Prediction: 1 Stock That Will Be Worth More Than Palantir 3 Years From Now

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

Palantir Technologies has been one of the hottest stocks on the market over the past couple of years, clocking eye-popping gains of more than 1,100% as of this writing thanks to its accelerating growth that's being driven by the booming demand for artificial intelligence (AI) enterprise software.

However, Palantir's remarkable run-up suggests that the stock may have gotten ahead of itself. After all, it is trading at an extremely expensive 75 times sales right now, which is significantly higher than the S&P 500 index's price-to-sales ratio of 3.11. Palantir's price-to-earnings ratio of 412 isn't cheap either when you consider that the S&P 500 sports an earnings multiple of 25.

As a result, it may be difficult for Palantir to sustain its outstanding rally, which probably explains why the stock's 12-month median price target of $39 points toward a 50% drop from current levels. Assuming the consensus Wall Street price target indeed turns out to be true and Palantir stock does lose half of its value in the coming year, its market cap could fall to $90 billion from the current reading of $180 billion.

Of course, Palantir stock could continue rising by delivering robust growth quarter after quarter thanks to its sizable revenue pipeline, but the expensive valuation indicates that the risk-reward ratio for investors looking to buy the stock right now may not be favorable. That's why investors would do well to take a closer look at another name that's trading at a relatively reasonable valuation, is delivering impressive growth, and has the potential to overtake Palantir's market cap over the next three years.

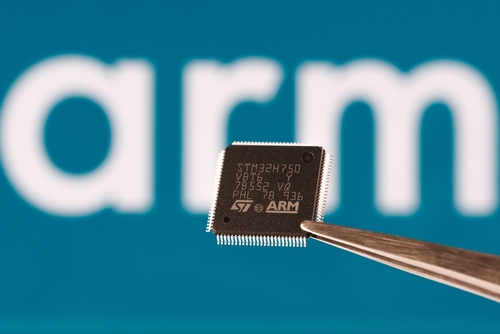

Arm Holdings is set to outpace Palantir's growth

British semiconductor company Arm Holdings (NASDAQ: ARM) has more than doubled in value since it made its stock market debut in September 2023. The company now has a market cap around $135 billion, and unlike Palantir, analysts are expecting Arm stock to head higher over the next year.

Arm has a price target of $160 as per 42 analysts covering the stock, which points toward a 24% jump from current levels. So, it may not take three years for Arm to overtake Palantir's valuation based on consensus price targets that the two stocks carry. However, let's look beyond the price targets and check why Arm is likely to have a higher market cap over a three-year period.

Arm's valuation is relatively lower than Palantir's. There is no doubt that Arm's sales multiple of 39 is on the expensive side, but it is almost half of Palantir's multiple. Also, Arm's forward earnings multiple of 65 is well below Palantir's reading of 165. What's more, Arm's earnings are expected to grow at a much faster pace than Palantir's over the next couple of fiscal years.

ARM EPS Estimates for Current Fiscal Year data by YCharts

So, the risk-reward profile of an investment in Arm seems favorable when compared to Palantir, and it is easy to see why analysts are expecting the semiconductor company's bottom line to grow at a faster pace over the next three years. Arm makes money by licensing its chip architecture to chipmakers and consumer electronics companies, and it also collects a royalty for each chip that's manufactured using its intellectual property (IP).

The business model makes it clear why the stock could be a long-term winner

Arm gets 40% of its revenue from the smartphone market, with consumer electronics and cloud and networking making up another 25% of its top line. The company claims that 99% of smartphone application processors are manufactured using its IP, and the good part is that it has been gaining ground in other markets such as consumer electronics, cloud computing, networking equipment, and automotive.

AI is the latest catalyst for Arm as the demand for its AI-focused Armv9 architecture has been increasing. That's not surprising as Arm promises faster computational performance, better security, and power efficiency with Armv9. As a result, the royalty share of Armv9 has been increasing at a nice pace in recent quarters, jumping to 25% of royalty revenue in the second quarter of fiscal 2025 from 10% in the year-ago period.

Even better, Armv9 reportedly carries a much higher royalty rate than the previous-generation Armv8, with some reports indicating that the company is charging double the royalty over the prior architecture. This explains why Arm is expected to deliver a stronger earnings growth rate over the next couple of years following a 23% spike in its bottom line in fiscal 2025 to $1.56 per share.

Other metrics also point toward a potential improvement in Arm's growth. For instance, the company's annualized contract value increased 13% year over year in the fiscal second quarter to $1.25 billion, suggesting that customers are now signing more lucrative contracts. At the same time, the demand for the company's licenses has been heading higher.

The number of total access agreements, which gives customers access to its comprehensive suite of IP, tools, training, software, and physical design to help them build central processing units (CPUs), graphics processing units (GPUs), and other chips, increased to 39 in the previous quarter, up from 22 in the year-ago period.

This impressive growth in the company's licensing agreements doesn't just point toward higher licensing revenue, but also toward stronger royalty revenue once these customers churn out chips using Arm's solutions. As such, Arm could turn out to be a better bet when compared to Palantir for not just 2025, but for the next three years as it indeed seems capable of growing its earnings at a faster pace.

Moreover, Arm has a much more reasonable valuation when compared to Palantir, a factor that's going to play in the company's favor since there is more room for the market to reward its healthy growth with a higher valuation. So, the possibility of Arm overtaking Palantir's market cap over the next three years cannot be ruled out.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.