President Trump’s Tariff Pause Fuels Market Rally, But Experts Warn of ‘Dead Cat Bounce’

- Gold Price Forecast: XAU/USD drifts higher above $4,200 as Fed delivers expected cut

- Gold Price Steady Climb and the Sudden Surge of Silver and Copper: Will Their Bull Run Extend Into 2026?

- Gold Price Forecast: XAU/USD climbs above $4,250 as Fed rate cut weakens US Dollar

- Bitcoin Cash Unveiled: Why Did BCH Price Surpass BTC? Can it Soar to $1,000 in the Future?

- Silver Price Forecast: XAG/USD refreshes record high, looks to build on move beyond $61.00

- AUD/USD holds steady below 0.6650, highest since September ahead of China's trade data

President Donald Trump’s latest decision to pause most of his tariffs has sparked a rally in stocks, bonds, the dollar, and cryptocurrencies. However, experts believe that the tariff delay may be creating a “dead cat bounce” in the market.

This recovery follows Trump’s earlier imposition of reciprocal tariffs on all nations, including a significant 104% tariff on Chinese imports. The announcement rattled markets, triggering a considerable downturn.

Is the Crypto Market Surge Just Another Dead Cat Bounce in Disguise?

BeInCrypto reported that Trump’s 90-day tariff pause excluded China. Importantly, following Beijing’s retaliatory measures, the tariffs have now escalated to 125%.

Nevertheless, the move has significantly boosted markets. The total cryptocurrency market capitalization surged by 5.5% in the past 24 hours, with Bitcoin (BTC) reclaiming the $80,000 mark.

Other major cryptocurrencies, such as Ethereum (ETH), XRP (XRP), and Solana (SOL), also recorded double-digit gains, signaling renewed investor optimism.

Top 10 Cryptocurrencies Market Performance. Source: BeInCrypto

Top 10 Cryptocurrencies Market Performance. Source: BeInCrypto

Yet, beneath the surface of this rally, skepticism remains prevalent. Jacob King, analyst and CEO of WhaleWire newsletter, warned that the tariff delay is setting a trap for retail investors.

“We’ve officially entered the dead cat bounce phase: delay the tariffs, bait the retail crowd back in, and set the stage for the next red wave,” he posted.

He predicts that while retail investors pile into the market, institutions will use the opportunity to “quietly dump their bags,” foreshadowing a sharp downturn. Many echo King’s concerns. Moreover, economics professor Steve Hanke was even more direct.

“If Trump continues to play his tariff cards, the rally will represent nothing more than a dead cat bounce,” Hanke said.

In fact, some investors are planning to sell to avoid losses.

“This is the 90 day dead cat exit bounce. sell in may and go away,” another analyst wrote.

Nonetheless, Amit, an investor and analyst, offered a different view. He suggested that the previous market bounce was a dead cat bounce because it was not based on any solid, fundamental reason.

This time, however, the analyst pointed out that there is an actual reason for market optimism.

“The difference here, and why selling into the rip *might* not be the best, is that if tariffs are truly delayed — well folks we have a fundamental catalyst for the markets,” he remarked.

He explained that the initial 10% tariffs were already priced in the market. However, the market could stabilize if the 90-day tariff pause extends indefinitely and leads to a deal with China.

“We also have sold off a ton assuming these tariffs would be in effect. Jobs data is fine. If the tariffs aren’t the issue, not saying we need to visit 7000 spx anytime soon, but it may not be a deadcat given this catalyst could be long-lasting,” Amit added.

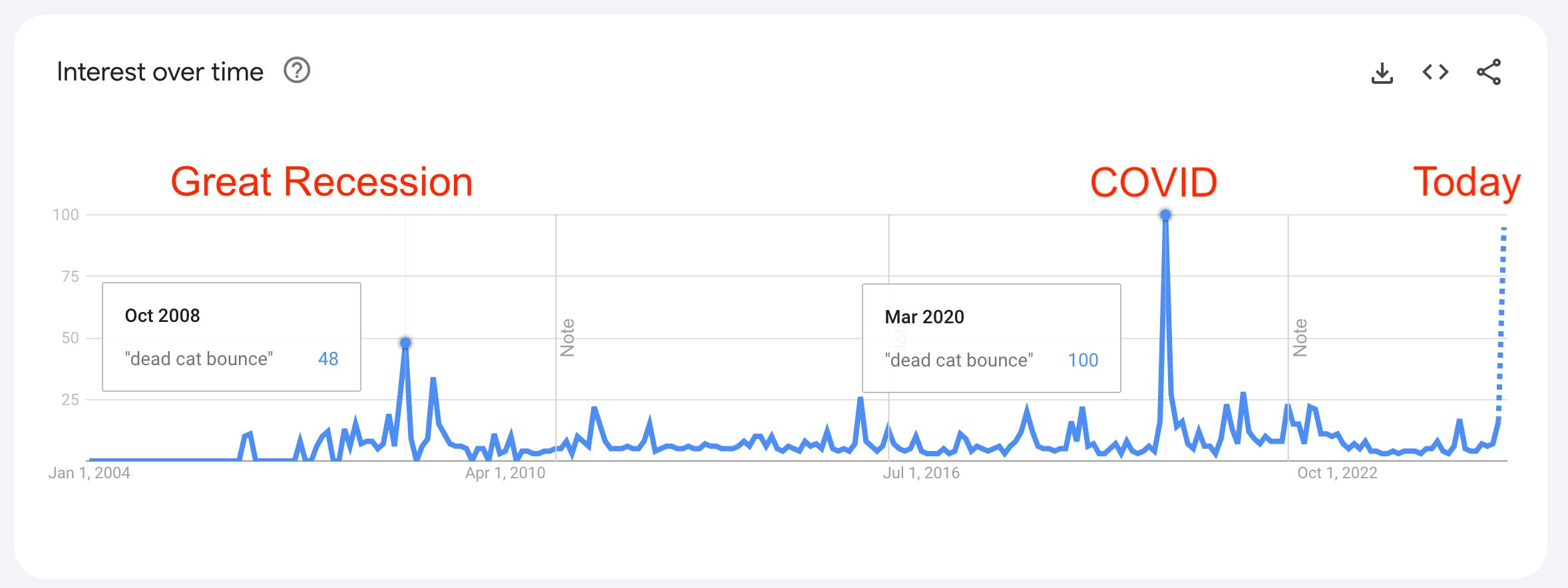

It is worth noting that the term “dead cat bounce”—a temporary recovery in asset prices after a steep decline, followed by a continued downtrend—has surged in online searches, reaching levels not seen since the COVID-19 pandemic.

Dead Cat Bounce Search Trends. Source: X/JEllulz

Dead Cat Bounce Search Trends. Source: X/JEllulz

During that period, markets like Bitcoin and stocks staged a V-shaped recovery fueled by quantitative easing (QE). BeInCrypto reported that this time, there is increased speculation that the Fed might return to QE in response to rising market volatility and financial instability.

If QE is revived, it could have a major impact on financial markets, including cryptocurrencies. The sector could see a strong rebound similar to past QE periods. Previously, Arthur Hayes, former CEO of BitMEX, predicted that Bitcoin could surge to $250,000 by the end of 2025 if this materializes.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.