Alphabet Reports Impressive Results, But AI Competition and Lawsuits Cast a Shadow Over Its Future

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

Alphabet's revenue and profit for the first quarter exceeded expectations. However, the market is worried about its future due to AI competition and legal issues.

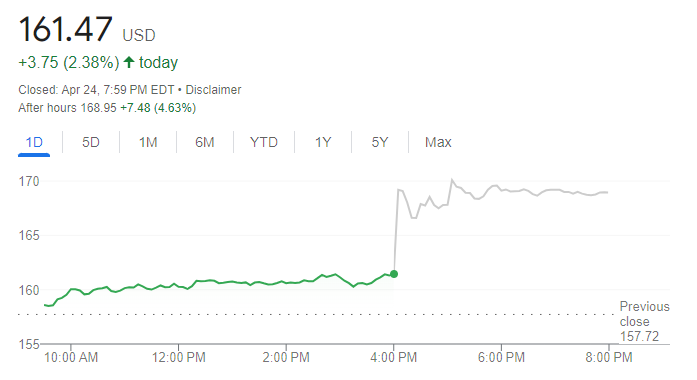

On Thursday, Alphabet Inc (GOOG) announced its first-quarter results after hours. The performance was stunning. They also announced a $70 billion stock buyback, boosting shares by 6% at one point. They later settled at a 4.63% increase.

Alphabet stock price chart, source: Google.

According to the earnings report, Alphabet's Q1 revenue was $90.23 billion, surpassing analysts' expectations of $89.1 billion. Earnings per share were $2.81, well above the forecast of $2.01.

The strong performance came from its core business—advertising revenue. Google’s ad revenue was $66.89 billion, exceeding expectations of $66.39 billion. However, revenue from Google Cloud and YouTube ads fell short or met analyst expectations.

Despite the strong Q1 results, the market is concerned about the future. Alphabet faces fierce competition in AI and ongoing lawsuits. Currently, its generative AI, Gemini, trails behind OpenAI's ChatGPT and Meta AI. It also faces strong competition from DeepSeek.

Moreover, a U.S. federal judge ruled that Google violated antitrust laws. This could lead to hefty fines and the divestment of products like the Chrome browser. The judge stated, "Google intended to engage in a series of anti-competitive practices to obtain and maintain its monopoly in the open web display advertising market."

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.