Bitcoin Price Forecast: BTC near its all-time highs ahead of US NFP

- Bitcoin price breaks out of consolidation, trading above $109,000 on Thursday, nearing record highs.

- Risk sentiment improves on the back of favorable macro conditions and the US-Vietnam trade deal.

- Traders eye the US Nonfarm Payrolls report for clues about the Fed rate-cut path.

Bitcoin (BTC) price climbs above $109,000 at the time of writing on Thursday, breaking out of its recent consolidation range and moving closer to its all-time highs. The breakout comes amid improving macroeconomic conditions and renewed risk appetite following the announcement of a US-Vietnam trade agreement. Traders now await the US Nonfarm Payrolls (NFP) report on Thursday, which could provide key insights into the Federal Reserve’s (Fed) interest rate trajectory.

Bitcoin traders await the NFP report

The Bitcoin price is trading above $109,000 on Thursday, and traders seem reluctant, opting to wait for the release of the US Nonfarm Payrolls report for fresh cues about the Federal Reserve's rate-cut path. The data will play a key role in influencing near-term US Dollar (USD) demand and provide a clear direction for riskier assets, such as Bitcoin.

Haresh Menghani, analyst at Fxstreet, reports that traders are currently pricing in nearly a 25% chance of an interest rate cut by the Fed at the July 29-30 monetary policy meeting. Moreover, a 25 basis points rate cut in September is all but certain, and expectations for two rate reductions by the end of this year are also high.

If Thursday’s NFP report supports the dovish stance, it may lead to lower interest rates. This could be a bullish case for riskier assets, such as BTC, as lower rates could increase the purchasing power of investors and prompt them to shift toward riskier assets. On the contrary, a hawkish stance could have a bearish effect on the BTC price.

Bitcoin rallies as trade tension eases

US President Donald Trump announced on Wednesday that the United States has struck a trade agreement with Vietnam that would ease certain tariffs previously imposed on Vietnamese exports. As part of the deal, a 20% tariff on goods imported from the Southeast Asian nation will be eliminated, and the US will gain tariff-free access to Vietnam’s markets.

Moreover, on Thursday, Bloomberg reported that the Trump administration has lifted recent export license requirements for chip design software sales in China as Washington and Beijing implement a trade deal to ease some restrictions on critical technologies for both countries.

These easing restrictions and trade deals have boosted investors' confidence and support for risky assets like Bitcoin.

However, traders should keep an eye on the tariff pause, as it is set to expire on July 9. More countries are pushing to secure a tariff-reducing deal ahead of Trump's July 9 deadline.

Moreover, Trump’s One Big Beautiful Bill (OBBB) heads back to the House after passing in the Senate earlier this week, and Trump aims to finalize the budget bill by Friday, which could bring volatility to the Bitcoin price.

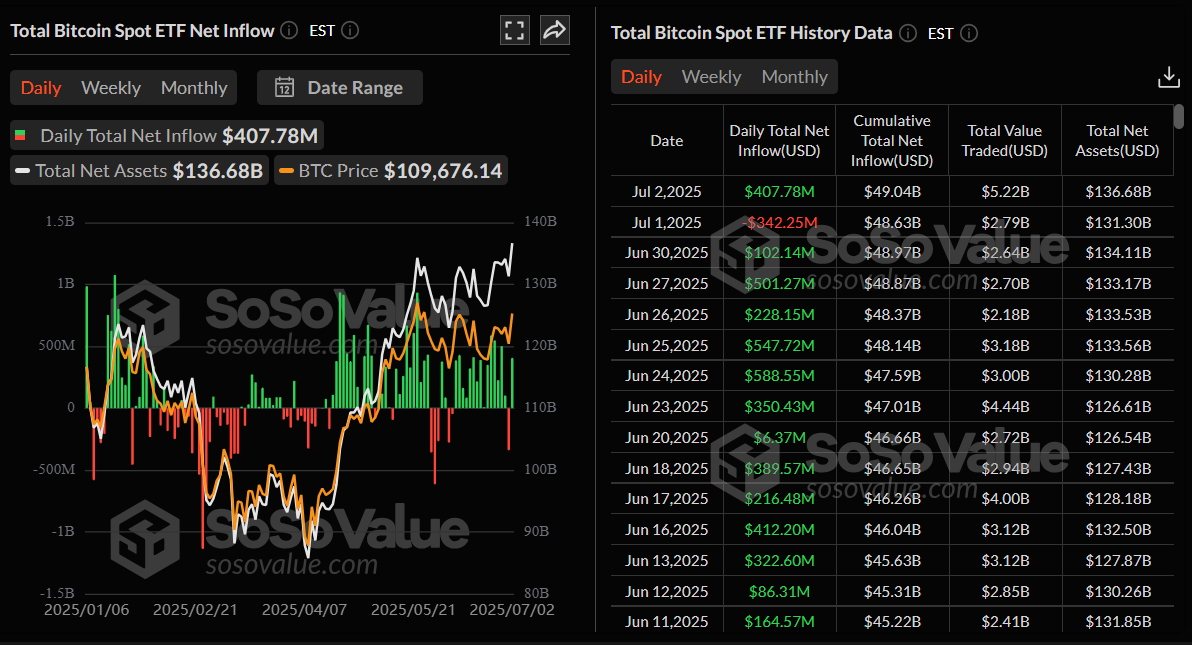

Institutional demand returns as spot ETF records inflow

According to SoSoValue data, US spot Bitcoin ETFs recorded an inflow of $407.78 million on Wednesday after an outflow of $342.25 million the previous day. This inflow suggests some optimism for the short term, but for BTC to continue its rally and reach record levels, the inflow must persist and intensify.

