Bitcoin Weekly Forecast: BTC enters full price-discovery mode after seven straight weeks of gains

- Bitcoin price stabilizes around $111,000 on Friday after reaching a new all-time high of $111,900 this week.

- Corporate accumulation, institutional demand, signs of easing regulations and fiscal woes in the US have fueled BTC’s rally.

- Investors continue to favor holding or investing in Bitcoin over rotating into altcoins, signaling further upside potential for BTC.

Bitcoin (BTC) price stabilizes near $111,000 on Friday after reaching a new all-time high of $111,900 this week. BTC enters an uncharted territory as a perfect storm of corporate accumulation, institutional demand, signs of easing regulation and increasing concerns among investors about debt sustainability in the United States (US) have fueled bullish momentum.

Corporate companies' interest in Bitcoin arises

The week started with multiple signs of companies and banks' support and interest in Bitcoin. On Monday, Japanese investment firm Metaplanet announced that it had purchased an additional 1,004 BTC, increasing its total holdings to 7,800 BTC.

On the same day, Indonesian fintech firm DigiAsia Corp announced its strategic decision to establish a Bitcoin treasury reserve. Additionally, CNBC reported on Monday that JPMorgan Chase would allow clients to buy Bitcoin, marking a significant step for the largest US bank, even as CEO Jamie Dimon has been a vocal critic.

These announcements are positive for Bitcoin as they indicate a growing acceptance of BTC as a strategic asset, boosting its legitimacy and potentially driving long-term adoption.

Later on Tuesday, Geoff Kendrick, Head of Digital Assets at Standard Chartered, published a projection saying that Bitcoin could reach $500,000 by 2029, citing growing institutional and government exposure through Strategy's stock holdings.

The projection added more credibility when Strategy announced on Thursday that it intended to offer shares of up to 10% of its perpetual strife preferred stock for sale to raise $2.1 billion under an At-The-Market (ATM) program to buy more BTC.

Earlier on Monday, the firm acquired 7,390 BTC and has achieved a BTC yield of 16.3% year-to-date (YTD) in 2025, with a total holding of 576,230 BTC acquired for $40.18 billion at an average of $69,726 per BTC.

Texas advances bill to create Strategic Bitcoin Reserve

The Texas House of Representatives advances Senate Bill 21 (SB21), known as the Texas Bitcoin Reserve Bill, after its second reading on Tuesday. The bill proposes the creation of a Texas Strategic Bitcoin Reserve, allowing the state to invest in Bitcoin and other top digital assets. Only digital assets with a market capitalization of over $500 billion would qualify for inclusion. Currently, only Bitcoin meets that threshold.

SB-21 heads to the Texas Governor’s desk for final approval, and the bill must pass out of the House Public Health Committee by Saturday to proceed to a final floor vote before the legislature adjourns in early June.

Texas would become the third US state to establish such a reserve if enacted into law, following New Hampshire and Arizona. Similar initiatives in Florida, Wyoming, Montana and Pennsylvania have failed this year.

Institutional demand fuels BTC rise

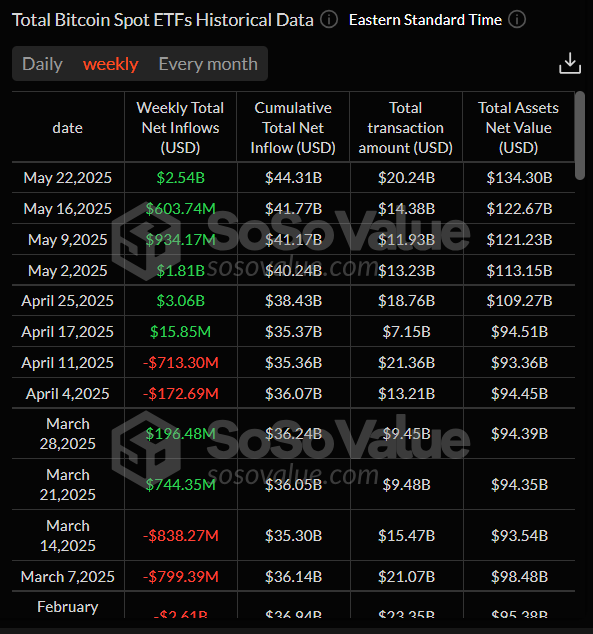

Bitcoin’s institutional demand accelerated sharply this week. According to SoSoValue data, US spot Bitcoin ETFs recorded a total inflow of $2.54 billion until Thursday, the highest weekly inflow since April 25 and extending a six-week streak that began in mid-April. The Bitcoin price should benefit if institutional inflows continue , putting it closer to its next key milestone at $120,000.

