January NFP Preview: Divergent Employment Outlook – Can Gold’s New Highs Be Sustained?

- International Oil Prices Retreat Rapidly; G-7 to Discuss Emergency Oil Reserve Release

- Goldman Sachs Raises Oil Price Forecasts and Warns Oil May Break All-Time Highs if Strait of Hormuz Disruption Persists

- Gold slumps below $5,100 as US Dollar gains

- Crypto’s Great Recovery: Is the Post-Conflict Surge a Sustainable Rally or a Sophisticated Bull Trap?

- WTI recovers to near $86.50 as Strait of Hormuz remains closed

- Gold slumps to near $5,050 on oil-driven inflation fears, stronger US Dollar

TradingKey - As the first nonfarm payrolls (NFP) report of 2025 approaches, the Federal Reserve’s rate cut prospects and markets such as gold and U.S. stocks face a critical test. Following unexpectedly strong ADP employment data, will the NFP report show signs of cooling as anticipated?

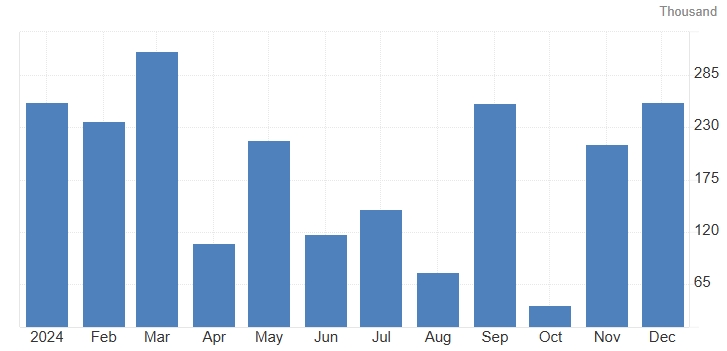

On Friday, February 7, the U.S. Bureau of Labor Statistics will release the January NFP report—the first since President Trump’s return to the White House. Economists generally expect nonfarm payrolls to have increased by 170,000, significantly lower than December 2024’s 256,000, with the unemployment rate holding steady at 4.1% and year-over-year wage growth easing slightly to 3.8%.

[U.S. Nonfarm Payrolls (NFP), Source: Trading Economics]

TradingKey analyst Jason Tang agrees with the consensus forecast, citing the following factors:

As a leading indicator, job openings in December last year stood at 7.6 million, nearly 500,000 lower than November, indicating that businesses are scaling back hiring efforts.

The diminishing expectations of Federal Reserve rate cuts have a significant impact on the labor market. Higher interest rates are unfavorable for business expansion, leading to fewer new job opportunities.

Seasonal factors also influence the U.S. hiring market. Generally, businesses tend to hire less aggressively during the winter months compared to other seasons.

Largest Annual Revision in History?

This report will include the U.S. Bureau of Labor Statistics' annual revisions, aligning employment data since March 2024 with quarterly unemployment insurance survey data.

In March last year, the Philadelphia Fed highlighted significant distortions in BLS employment data, sparking concerns over a "false employment prosperity." It indicated that NFP figures were overstated by 1.1 million from March to June 2022 and by 800,000 in 2023.

Goldman Sachs predicts that this NFP report will feature the largest revision in history, with:

- The total labor force increasing by 2.5 million

- Household employment rising by 2.3 million

- The labor force participation rate increasing by 11 basis points

- The unemployment rate rising by 4 basis points

Bloomberg economists estimate that revised average monthly employment growth for 2024 will be adjusted downward from 182,000 to 148,000.

Divergent Employment Growth Outlook

Economists believe that Trump’s pro-business policies will drive moderate U.S. economic growth, supporting a stable labor market.

Randstad NV, the world’s largest HR services provider, noted growing optimism in the U.S. regarding deregulation, innovation, and new technologies—factors that could boost hiring.

However, recent employment data shows mixed signals:

- ADP employment for January rose to 183,000, the highest since October 2024, exceeding forecasts of 150,000 and up from 122,000 in December.

- December JOLTS figures came in at 7.6 million, below market expectations of 8 million, while the hiring rate remained at 3.4% for three consecutive months—lower than the pre-pandemic 3.9% in February 2020.

- A recent Gallup survey found that 38% of Americans expect unemployment to rise, while another 38% anticipate a decline.

Rate Cut Prospects and Asset Performance

A strong NFP report could reduce the likelihood of Federal Reserve rate cuts, pressuring gold and U.S. stocks. Conversely, weaker employment data could bolster rate cut expectations, supporting risk assets.

Richmond Fed President Barkin cautioned that heightened policy uncertainty under Trump’s second term requires more time to assess the U.S. economy, employment, and inflation. He expects stable employment and spending but remains skeptical about business investment due to economic unknowns.

Recently, gold prices have repeatedly hit record highs, driven by policy uncertainty, currently trading at $2,865.50 per ounce.

Federal Reserve officials highlighted that Trump-era policy uncertainties, particularly on tariffs, pose one of the biggest challenges for future monetary policy.

ANZ strategists suggest that gold could soon reach $3,000, though a resolution in trade tensions could lead to price corrections.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.