUR/USD reversed its direction in the second half of the day on Thursday and closed in positive territory above 1.1700. Early Friday, the pair stays in a consolidation phase below 1.1750.

The US Bureau of Labor Statistics (BLS) reported on Thursday that annual inflation in the US, as measured by the change in the Consumer Price Index (CPI), rose to 2.9% in August from 2.7% in July. On a monthly basis, the core CPI, which excludes volatile food and energy price, increased 0.3%. Both of these readings came in line with analysts' estimates. On a concerning note, the Department of Labor's weekly publication showed that the number of first-time application for unemployment benefits climbed to 263,000 in the week ending September 6, compared to the market expectation of 235,0000, from 236,000 in the previous week. The USD came under bearish pressure after these releases and the USD Index lost about 0.3% on a daily basis. Early Friday, the index clings to small gains above 97.50, while US stock index futures lose about 0.1%.

The UK's Office for National Statistics (ONS) announced early Friday that the Gross Domestic Product was unchanged on a monthly basis in July. Meanwhile, Industrial Production and Manufacturing Production contracted by 0.9% and 1.3% in this period, respectively. GBP/USD edges lower in the European morning and trades slightly above 1.3550.

USD/JPY registered small losses on Thursday after failing to stabilize above 148.00. The pair stays in a consolidation phase at around 147.50 in the European session on Friday. Japan’s Trade Ministry announced on Friday that the country will impose additional export restrictions on several foreign entities as part of sanctions against Russia’s invasion of Ukraine.

Gold failed to gather bullish momentum and closed modestly lower on Thursday. XAU/USD holds its ground early and trades in positive territory at around $3,650.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.