The buyback trend in the cryptocurrency market – Using Wall Street’s oldest trick in the book

- Chainlink, Hyperliquid, Aave, and multiple other cryptocurrency projects are repurchasing their tokens to limit the available supply.

- Stock buyback options have been a critical measure for Wall Street players as a sign of confidence.

- FXStreet interviewed multiple market experts to gather their opinions on the current trend of token buybacks in the cryptocurrency market.

Token buyback is one of the latest trends in the broader cryptocurrency market in 2025, similar to stock buybacks on Wall Street but with several key differences. Shaking the demand-supply scales, multiple blue-chip altcoins are adjusting their tokenomics through buybacks to build native reserves, corporate reserves, or by burning their own tokens. To gain further insights into token buybacks, their impact on altcoins, and the broader cryptocurrency ecosystem, FXStreet interviewed experts in the crypto markets.

History of stock buyback on Wall Street

A share buyback initiative is a traditional financial strategy that accounts for a multi-trillion-dollar statement annually in the US stock market. Typically, a company’s call for buyback is a show of confidence, anticipating a further rise in share price and its valuation.

Furthermore, this strengthens the company's centralization while limiting the supply available on the stock market. Meanwhile, the risks of centralization, including supply dump, stock manipulation, and a mechanical increase in Earnings per Share (EPS) due to reduced share count, arise.

Apple (AAPL), a benchmark repurchaser, has steadily expanded its buyback program from an increase to $60 billion in 2013 to a consistent annual buyback of triple-digit billion dollars. In 2024, Apple set a record of $110 billion in stock repurchases, with the cumulative buyback accounting for over $735 billion in total.

Taking a page from Wall Street, crypto projects are repurchasing tokens, resulting in an artificial increase in demand due to reduced supply. Shared below are the effects of either token buybacks or burning seen in 2025.

Effect of token buybacks or burns

Emission and token unlocks inflate the available supply of a crypto. At the same time, buybacks or burns have a deflationary impact on the tokenomics of a cryptocurrency, effectively altering liquidity, token price, and rewards.

Typically, the net change in supply after such events could be calculated using the formula,

Net supply change = Emissions + Token unlocks − Buybacks - Burns

For an effective buyback or burn, the event must counterbalance the inflation from token unlocks, rewards, and team/treasury distributions. If not, the circulating supply could continue to increase, resulting in an overall inflationary trend in tokenomics.

Could the artificial demand of token buybacks or burns pump the crypto market?

Token buybacks or burns may temporarily stabilize the price charts, but a steady uptrend requires a consistent buying pressure. If the buyback or burn is inconsistent, the market reverts to normal levels with market makers restocking the token, sellers front-run potential buy orders, and the marginal impact declines.

With buybacks in trend, a one‑off or lean buyback relative to Fully Diluted Value (FDV) could be lucrative. Still, traders should consider the rising benchmarks in the market and compare the buyback-to-FDV and buyback-to-circulating-cap ratios to analyze the arrangement.

