China stock strategies pivot after $68 billion state‑linked exit from equities

For years, traders in China leaned on one quiet assumption. When prices fell hard, the national team would step in and buy. That belief sat under the market like a floor.

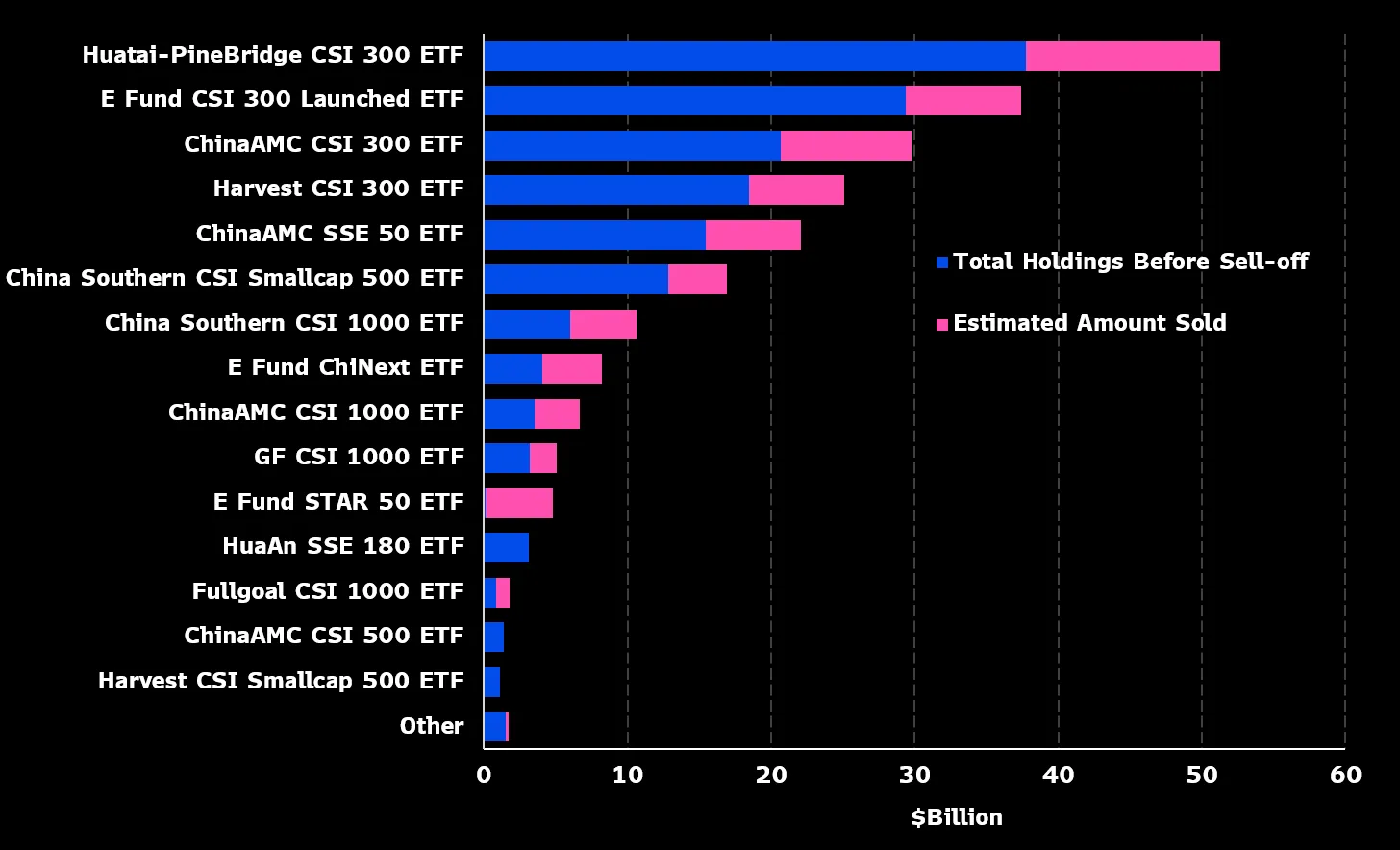

But last week, that floor cracked in public after Central Huijin Investment, a state-linked fund, sold sold about $67.5 billion across 14 tech-related ETFs in six sessions through Thursday, according to Bloomberg.

Chen Da, founder of Dante Research, said, “If enough people are watching what this player is doing, its actions could be enough to alter expectations.” That view spread quickly on trading floors. The national team was no longer a one-way buyer. It was trading both sides.

The numbers showed why nerves rose. The CSI 300 gained 1.8% over the past month. The Star 50 Index, packed with chip names, jumped 16%. Wu Wei, a fund manager at Beijing Win Integrity Investment Management Co., said, “These days it’s probably smart to focus trading on the stocks that the team owns less of to avoid being in the line of fire.”

Wu Wei added, “My trading has slowed a bit, because it’s not a bullish signal at the end of the day.”

ETF turnover exposes selling patterns during rebounds

Details on the trades will only appear in quarterly reports. Until then, investors are doing the math. Central Huijin began buying China’s ETFs aggressively in 2023.

By the end of August 2025, it held about $180 billion in these assets.Analyst Rebecca Sin, wrote that the “scale of liquidation suggests a proactive effort to facilitate a price correction in overheated sectors.”

After record outflows from a fund tracking the Star 50, they estimate only about 5% of Central Huijin’s firepower remains in that product.

Traders started spotting patterns during the week.When indexes jumped during the session, ETF turnover surged.

Prices then faded. On Wednesday, turnover in CSI 1000 ETFs climbed as the index rebounded nearly 2% within an hour, before slipping lower. Many desks read that as state selling.

The pattern repeated, though strong risk appetite kept some gauges afloat. The E‑fund ChiNext ETF saw large outflows on Thursday. The index later recovered part of its intraday drop. The selling surprised some investors, but others saw it as controlled pressure rather than panic.

Volatility eases as investors reassess exposure

Short-term volatility on the CSI 300 fell to its lowest level since May. Onshore trading cooled from nearly 4 trillion yuan, or $574 billion, earlier this month. Yang Ruyi, a fund manager at Shanghai Prospect Investment Management Co., said:-

“Instead of reading the state funds’ selling as a signal that the rally is over, we should consider this in the context of the structural, slow bull.”

Yang Ruyi also said it made sense for Central Huijin to reposition into other thematic ETFs.

Z‑Ben Advisors said the market absorbed the selloffs without major swings.That pointed to strong institutional demand for A‑shares in China.

Zhu Zhenxin, head of Asymptote Investment Research in Beijing, said, “Selling right now will free up positions so that they can provide a boost at a future time of risk.” Zhu Zhenxin added, “Such intervention will prevent a ‘mad bull’ like the one we saw in 2015.”

Attention is now on how much stock remains to sell. Some investors think tech buying could restart once supply dries up. Demand has stayed strong even with clear intervention. The CSI 1000 Index, home to rocket stocks like Hunan Aerospace Huanyu Communication Technology Co. and chip supply names, is still at its highest level since 2017.

Questions remain about whether heavy ETF trading is distorting prices. For now, Niu Chunbao, a fund manager at Shanghai Wanji Asset Management Co., is watching blue chips caught in the selling.

Niu Chunbao said, “I am pleased to see the team exit some of the ETFs as gains in some stocks were making the market restless and impulsive.” Niu Chunbao added, “Dips caused by their selling may render some value stocks even more attractive to us.”

Join a premium crypto trading community free for 30 days - normally $100/mo.