Will Palantir Stock Rise After Feb. 2? History Offers an Answer That's Strikingly Clear.

Key Points

Palantir Technologies has seen revenue take off in recent years.

The commercial customer has emerged as a significant growth driver.

- 10 stocks we like better than Palantir Technologies ›

Palantir Technologies (NASDAQ: PLTR) launched an initial public offering in 2020, and since that time, the stock has delivered an eye-popping 1,600% gain. The increase didn't come immediately, though. In fact, after reaching a peak a year post-IPO, the stock actually spent a couple of years in the doldrums before taking off.

The sudden interest in Palantir stock coincides with strong earnings momentum for the company -- driven by the tech player's release of an artificial intelligence-driven system. Palantir's Artificial Intelligence Platform (AIP) entered the market in 2023, allowing customers the ability to quickly and easily harness the power of AI. Customers piled into AIP, fueling gains in revenue, and demand hasn't let up.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

So, Palantir has seen many periods of solid stock price performance in recent years. Now, the company is approaching a moment that could potentially push the stock higher or lower. Will Palantir stock rise after this Feb. 2 event? History offers an answer that's strikingly clear.

Image source: Getty Images.

Palantir and the AI boom

Before we consider this upcoming potential catalyst, let's first take a look at Palantir's path over the past few years. The company makes software systems that aggregate customers' data and help them use it as a basis for decision-making, developing new strategies, and more. As mentioned above, the star product as this AI boom progresses has been AIP.

These days, companies are eager to apply AI to their real-world situations, but this could be a time-consuming, costly, and intimidating endeavor. However, through AIP, they can easily and quickly get in on the benefits of AI -- and that has helped drive the popularity of this platform.

The results have appeared quarter after quarter in Palantir's earnings reports. Palantir has seen revenue from its two businesses -- government and commercial -- rise in the double digits. Trends in the commercial business are particularly interesting as this represents a new growth driver. For years, Palantir relied on government contracts for revenue, and as recently as about five years ago, the company had only 14 U.S. commercial customers.

But, with the launch of AIP and the general interest in AI, the commercial business has taken off, and Palantir now has hundreds of commercial customers powering more than $1 billion in contract value. For example, in the recent quarter, the company closed U.S. commercial total contract value of $1.3 billion.

Palantir's next earnings report

Now, speaking of earnings, this brings me to the subject of what's just ahead. Palantir is set to release fourth-quarter and full-year earnings on Feb. 2 after the closing bell.

We could imagine that Palantir's latest report, based on whether the news is positive or negative, may serve as a catalyst for stock performance. In recent quarters, Palantir's reports have been overwhelmingly positive, with the company reporting soaring demand and lifting guidance. But has Palantir's stock reflected the good news? Let's take a look at history and see what it suggests regarding the stock's upcoming performance.

After the past seven earnings reports, Palantir stock advanced five times and fell twice in the two weeks following the reports.

The wins and losses were as follows:

| Earnings period | Stock performance in the two weeks following the report |

|---|---|

| Q1 2024 | down 14% |

| Q2 2024 | up 34% |

| Q3 2024 | up 47% |

| Q4 2024 | up 42% |

| Q1 2025 | up 2% |

| Q2 2025 | up 8% |

| Q3 2025 | down 17% |

|

Data source: Ycharts |

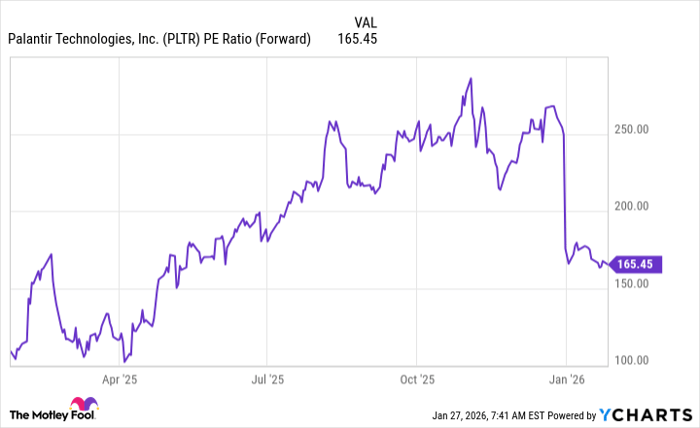

It's important to note that losses haven't necessarily been linked to negative news from the company. For example, the timing of Palantir's last earnings report, in early November, coincided with growing concerns about a potential AI bubble. And Palantir, with a sky-high valuation, was clearly a player that caught investors' attention -- they worried that such valuations may not be sustainable.

PLTR PE Ratio (Forward) data by YCharts

In any case, history suggests that Palantir has most often advanced, and on some of these occasions, it's delivered enormous gains, after its earnings reports. Of course, this time around, Palantir stock could deviate from the trend and stagnate or decline -- regardless of the contents of the earnings report. So, it's important to keep in mind that while history offers us an idea of what might happen, it's not 100% reliable.

But if history is right this time, the answer to our question is strikingly clear: Palantir stock could climb after Feb. 2.

Should you buy stock in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $461,527!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,155,666!*

Now, it’s worth noting Stock Advisor’s total average return is 950% — a market-crushing outperformance compared to 197% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 29, 2026.

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.