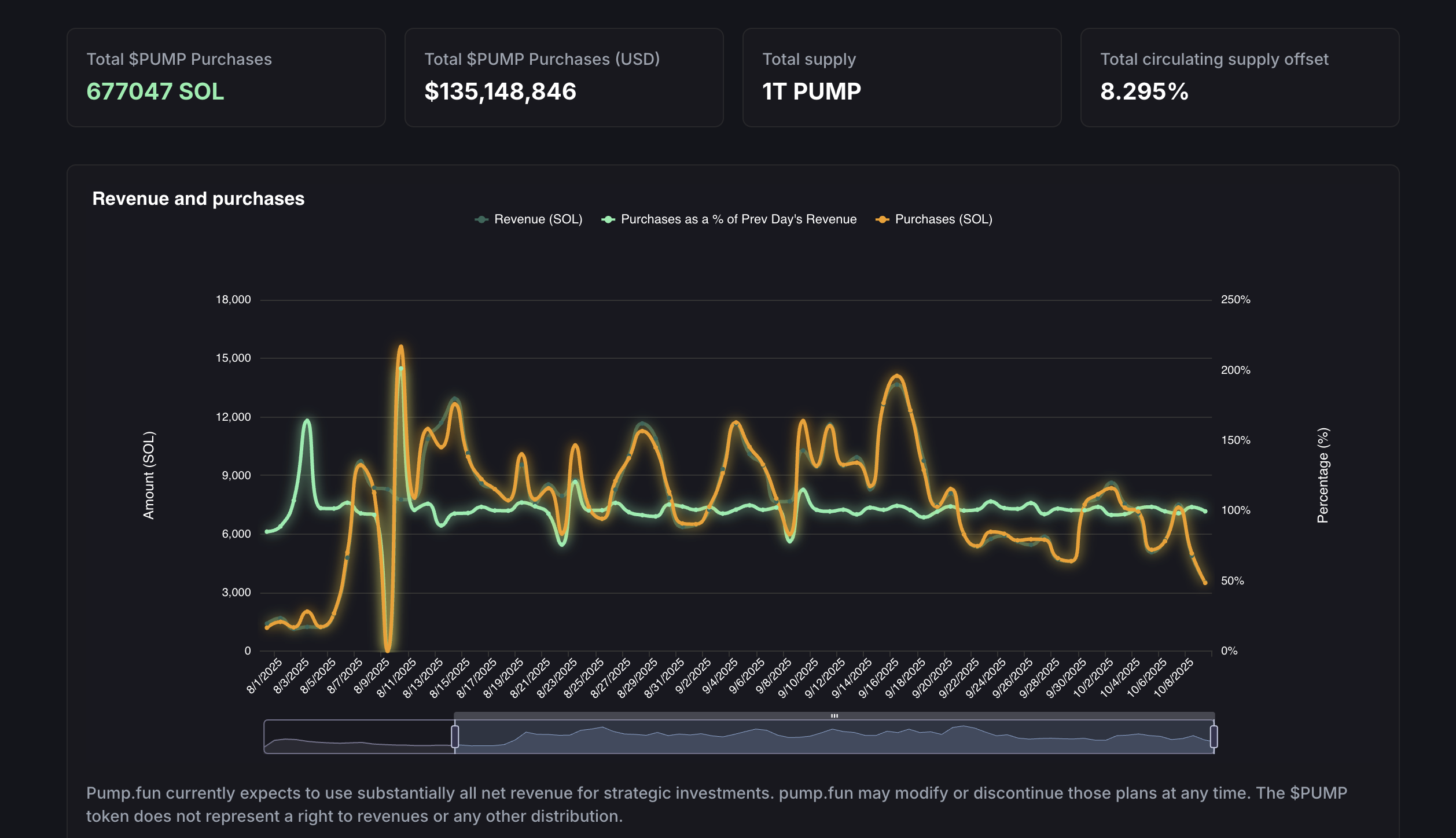

However, the over-reliance on revenue to fuel buybacks, as seen with Pump.fun, bears the risk of starving development, protocol security, or liquidity incentives. Such risks could surface in a bear market when user deposits, revenues, and fees decay.

Token buybacks and burns in the cryptocurrency market

Similar to the stock buyback option seen on Wall Street, which reduces the available shares in the market to boost their value, token buybacks, based on the general demand-supply rule, similarly impact crypto prices.

However, the crypto market offers greater flexibility with multiple options, such as buyback and hold, reserve building, or allocating the pool for other purposes. Below are examples of token buybacks based on their purpose.

