Top Crypto Losers: Zcash, Starknet, and Ethena lead losses amid bearish pressure

- Zcash edges lower by 10% on Monday, crossing below $400 as Vitalik Buterin warns against token voting.

- Starknet extends the downtrend for the fifth consecutive day, approaching the $0.1000 psychological level.

- Ethena is down 5% on Monday, extending a bearish turnaround within a falling channel pattern.

Zcash (ZEC), Starknet (STRK), and Ethena (ENA) start December on a bearish note, extending the pullback from last week. With double-digit losses over the last 24 hours, ZEC, STRK, and ENA are the top crypto losers and are at risk of further decline.

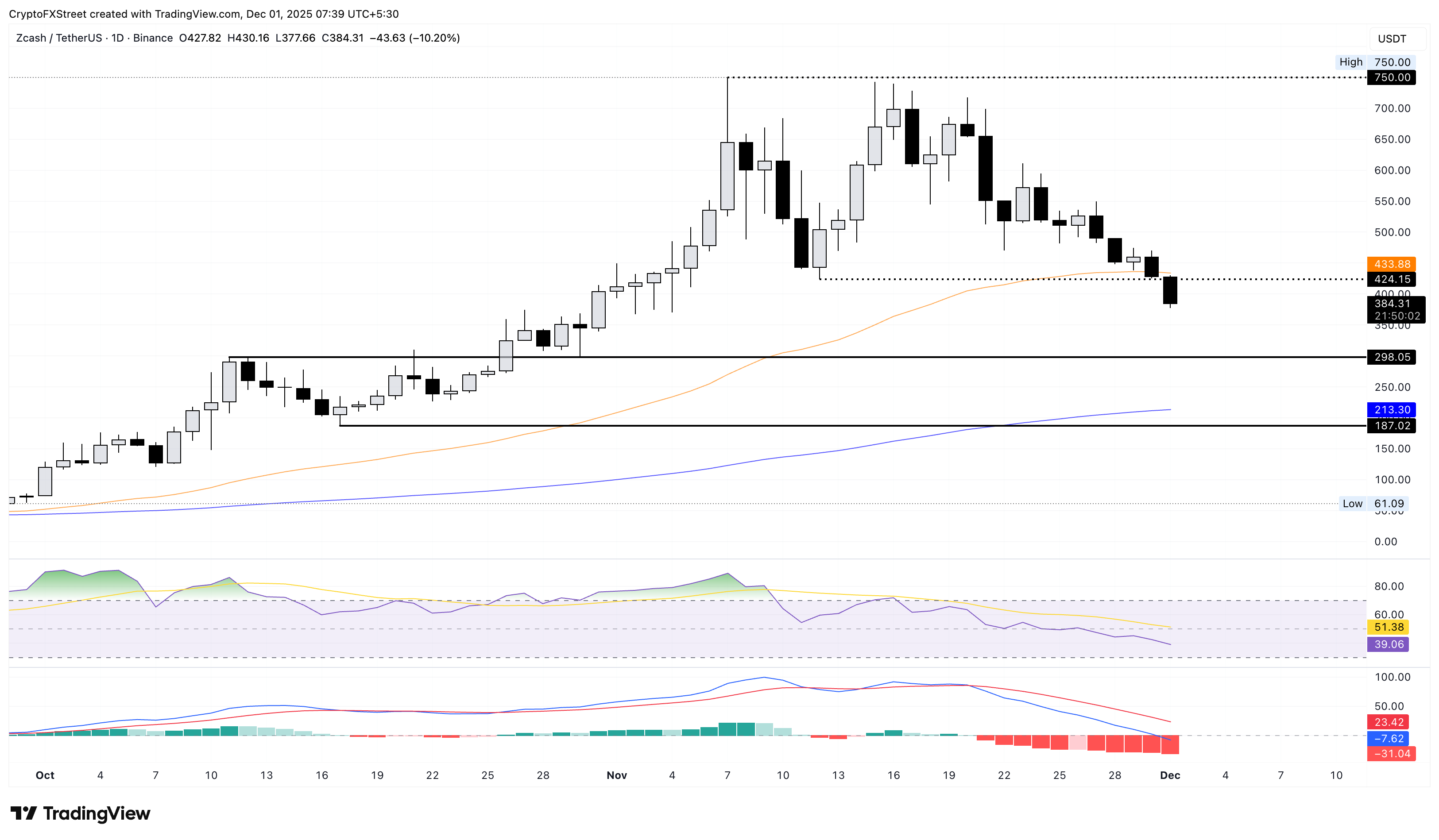

Zcash risks a drop to $300 as Buterin warns against token voting

Vitalik Buterin, the co-founder of Ethereum, warned the Zcash community against token voting that would erode the existing privacy status quo in the long term.

Zcash trades below the $400 mark and the 50-day Exponential Moving Average (EMA) on Monday. At the time of writing, the privacy coin is down 10% amid increased selling pressure.

The Relative Strength Index (RSI) is at 39, advancing the downward slope towards the oversold zone. Additionally, the Moving Average Convergence Divergence (MACD) crosses below the zero line, with the signal line mirroring its downtrend, indicating strong bearish momentum.

The immediate support for Zcash lies near the $300 psychological level, previously tested on October 30.

However, if ZEC resurfaces above the 50-day EMA at $433, it could rise above the $500 psychological milestone.

Starknet could lose psychological support as selling increases

Starknet remains under extreme selling pressure, recording over 5% drop at press time on Monday. The zero-knowledge layer-2 risks losing the $0.1000 round figure as the reversal from the 50-day EMA on Thursday gains traction.

Technically, the momentum indicators on the daily chart maintain a sell signal for Starknet, as the RSI at 40 dips below the midline, with room on the downside before reaching saturation levels below 30. Moreover, the MACD and signal line continue to trend downward, with successive red histogram bars below the zero line.

If STRK drops below $0.1000, it could test the $0.0962 support floor marked by the June 22 low.

To reignite an uprising, STRK bulls should defend the $0.1000 level, with a potential rebound targeting the 50-day EMA at $0.1465.

Ethena risks extending losses in a falling channel pattern

Ethena is down 5% by press time on Monday, extending the 8% loss from Sunday. The synthetic dollar token displays a bearish reversal from the resistance of a falling channel pattern on the daily logarithmic chart.

Similar to privacy coins, Ethena is showing bearish momentum, with its RSI at 35 reversing from the midline and is inching towards the oversold region. Meanwhile, the MACD risks crossing below its signal line, flashing a bearish signal of a trend reversal.

The declining trend threatens a break below the $0.2180 low from November 21, which could test the $0.1313 low from October 10.

If Ethena bulls could hold above $0.2180, the possibility of forming a double bottom pattern would increase. In such a case, a rebound in ENA could aim for the resistance trendline near $0.2900.