Shiba Inu Price Prediction: 91T Age Consumed supports 25% SHIB rally

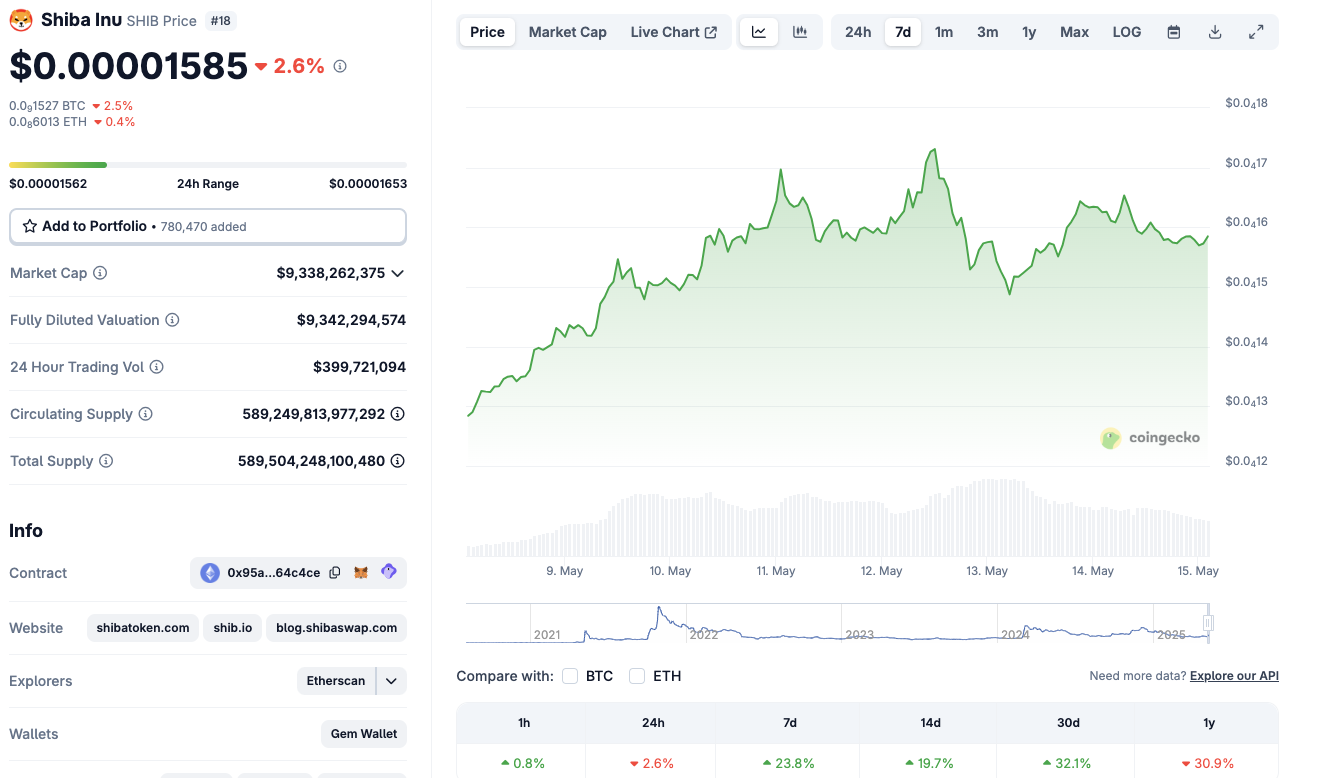

- Shiba Inu price consolidates at $0.000015 after a 3.6% correction on Wednesday.

- A Chinese firm acquired $300 million worth of Trump’s official memecoin, sparking sector-wide jittery.

- 91.4 trillion SHIB Age Consumed signals resilience among SHIB long-term holders.

Shiba Inu closed trading above $0.000015 level despite a 4% correction on Wednesday. Market reports suggest the SHIB price dip is linked to controversy surrounding a Chinese firm acquiring $300 million worth of Trump’s official memecoin.

Shiba Inu (SHIB) holds $0.000015 support level as Chinese firm triggers memecoin sector volatility

Shiba Inu price closed at $0.000015 on Wednesday, down 4% intraday, as memecoin markets reacted to a $300 million purchase of Trump’s official token by a Chinese tech company reportedly linked to TikTok stakeholders.

According to Coingecko data, SHIB's decisive close above $0.000015 means bulls maintain 7-day timeframe gains of 25%.

Shiba Inu (SHIB) Price Action, May 15, 2025 | Source: Coingecko

While the acquisition initially stirred enthusiasm among Trump Coin loyalists, memecoin sector sentiment turned defensive on fears of potential market manipulation risks as the Trump Coin transaction represents nearly 11% of its $2.7 billion market cap at press time.

Compounding those concerns, the timing of the $300 million transaction aligns with ongoing scrutiny of Trump’s affiliation with recently launched USD1 stablecoin, leading to suspension of the GENIUS act.

Consequently, heightened fears of impending regulatory action, and congressional scrutiny, fueled risk-off sentiment for SHIB and other memecoin holders.