Aave

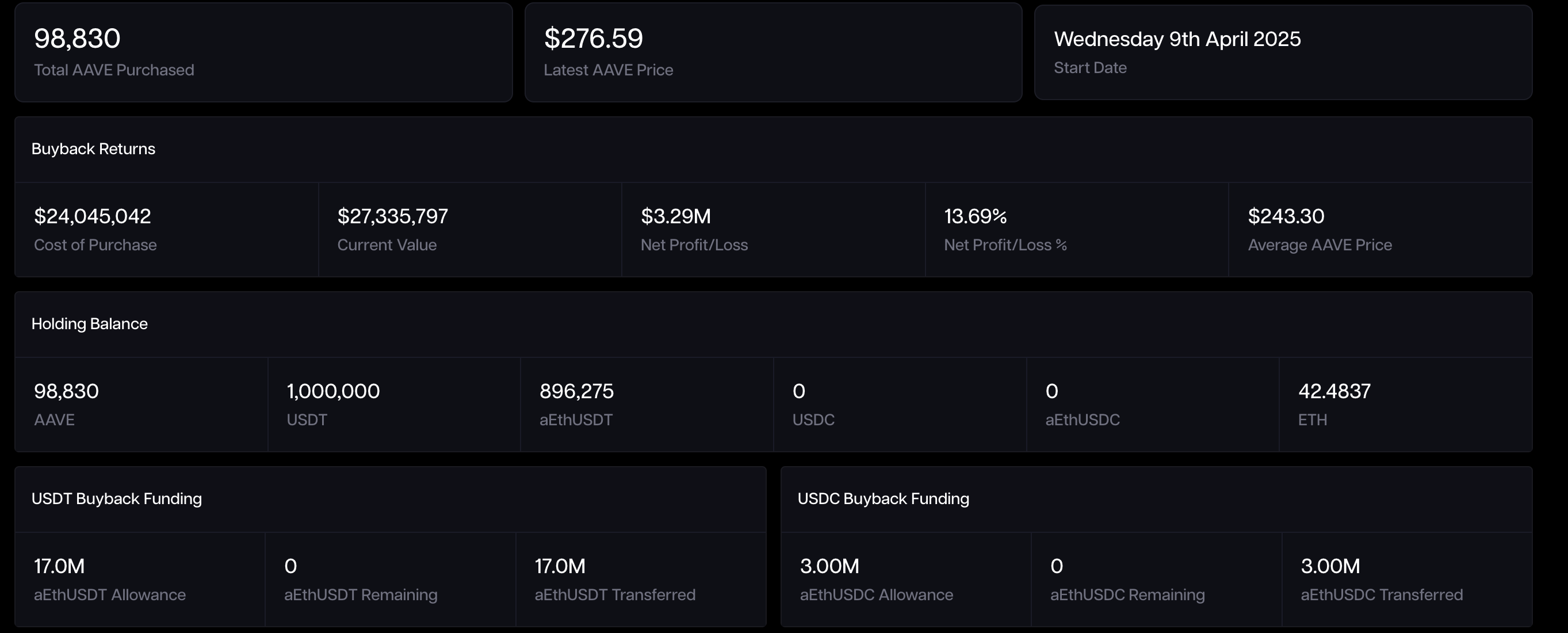

Aave, a lending protocol, initiated its recurring buyback program funded by protocol assets on April 9, allocating $1 million per week. Tokenlogic data indicates that the buyback treasury has increased to 98,830 AAVE tokens as of October 10, valued at over $27.18 million.

AAVE treasury. Source: Tokenlogic

Chainlink

Chainlink (LINK), an oracle network, has repurchased 463,190 LINK tokens since early August, creating a native reserve worth $10.5 million as of October 10. This reserve accounts for 0.0683% of the 678.09 million LINK tokens in circulation.

Notably, the reserve is funded by revenue collected from both off-chain and on-chain services, indicating that the rise of this reserve will be directly dependent on Chainlink’s market adoption. This would provide an additional boost to the token’s market price by gradually reducing the supply as demand increases.

Since the start of the buyback program, the LINK price has increased by almost 35% as of October 10, despite a decline from its August peak of $27.87.

LINK/USDT daily price chart.

