Gold surges over 3% as dip buyers pounce on weaker USD

- Gold rebounds from $4,655 daily lows as weaker US labor data pressures the Greenback.

- Rising Fed cut expectations offset firmer Treasury yields, fueling dip-buying demand for bullion.

- Focus shifts to US CPI, Retail Sales and Fed speakers for near-term policy direction.

Gold price (XAU/USD) rallies more than 3% on Friday, poised for a decent weekly gain as dip buyers emerged, following a session that pushed the yellow metal below the $4,800 mark. Worth noting that Friday has been a volatile session, with the non-yielding metal falling to a three-day low of $4,655 before erasing those previous losses. At the time of writing, XAU/USD trades at $4,963.

XAU/USD stages a sharp rebound toward $4,950 as soft US labor data revives Fed easing bets

The non-yielding metal is enjoying a healthy recovery from Thursday. Greenback’s initial weakness on Friday reflected worse-than-expected US labor market data on Thursday, which fueled speculation for further easing by the Federal Reserve (Fed). This prompted traders to buy bullion’s dip even though US Treasury yields began to show signs of life.

The data front was light as January’s Nonfarm Payrolls were delayed for February 11, due to the US government shutdown. Consumer sentiment in the US improved, revealed the University of Michigan (UoM) survey, which should be reviewed with a pinch of salt, as it revealed that “Sentiment surged for consumers with the largest stock portfolios, while it stagnated and remained at dismal levels for consumers without stock holdings,” stated Joanne Hsu, the Survey’s Director.

On the geopolitical front, US-Iran talks began in Omani, with both parties agreeing to continue negotiations. Despite this, it is said that Iran refused to end nuclear enrichment in discussions with the US, as revealed by The Wall Street Journal.

The week ahead will feature the release of US employment situation, Retail Sales and the Consumer Price Index (CPI). Also, traders would be dissecting speeches by a flurry of Federal Reserve officials.

Daily digest market movers: Gold boosted by softer-than-expected US data

- The US Dollar Index (DXY), which measures the buck’s value against a basket of six currencies, loses 0.35% as of writing. The DXY is at 97.49 after failing to clear the 98.00 mark, a tailwind for Gold prices.

- Meanwhile, US Treasury yields ─which usually correlate negatively with Bullion’s value ─ are rising in tandem with XAU. The US 10-year Treasury note is up nearly three basis points at 4.216%.

- San Francisco Fed President Mary Daly said they need to look at both sides of the Fed's mandate. She reiterated that the low-firing, low-hiring could remain for some time, but said that it could quickly shift to no-hiring, more firing amid a scenario of inflation remaining above the Fed’s 2% goal.

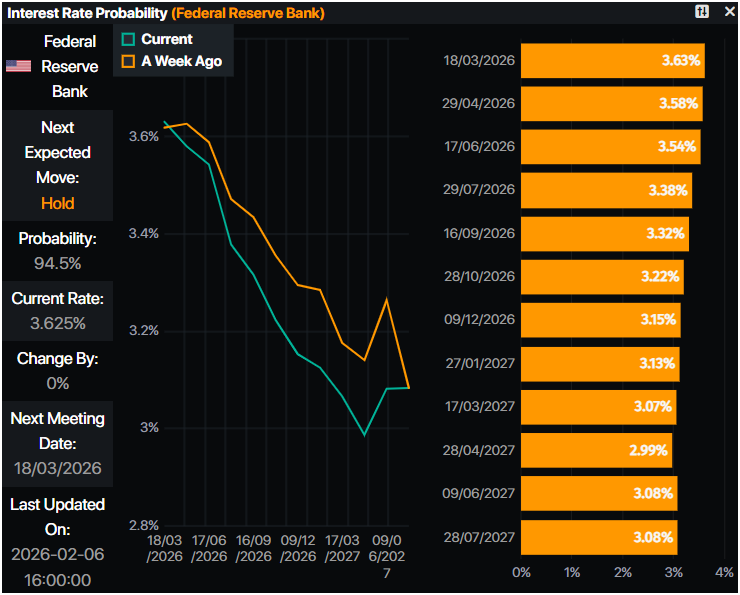

- A decline in job openings, a rise in layoffs flagged by the Challenger report, and a jump in Jobless Claims have strengthened expectations that the Federal Reserve will cut interest rates in 2026.

- Meanwhile, the University of Michigan’s February Consumer Sentiment index improved to 57.3 from 56.4, beating forecasts of 55. One-year inflation expectations eased to 3.5% from 4.0%, while five-year expectations edged slightly higher to 3.4% from 3.3%.

- Money markets have priced in 54 basis points of Fed easing by year-end, according to Prime Market Terminal data.

Technical outlook: Gold turns bullish once more, eyes on $5,000

Gold price uptrend remains intact, after it fell below the 20-day Simple Moving Average (SMA) of $4,861. Since testing three-day lows of $4,655, the precious metal has not looked back, seeming poised to challenge $5,000.

Bullish momentum is picking up after the Relative Strength Index (RSI) fell below neutral levels on Tuesday. However, it has recovered and is aiming upward in bullish territory.

Conversely, if Gold price falls below $4,900, it could consolidate within the 20-day SMA of $4,861 and $4,900 ahead of the next week.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.