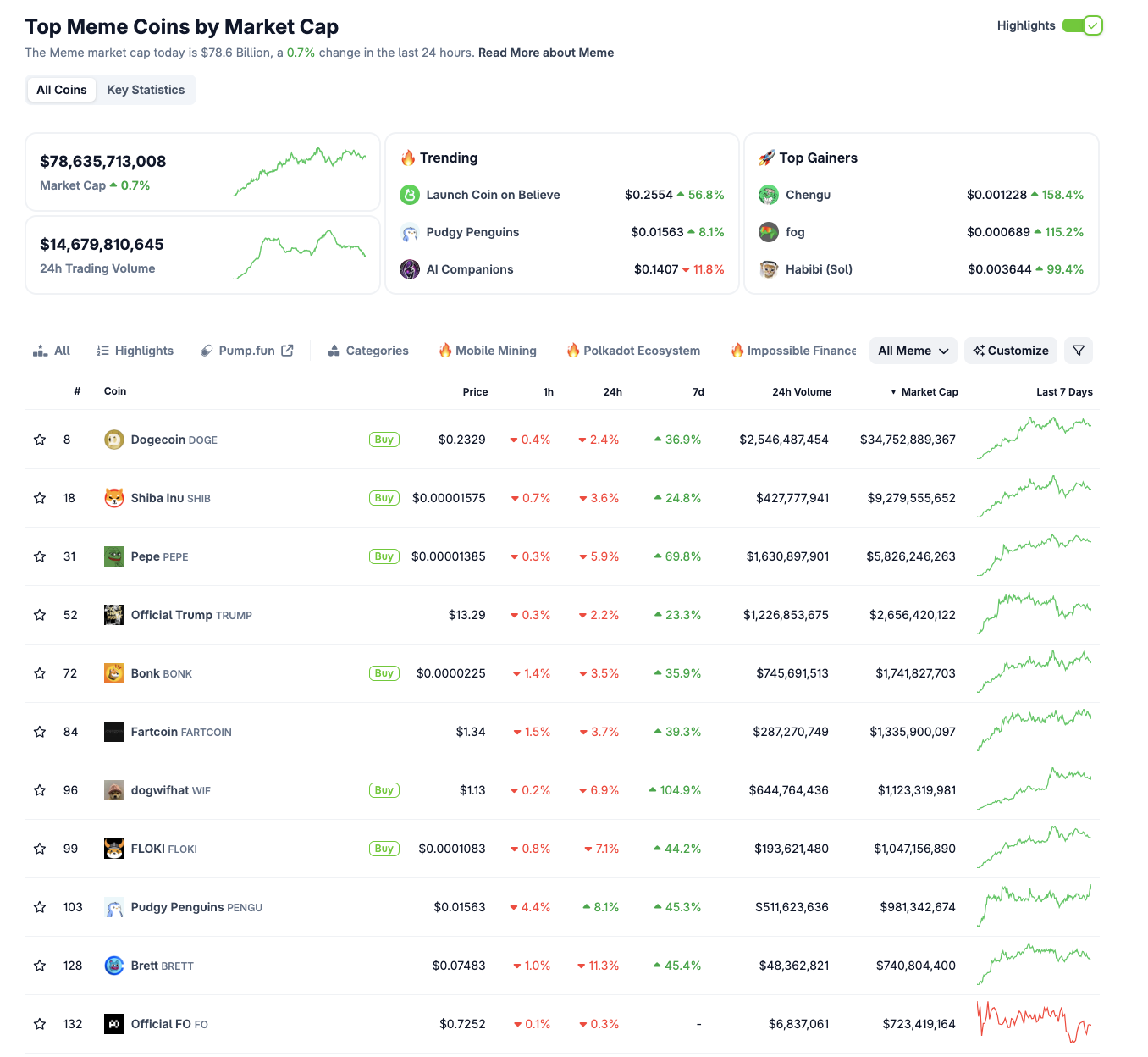

Nine of the Top 10 Memecoins posted losses on Wednesday

Following the controversial $300 million TRUMP transaction, the broader meme coin market endured widespread downturns on Wednesday. Nine of the top 10 tokens by market cap posted daily losses, according to Coingecko data.

The sector’s total market cap now stands at $78.6 billion, reflecting a 0.7% decline over the last 24 hours. Notably, while SHIB price plunges 3.6%, top-ranked Dogecoin (DOGE) dropped 2.4%, as Solana’s largest memecoin BONK shed 3.5%.

Top 10 Memecoins performance, May 15, 2025 | Source: Coingecko

Only Pudgy Penguins, an NFT based memecoin project managed to buck the negative trend, posting a considerable 8% uptick.

The synchronized sell-off across the top memecoin suggests more traders are actively rotating funds towards more niche mid-cap memecoins without exposure to US regulatory scrutiny.

SHIB Age Consumed trends flat at 91.4 trillion as long-term holders show resilience

On-chain data in the wake of the $300 million Trump Coin transaction suggests that Shiba Inu's long-term holders remain reluctant to sell. Santiment’s Age Consumed metric, an indicator that multiplies the number of tokens moved by the time since they last moved, further emphasizes this narrative.

Shiba Inu saw its Age Consumed remain flat at 91.4 trillion tokens as of Thursday.

Shiba Inu Age Consumed vs. SHIB price | Source: Santiment

Notably, zooming out to a three-month view reveals a consistent pattern of lower highs in Age Consumed, even during price corrections. This rare dynamic, especially following a sector-wide bearish event, is considered bullish for two main reasons.

First, it signals the 3.6% Shiba Inu price correction on Wednesday was largely driven by short-term traders, but has not sparked panic among long-term investors, playing down the negative impact of the cautious sentiment around top ranked memecoins on Wednesday amid growing political scrutiny.

Second, such muted Age Consumed behavior after a steep correction suggests SHIB is more likely to consolidate and rebound, rather than capitulate.

This lack of significant token movement from dormant SHIB wallets implies that the conviction among holders remains firm.

If SHIB maintains the $0.000015 support and market sentiment stabilizes, an instant rebound toward $0.000018 could be on the cards.