Hyperliquid

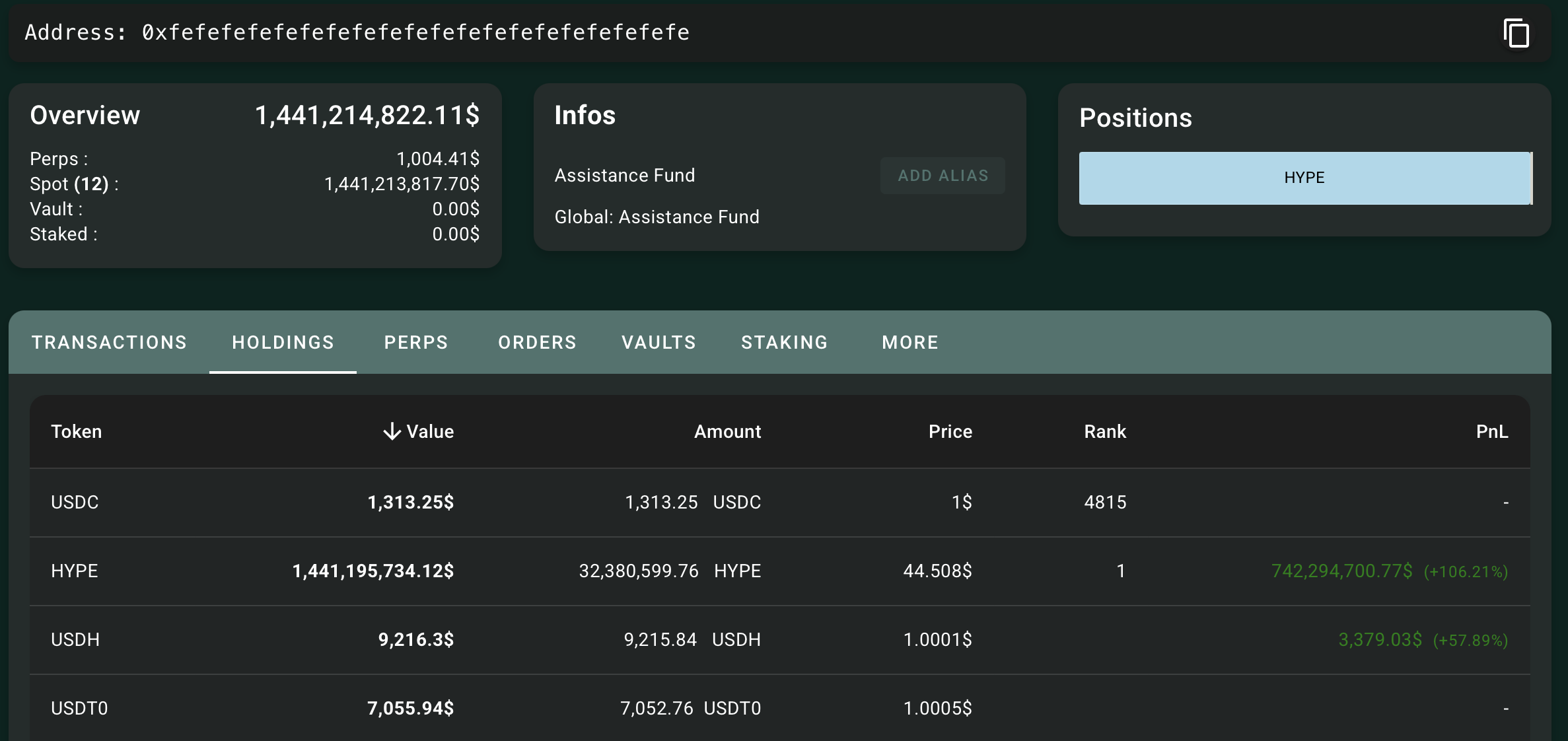

Hyperliquid (HYPE), a perpetual contracts-focused Decentralized Exchange (DEX), adopts a revenue-based model to fund its token buybacks. The DEX has allocated 97% of its trading fees to buy back its HYPE token in an Assistance Fund.

Hypurrscan data shows that this fund has acquired 32.37 million HYPE tokens worth over $1.44 billion as of October 10, accounting for more than 3% of the total supply.

Hyperliquid assisstance fund. Source: HypurScan.

With the rising interest in perpetual DEX trading among retail investors, as evident by the rise of Binance-backed competitor Aster, Hyperliquid is likely to expand further its Assistance Fund, which is founded on revenue-based token buybacks.

Pump.fun

Pump.fun, a Solana-based launchpad focused on meme coins, is one of the top-performing protocols in the market based on its revenue collection. The buyback program has redirected the majority of its daily revenue, accumulating over 8.295% of the circulating supply, valued at over $135.14 million as of October 10.

Pump.fun reserve. Source: Pump.fun

OKB

Apart from token buybacks, token burning refers to sending a portion of the circulating supply to “null” addresses. This effectively removes these tokens from circulation, resulting in deflationary pressure.

OKB, the native token of OKX’s X layer, underwent a massive shift in tokenomics with the burning of 65.25 million tokens, capping its total supply to 21 million on August 13. This enormous cut in available supply resulted in a sudden 125% surge on the same day, accounting for over 260% gains in the month. OKX’s approach to decreasing its supply is a prime example of flexibility in the Web 3.0 world, where it burns the tokens instead of the traditional buyback and hold option.