Total Bitcoin spot ETF net inflow daily chart. Source: SoSoValue

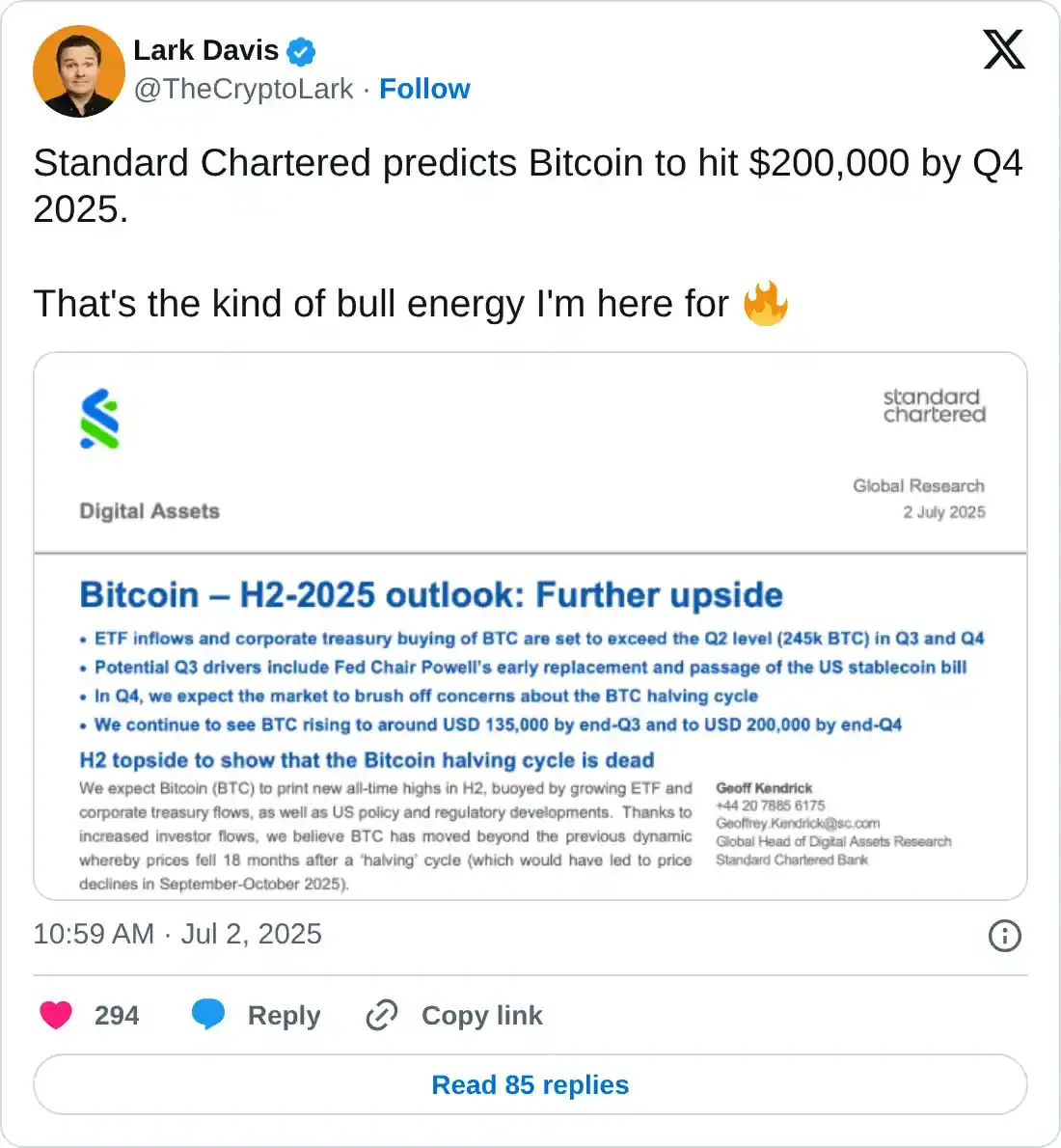

Another bullish outlook is the rising US M2 money supply, which increased 4.5% year-over-year in May to a high of $21.94 trillion, and Standard Chartered's positive forecast for Bitcoin. The bank predicts that Bitcoin could reach $135,000 by late 2025 and potentially even $200,000 by year-end 2025.

Bitcoin Price Forecast: BTC closes above its consolidation zone

Bitcoin price broke and closed above the upper boundary of a consolidation zone at $108,355 on Wednesday, rallying 3% that day. At the time of writing on Thursday, BTC extends the bullish leg to trade above $109,000.

If BTC continues its upward momentum, it could extend the rally toward the May 22 all-time high at $111,980.

The Relative Strength Index (RSI) on the daily chart reads 59 and points upward after rebounding from its neutral level of 50, indicating bullish momentum is gaining traction. The Moving Average Convergence Divergence (MACD) on the daily chart displayed a bullish crossover last week. It also shows rising green histogram bars above its neutral level, suggesting bullish momentum and indicating an upward trend.

BTC/USDT daily chart

However, if BTC faces a correction and closes below its support at $108,355, it could extend the decline to retest the lower boundary of the consolidation zone at $105,333.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.