Total Bitcoin Spot ETFs weekly chart. Source: SoSoValue

Crypto market regulations ease as the GENIUS ACT clears key Senate hurdle

Another bullish narrative for Bitcoin is the Stablecoin legislation, the GENIUS Act, which overcame a procedural blockade on Monday night in the US Senate, marking a major victory for the crypto industry. The US Senate voted 66-32 to advance the GENIUS Act, setting the stage for a final vote in the Senate.

Deutsche Bank's Research report on Thursday highlights key takeaways from the GENIUS Act:

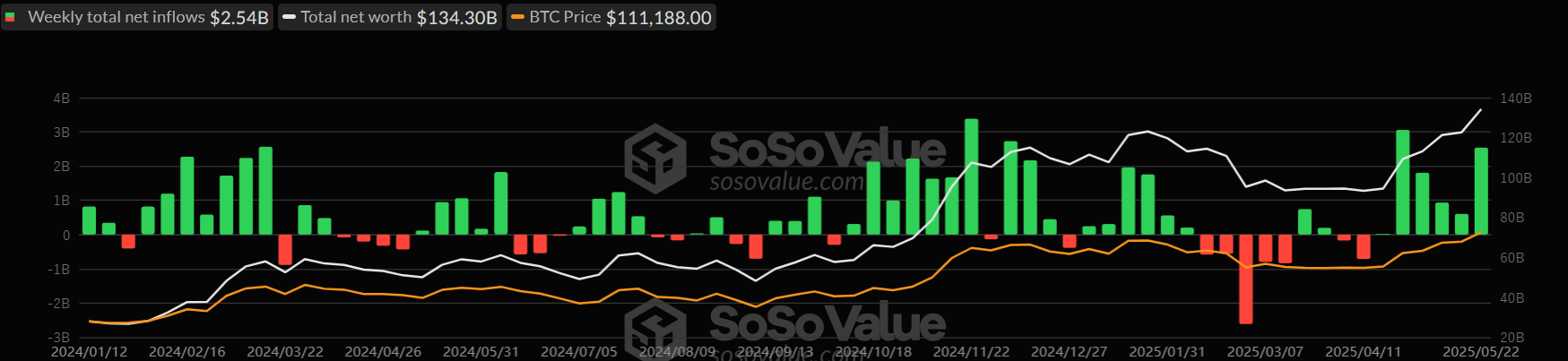

- The GENIUS Act mandates that all stablecoins be backed 1:1 by high-quality, low-risk liquid assets – specifically, US Treasury bills. The GENIUS Act formalizes stablecoin issuers' role as quasi-money market funds, like Tether (USDT), which currently ranks among the largest holders of US Treasuries globally. This move would support US short-term debt markets and channel non-USD liquidity into dollars. Republican Senator Bill Hagerty predicted that stablecoin issuers will become the world’s “largest holders of US Treasuries” by 2030.

Major foreign holders of US Treasuries, billions (2025). Source: Deutsche Bank Research

- According to a draft memo, it aims to restrict major tech companies, like Meta (Facebook), Apple, and Amazon, from issuing their own stablecoins, unless they meet strict standards on financial risk, consumer data privacy and fair business practices.

- The bill also empowers the US Treasury and the Stablecoin Certification Review Committee to oversee foreign stablecoin issuers, closing previous regulatory loopholes. Offshore players like Tether will now be regulated under the same framework as U.S.-based issuers, aligning cross-border compliance.

- The act prohibits interest payments on regulated stablecoins, effectively banning yield-bearing stablecoins within the US regulatory perimeter. This restriction may redirect capital toward tokenized money market funds (MMF) as alternatives, like BlackRock, which tokenized its money market fund on Ethereum, making it a more compliant and trustworthy instrument.

