Got $500? 2 Cryptocurrencies to Buy and Hold for Decades.

Key Points

The cryptocurrency industry slumped in 2025, and that trend could continue in 2026.

Investors should keep a long-term perspective on two digital coins. Historically, they have always bounced back.

- 10 stocks we like better than Bitcoin ›

When it comes to investing, sometimes it's better to buy the rumor and sell on the news. Optimism about President Donald Trump's election victory sent cryptocurrency prices soaring in late 2024, but the industry has given back much of its gains during his administration -- despite a slew of policy changes and legislative action designed to boost crypto's adoption.

That said, the medium- to long-term outlook still looks good. Aside from the political changes, the asset class could also benefit from growing uncertainty about the Federal Reserve's independence and the White House's increasingly erratic trade policy, which is shaking faith in the dollar. Let's explore why Bitcoin (CRYPTO: BTC) and XRP (CRYPTO: XRP) could be great ways to bet on a rebound.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Bitcoin

Never underestimate the power of a brand. It's the reason Coca-Cola remains more popular than Pepsi despite the latter often winning blind taste tests.

Bitcoin is in a similar position. And its first-mover advantage has given it brand recognition that will help it maintain its dominant position in the cryptocurrency market, despite competition from newer, more technically sophisticated blockchain networks.

Bitcoin's perception as digital gold makes it appealing for investors who want to hedge against macroeconomic uncertainty. This is especially true in the U.S., where issues like the Trump administration's aggressive global tariffs and constantly changing policies are weighing on investor sentiment.

The political uncertainty is already having an effect, with the dollar index down by more than 10% during the past 12 months. And there are plenty of catalysts for the situation to worsen. These include the country's $38 trillion mountain of debt and an executive branch that has shown a willingness to use political pressure on the Federal Reserve.

Historically, these have been the ingredients for the value of a currency to rapidly erode, as seen in recent examples such as Turkey.

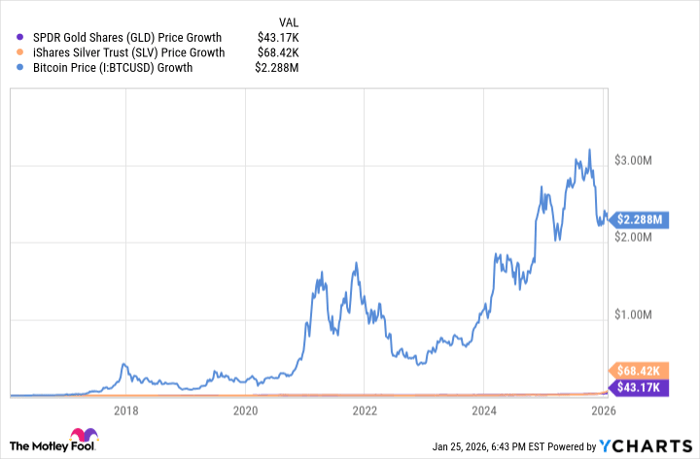

Bitcoin will face competition from precious metals like gold and silver, which also allow investors to hedge against currency risk. And while these assets have sharply outperformed Bitcoin during the past few months, the iconic cryptocurrency has consistently demonstrated significantly better long-term potential.

GLD data by YCharts.

XRP

Bitcoin can be thought of as the safest and most reliable blue chip cryptocurrency, but so-called altcoins better serve investors who are willing to take more risk for potentially better growth. XRP could be one such good choice because of its recent regulatory wins, increasing mainstream adoption, and an ambitious development team in Ripple Labs.

Unlike Bitcoin and other cryptocurrencies that stress their anonymous development and lack of centralized control, XRP takes a different approach. Although the XRP ledger itself is decentralized, the platform's developer continues to play a substantial role in pushing mainstream adoption of its native coin. This recently involved defending against a lawsuit from the Securities and Exchange Commission (SEC) that sought to regulate its coin sales under securities law.

Image source: Getty Images.

That developer, Ripple Labs, won a partial victory when its previous sales to institutional investors were considered securities sales, while sales to retail investors were not. The organization paid a $50 million fine, but the resolution of this case gives much-needed clarity to institutional investors who may be interested in adding XRP to their portfolios.

Ripple's legal win was soon followed by the SEC's decision to approve several spot XRP exchange-traded funds (ETFs). These funds make it easier for large investors to get exposure to the asset without dealing with digital wallets and other cryptocurrency-related complexities. It's still too early to know for sure, but XRP's growing mainstream adoption could help it break free from the boom-and-bust volatility and start delivering more consistent long-term returns.

Should you buy stock in Bitcoin right now?

Before you buy stock in Bitcoin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bitcoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $461,527!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,155,666!*

Now, it’s worth noting Stock Advisor’s total average return is 950% — a market-crushing outperformance compared to 197% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 29, 2026.

Will Ebiefung has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin and XRP. The Motley Fool has a disclosure policy.