Shiba Inu

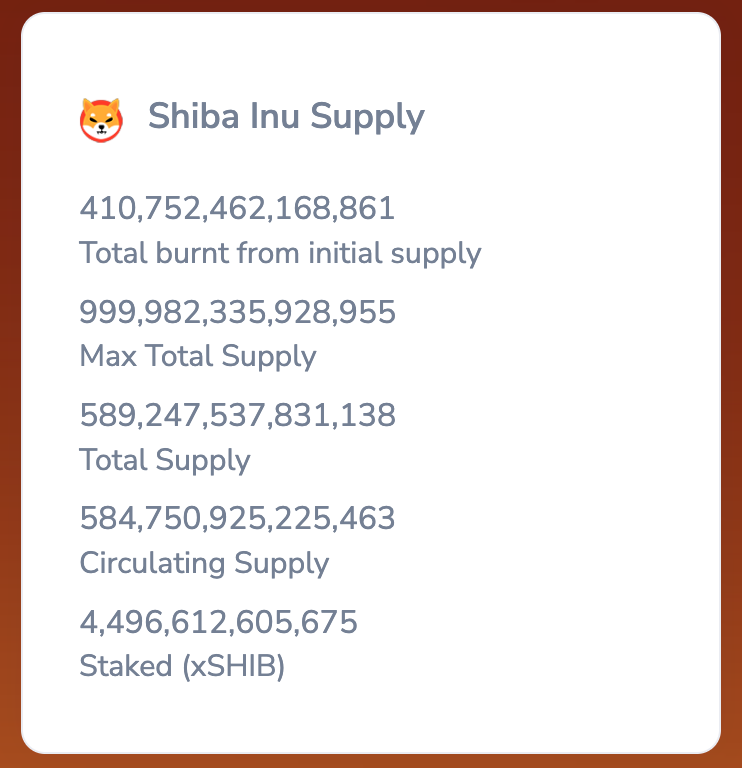

Shiba Inu, the second-biggest meme coin by market capitalization at $7.1 billion at the time of writing, conducts regular token burns through the community burn portal, fee conversion to burn, and holder burn to dead wallet, all tracked by Shibburn. As of October 10, 410.75 trillion SHIB tokens have been burned out of the 999.98 trillion SHIB maximum supply.

Shiba Inu supply burn. Source: Shibburn

Expert views on token buybacks

To gain further insights into the effects of token buybacks, FXStreet interviewed experts in the cryptocurrency markets. Here are some of the answers shared below:

Oliver Yates, CEO of Aplo

Are token buybacks a defensive tool during market pullbacks or a proactive part of your value accrual and incentive design?

This depends on the specific project. For many, token buybacks are a proactive and fundamental part of their tokenomics as outlined in their whitepaper from the start to generate long-term value. For others, it can be a defensive measure.

How can one differentiate between a sustainable, revenue-driven buyback program and a short-term market manipulation tactic, and what metrics should investors use to assess credibility?

A key differentiator is whether the buyback mechanism was part of the project's original design. A sustainable program is often directly linked to project revenues, such as a DEX using part of its fee income to repurchase tokens. A buyback program that appears suddenly without being part of the initial tokenomics could be viewed with more skepticism.

Should the choice between burning and holding after token buyback be governed on-chain, allowing token holders to vote on the fate of repurchased tokens after each buyback cycle?

This is largely a question of governance structure. For a DAO, on-chain voting by token holders makes logical sense. However, for more centralized tokens, such as those issued by exchanges like BNB or OKB, this model may be less applicable.

Punit Agarwal, Founder of KoinX

What are your predictions for the Altcoin cycle based on the emerging trends such as Crypto ETFs, token buybacks, burning, corporate reserves, etc.?

Each cycle brings more maturity. Earlier, it was hype-driven; now we’re seeing real business fundamentals — revenues, buybacks, and treasury management. ETFs and corporate reserves are pushing the industry toward more structure. I think projects that build solid, transparent businesses will lead the next wave.

Would burning repurchased tokenized shares provide greater auditability and investor trust compared to off-chain treasury holdings, and could this become a new practice?

Burning is clear — everyone can see it happen on-chain, and it can’t be reversed. But holding can also make sense if the project plans to reinvest or reward users later. What really matters is being open about why you’re doing it and tracking it transparently.