Why Bitcoin ETFs Haven’t Sparked Major Adoption Yet: Bianco Research CEO Weighs In

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Gold slumps below $5,100 as US Dollar gains

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

- US Dollar Index gathers strength to near 99.00 on Middle East tensions, robust US services data

- WTI climbs to $76.00, eyes one-year high amid rising tensions in the Middle East

- How to Survive Bitcoin Winter? Will It Still Fall Below $60,000 in 2026?

Although the recent launch of Bitcoin ETFs or exchange-traded funds in the United States appears to have been met with excitement, according to Jim Bianco, CEO of Bianco Research, these financial products have not yet lived up to their anticipated role as a major catalyst for cryptocurrency adoption.

In a post shared on Elon Musk’s social media platform, X, Bianco suggested that Bitcoin ETFs would need more time to mature before they could serve as a major “instrument of adoption” rather than just a “small tourist tool.”

Bitcoin ETF Outflows And Lack of Institutional Involvement

Bianco’s comments highlighted growing skepticism about the performance of Bitcoin ETFs since their debut for trading in January.

While there was significant pre-launch hype about the potential of spot Bitcoin ETFs, Bianco pointed to several signs that the market may not yet be as strong as expected.

Key issues pointed out by the expert include recent outflows, losses by holders of these ETFs, and a general lack of major institutional investment, all of which suggest that the Bitcoin ETF market may need more time to develop fully.

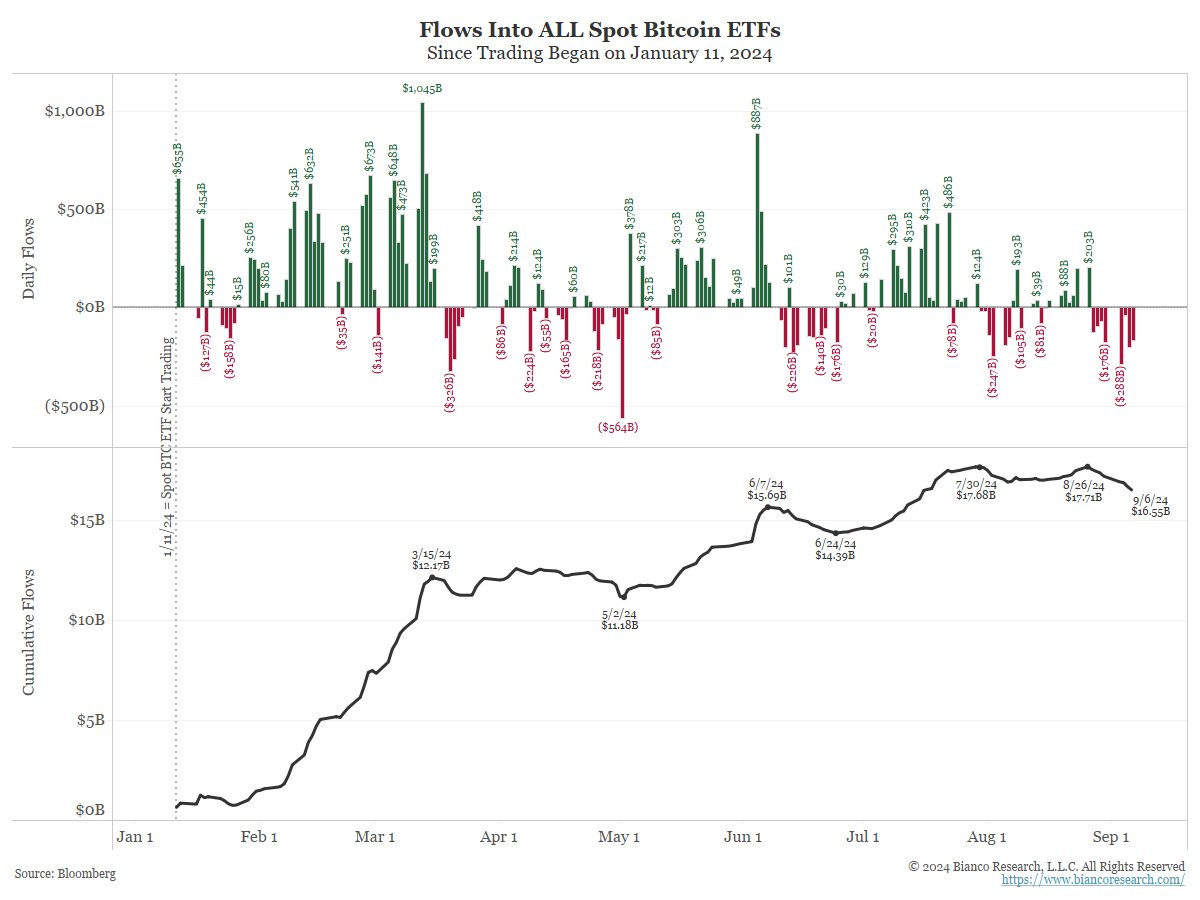

One critical point Bianco raised is the substantial net outflows within the Bitcoin ETF market. Citing data from Farside Investors, Bianco showed that there has been over $1 billion in net outflows from the 11 US Bitcoin ETFs in just the last eight trading days.

This has reduced the total assets under management (AUM) for Bitcoin ETFs from a peak of $61 billion in March to around $48 billion. Bianco argued that these outflows demonstrate a need for more sustained interest and capital inflow from institutional investors.

He further pointed out that most inflows into Bitcoin ETFs were from existing cryptocurrency holders who shifted their positions back into traditional finance (Trad-Fi) accounts rather than from new investors entering the market. This indicates that the ETFs may not have attracted fresh capital as initially hoped.

Adding credibility to the skepticism, Bianco mentioned that even BlackRock confirms that roughly 80% of Bitcoin ETF purchases have likely been made through self-directed online accounts, further suggesting that institutional investors have yet to engage with the Bitcoin ETF market fully.

The expert added:

Crypto-quant analysis suggests that most Spot BTC ETF inflows were from on-chain holders moving back to tradfi accounts— so very little “new” money has entered the crypto space. So far, these instruments have NOT lived up to the hype of “here come the boomers.” Very few have come, and those that have are holding losses and may now be leaving ($1B outflows over the last 8 days).

What Does The Bitcoin ETF Market Need To Mature?

While the recent performance of Bitcoin ETFs may not have met the initial expectations, Bianco remains optimistic that they can still become a valuable instrument for cryptocurrency adoption.

He emphasized the need for “patience” and the development of more on-chain tools that could drive the market forward. Bianco says it may take “a couple of seasons, including a winter or two and development breakthroughs” before the Bitcoin ETF market truly hits its stride.

The CEO noted:

Can these tools be an instrument of adoption? Yes, maybe after the next having (2028) and after significant development of on-chain tools have occurred first. (i.e., BTC chain DeFi, NFTs, payments, etc.)

Featured image created with DALL-E, Chart from TradingView

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.