“The government appears keen to preserve USD dominance—especially as a tool to shore up US debt—while curtailing any threat to its primacy from private tech monopolies,” says Deutsche Bank Research Analysts Marion Laboure and Camilla Siazon.

Vugar Usi Zade, COO at Bitget, told FXStreet in an exclusive interview that the Senate’s advancement of the GENIUS Act signals meaningful momentum toward establishing a federal regulatory framework for stablecoins.

"The bill outlines clear licensing standards, reserve mandates, and consumer protections — components that could significantly boost market confidence and provide long-awaited clarity for issuers and investors alike. It positions the US to lead in digital asset regulation at a time when global competition is intensifying," he added.

What’s next for Bitcoin? Is Altcoin season here?

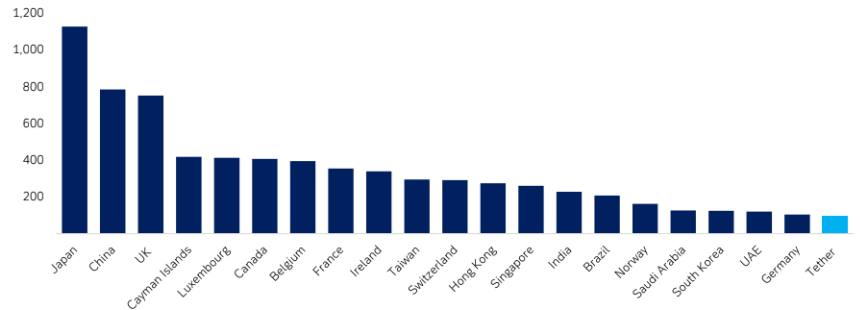

As the graph below explains, traders should watch for capital rotation. Given Bitcoin’s all-time high, the market is likely in Phase 1 (the flow of money into BTC causing a price surge) or transitioning into Phase 2. Ethereum may start to outperform Bitcoin soon, and large-cap altcoins could begin seeing inflows.

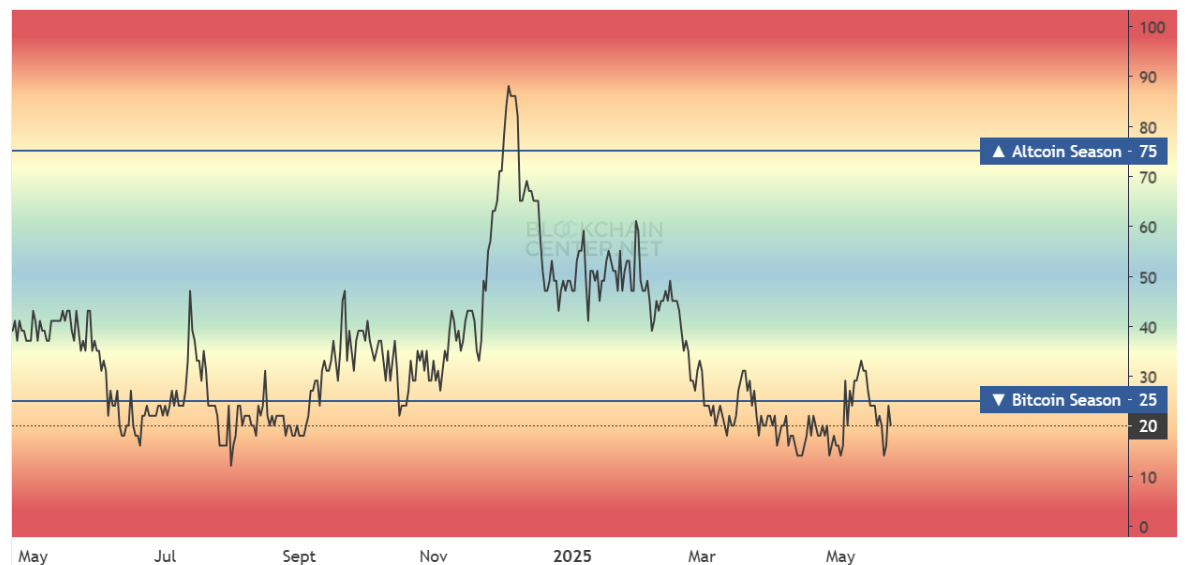

The Altseason (Phase 4) typically comes after these earlier phases, as Blockchaincenter.net’s Altcoin Season index currently reads 20. The metric indicates that altcoins have more room for growth, and investors still prefer to invest their money in Bitcoin or hold it rather than transfer it to altcoins. This suggests that the market is likely in Phase 1 and that Bitcoin has more room for upside.

