Meet the Brilliant Vanguard ETF With 45.3% of Its Portfolio Invested in Nvidia, Apple, Microsoft, and Alphabet

Key Points

The Vanguard Mega Cap Growth ETF tracks the performance of the CRSP U.S. Mega Cap Growth Index, which holds 65 of America's top growth companies.

Those 65 companies represent 70% of the value of the entire U.S. stock market, and they include Nvidia, Apple, Microsoft, and Alphabet.

The Vanguard Mega Cap Growth ETF can supercharge the returns of a diversified portfolio.

- 10 stocks we like better than Vanguard World Fund - Vanguard Mega Cap Growth ETF ›

The CRSP U.S. Total Market Index holds all 3,498 companies listed on U.S. stock exchanges. The largest 65 companies account for a staggering 70% of the combined value, which highlights the extreme concentration of wealth in the corporate sector. The CRSP U.S. Mega Cap Growth Index exclusively holds those top 65 companies, and it consistently delivers very strong returns because of its high exposure to areas like artificial intelligence (AI).

After all, its four largest holdings are Nvidia, Apple, Microsoft, and Alphabet, which have a combined value of $14.9 trillion.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

The Vanguard Mega Cap Growth ETF (NYSEMKT: MGK) is an exchange-traded fund (ETF) that tracks the performance of the CRSP U.S. Mega Cap Growth Index by holding the same stocks and maintaining similar weightings. Here's how adding it to a diversified portfolio can supercharge investors' returns.

Image source: Getty Images.

America's best growth stocks packed into one ETF

AI is a game-changing technology that is helping businesses boost their productivity and unlock new opportunities to generate revenue. Nvidia, Apple, Microsoft, and Alphabet are investing billions of dollars to develop the hardware, software, and platforms driving the industry forward:

- Nvidia's graphics processing units (GPUs) for data centers are the gold standard for AI development. Every time the company launches a new GPU architecture, it paves the way for developers to build "smarter" and more powerful AI models than ever before.

- Apple's latest iPhones, iPads, and Mac computers are fitted with custom chips that are designed for processing its new Apple Intelligence suite of AI applications and features. With over 2.5 billion active devices globally, Apple could become the biggest distributor of AI to consumers in the world.

- Microsoft developed an AI assistant called Copilot, which is embedded in its flagship software products like Windows, Bing, and 365 (Word, Excel, and Outlook). The company's Azure cloud platform is also a top destination for developers who want to rent data center capacity to build their own AI software.

- Alphabet owns Google Search, which it recently transformed with a series of new AI features that are fueling an acceleration in its revenue growth. Google Cloud is also a leading provider of data center infrastructure and other tools for AI developers, and it's growing at a lightning-fast pace, too.

Those four stocks had a combined weighting of 45.3% in the Vanguard Mega Cap Growth ETF as of the end of January, so they are extremely influential over its performance:

|

Stock |

Vanguard ETF Portfolio Weighting |

|---|---|

|

1. Nvidia |

13.51% |

|

2. Apple |

11.71% |

|

3. Alphabet |

10.48% |

|

4. Microsoft |

9.60% |

Data source: Vanguard. Portfolio weightings are accurate as of Jan. 31, 2026.

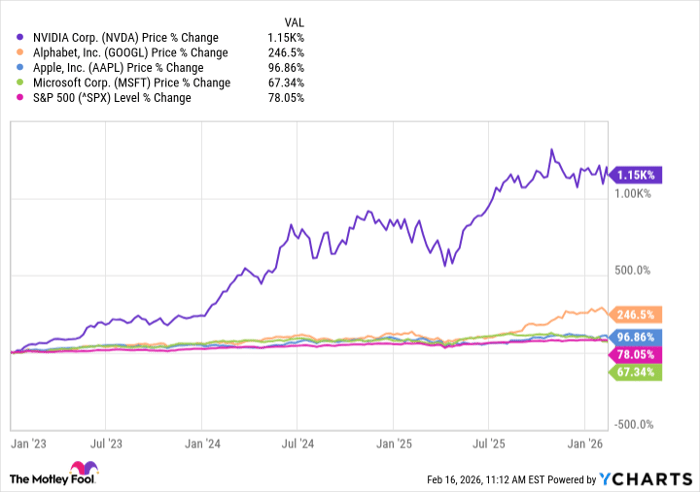

The S&P 500 has climbed by 78% since the AI boom started gathering steam at the beginning of 2023, whereas Nvidia stock has rocketed higher by a staggering 1,150%. In fact, each of the above four stocks has outperformed the S&P by a wide margin over the last few years, with the exception of Microsoft, which is lagging. I think it will recover soon).

NVDA data by YCharts

Some of the other leading AI stocks in this Vanguard ETF include Meta Platforms, Amazon, Tesla, Broadcom, and Palantir Technologies.

The Vanguard ETF can supercharge a diversified portfolio

The Vanguard Mega Cap Growth ETF has delivered a compound annual return of 13.6% since its inception in 2007, and an even faster annual return of 18.8% over the last 10 years as the adoption of technologies like enterprise software, cloud computing, and AI ramped up. But despite its track record, investors shouldn't park all of their money in this ETF, because its highly concentrated portfolio could lead to volatility if emerging industries like AI hit a speed bump.

Instead, this ETF could be a great addition to a diversified portfolio that doesn't already have a high degree of exposure to the tech sector or AI.

For example, if an investor had parked $10,000 in the Vanguard Total World Stock ETF (which holds a highly diversified portfolio of 10,000 stocks) 10 years ago, they would have $33,349 today. However, had they split the $10,000 by placing $5,000 in the Vanguard Total World Stock ETF and the other $5,000 in the Vanguard Mega Cap Growth ETF, they would be sitting on $44,672 today instead.

That strategy allows the investor to benefit from the continued potential growth of companies like Nvidia, Apple, Microsoft, and Alphabet, while keeping their risk in check by remaining sufficiently diversified.

Should you buy stock in Vanguard World Fund - Vanguard Mega Cap Growth ETF right now?

Before you buy stock in Vanguard World Fund - Vanguard Mega Cap Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard World Fund - Vanguard Mega Cap Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $415,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,904!*

Now, it’s worth noting Stock Advisor’s total average return is 889% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 19, 2026.

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Palantir Technologies, and Tesla. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.