Could This $14 Stock Be Your Ticket to Millionaire Status?

Key Points

NuScale Power has a nuclear energy design that could change how the world generates power.

Its biggest opportunity is data center construction, which needs more power than the U.S. grid can handle.

The company has yet to ink a firm sale, which is weighing heavily on the stock.

- 10 stocks we like better than NuScale Power ›

NuScale Power (NYSE: SMR) is a nuclear technology company whose big ambitions revolve around a small modular reactor (SMR).

Based in Portland, Oregon, NuScale is currently the only U.S. nuclear company with SMR design approval from the Nuclear Regulatory Commission (NRC). Out of the dozen or so nuclear start-ups, including Oklo and Nano Nuclear Energy, NuScale is the lone ranger with a license to deploy small reactor technology on a commercial scale.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

Image source: Getty Images.

So far, that first-mover advantage hasn't done much for this nuclear energy stock, whose shares are about $14 each at the time of this writing. While the company has agreed to deploy its technology for the Tennessee Valley Authority (TVA) and a Romanian power plant project, it has no firm sales yet.

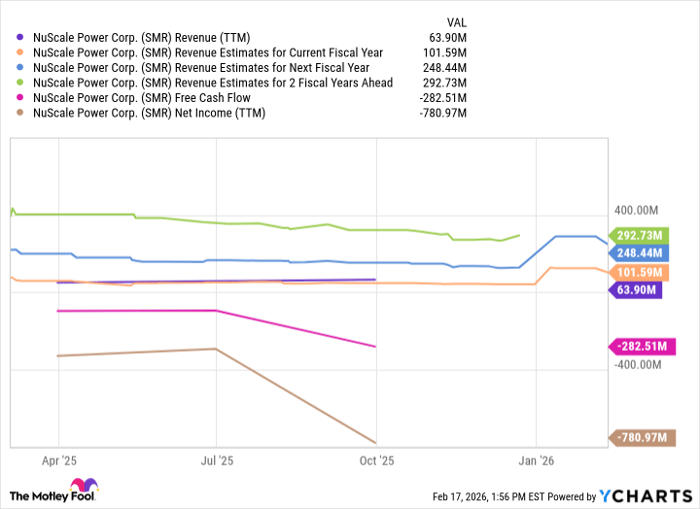

As such, the company is operating at a loss and burning cash. It could be several years before this company achieves profitability for the first time.

SMR Revenue (TTM) data by YCharts

At the same time, the opportunity for NuScale could be historic. Data centers' demand for power could accelerate by as much as 175% by 2030, according to research by Goldman Sachs.

The power grid in the U.S., much of which was built in the decades after World War II, was simply not designed to handle that much power. New energy solutions are needed to support today's infrastructure and handle the enormous energy demand that could soon be placed on it. NuScale's factory-assembled reactor could alleviate much of the burden.

The company carries a $4.3 billion market cap. With trailing-12-month revenue of about $64 million, it trades at roughly 68 times sales. That's very expensive on revenue alone.

NuScale could change how the world generates nuclear energy, but generating $1 million for investors isn't likely going to happen soon. Even at $14 a share, investors should carefully weigh the potential long-term reward against the near-term volatility likely to be immense.

Should you buy stock in NuScale Power right now?

Before you buy stock in NuScale Power, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and NuScale Power wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $415,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,151,865!*

Now, it’s worth noting Stock Advisor’s total average return is 892% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 20, 2026.

Steven Porrello has positions in Oklo. The Motley Fool has positions in and recommends Goldman Sachs Group. The Motley Fool recommends NuScale Power. The Motley Fool has a disclosure policy.