Altcoin Season index. Source: Blockchaincenter.net

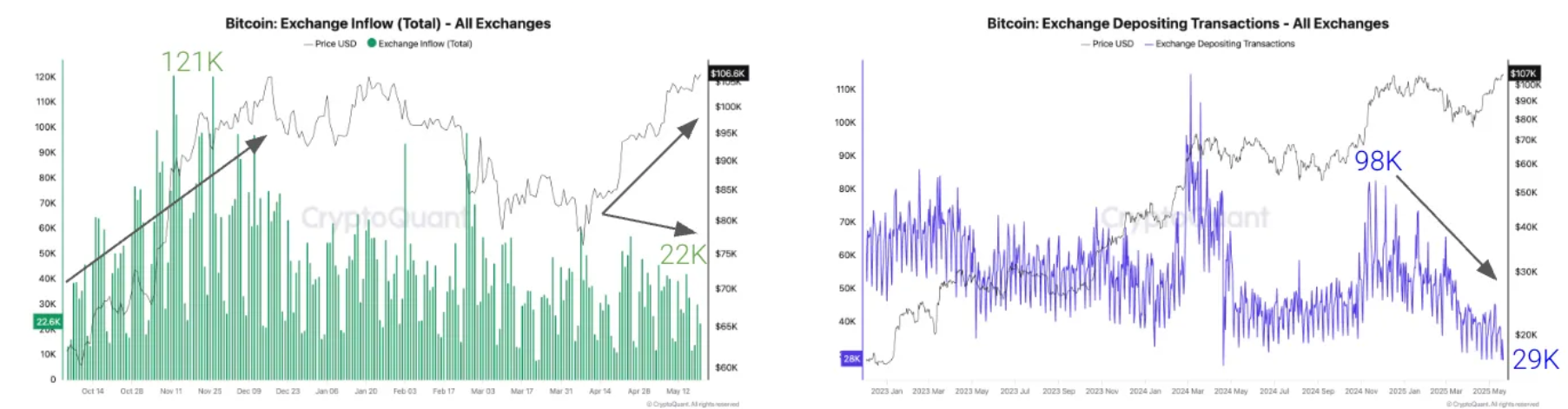

Another bullish outlook for BTC is that selling pressure remains subdued, as low exchange inflow activity indicates. According to data from a CryptoQuant report in the chart below, Bitcoin inflows to exchanges stand roughly at 22,000 BTC, a sharp decline from the 121,000 BTC seen in November when Bitcoin first surpassed the $100,000 mark.

Historically, higher exchange inflows have signaled increased selling pressure. As the current levels are muted, they suggest reduced intent to sell among investors, which could support further price increases.

Adding to the positive metrics, the number of individual deposits to exchanges has dropped significantly, falling from 98,000 in November to just 29,000 on Wednesday, reinforcing the view that investor selling activity remains limited despite elevated prices.

Bitcoin Exchange inflow total (Left). Bitcoin Exchange depositing transactions (Right). Source: CryptoQuant

Bitcoin price action enters uncharted territory

The weekly chart shows that Bitcoin has entered a price-discovery mode after seven straight weeks of gains since early April. As of this week, it broke above the previous all-time high of $109,588 set on January 20 and continues to trade higher.

If BTC continues its upward momentum, it could extend the rally toward a key psychological level of $120,000.

The Relative Strength Index (RSI) on the weekly chart reads 68, pointing upward toward its overbought level of 70, indicating strong bullish momentum as it still has room for upside.

The Moving Average Convergence Divergence (MACD) on the weekly chart also showed a bullish crossover, giving buy signals and supporting the bullish thesis. Moreover, it shows a rising green histogram above its neutral level of zero, indicating strong bullish momentum and continuation of an upward trend.

BTC/USDT weekly chart

If BTC faces a pullback, it could extend the correction to retest its key weekly support at $104,563.