Apple Shares Surge 5% — $100 Brillion U.S. Investment Secures Tariff Exemption, Company Back on Track

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

TradingKey - Apple (AAPL) posted its largest single-day gain in over three months, rising 5.09% to $213.25 on Wednesday, August 6, after CEO Tim Cook announced a massive new U.S. investment plan — effectively securing a tariff exemption from the Trump administration.

To avoid the financial impact of new tariffs, Cook once again deployed a proven strategy: bringing manufacturing back to America in exchange for favorable trade treatment.

A $600 Billion Bet on America

At the White House, Cook announced that Apple will invest an additional $100 billion in the United States over the next four years. Combined with its $500 billion commitment announced in February, this brings Apple’s total U.S. investment to $600 billion — the largest in company history.

The plan includes:

Creating 20,000 new U.S. jobs

Investing $2.5 billion in Corning, its long-time glass supplier

Building a new server manufacturing facility in Houston

Establishing a supplier training academy in Michigan

The White House hailed the move as a major win for President Trump’s “America First” economic agenda and a sign of renewed momentum in U.S. manufacturing.

A Strategy Repeated

This is not the first time Apple has used domestic investment pledges to navigate trade policy risks.

During Trump’s first term, Apple made several high-profile U.S. investment announcements to avoid tariffs. In 2019, the company committed to assembling a new Mac Pro in Texas — even though it had already been producing earlier models there since 2013. That move helped Apple avoid tariff exposure.

Tariff Exemption Confirmed

In Trump’s latest trade actions — including raising tariffs on India to 50% and proposing 100% tariffs on foreign-made chips — Apple was notably excluded.

Trump confirmed that,

“The good news for companies like Apple is, if you’re building in the United States, or have committed to build, there will be no charge.”

In recent years, Apple has accelerated efforts to shift iPhone production from China to India, aiming to produce 60 million iPhones sold in the U.S annually in India by late 2026.

The exemption from India-related tariffs removes a major financial risk and eases margin pressure on Apple’s important product line.

Market Reaction: Confidence Returns

The announcement boosted investor sentiment. Apple’s stock rose 5.09% to $213.25, its largest single-day gain since May 12 (+6.31%), narrowing its 2025 year-to-date loss to under 15%.

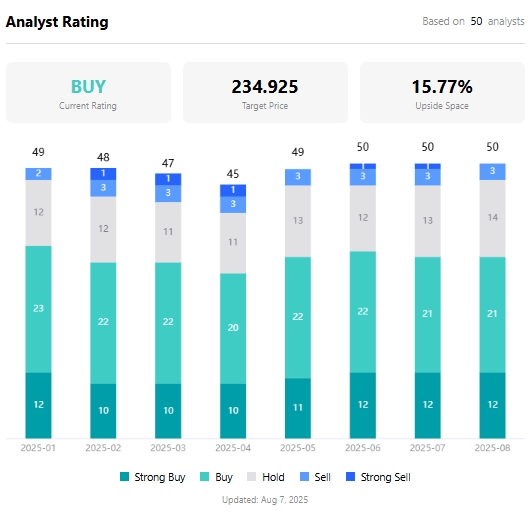

According to TradingKey, the average Wall Street price target for Apple is $234.93, implying about 16% upside from current levels.

Analyst Price Targets for Apple, Source: TradingKey

Analysts: A Smart Move

Daniel Ives, Analyst at Wedbush Securities, said:

“Today is a good step in the right direction for Apple, and it helps get on Trump's good side after what appears to be a tension-filled few months in the eyes of the Street between the White House and Apple.”

While Wall Street remains skeptical about Apple’s ability to bring large-scale iPhone manufacturing back to the U.S., Nancy Tengler, CEO of Laffer Tengler Investments, called the announcement a “savvy solution” to Trump’s aggressive trade posture.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.