Investing in an S&P 500 ETF in 2026? There's a Major Hidden Risk Investors Need to Know.

Key Points

The S&P 500 ETF is a powerful and potentially lucrative investment.

However, its tech-heavy focus could increase its risk.

For those seeking a more stable S&P 500 option, there's a strong alternative.

- 10 stocks we like better than Invesco S&P 500 Equal Weight ETF ›

S&P 500 (SNPINDEX: ^GSPC) exchange-traded funds (ETFs) are incredibly popular investments, and for good reason. The S&P 500 index itself is a powerhouse, containing stocks from 500 leading U.S. companies.

However, this type of investment has a hidden risk, and it may not be as safe and stable as some investors believe. Here's what you need to know if you own an S&P 500 ETF or are considering investing in one.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

The tech takeover

Most S&P 500 ETFs are weighted by market cap, meaning the largest companies in the index make up the largest proportion of the portfolio. That's not necessarily a bad thing, but as tech giants get bigger and bigger, these companies now dominate the S&P 500.

Nearly all of the top 10 stocks in the S&P 500 are from the tech industry, and the top three holdings -- Nvidia, Apple, and Microsoft -- combined make up roughly 20% of the entire index by market cap weight.

Tech stocks can be incredibly lucrative, and larger companies, in general, do tend to be somewhat more stable than smaller corporations. However, tech also has a reputation for being volatile. Many major tech companies are also heavily involved in the advancement of artificial intelligence (AI), which can be both an advantage and a risk, depending on how that sector fares going forward.

Again, the S&P 500's heavy tech focus isn't inherently a bad thing. But many people invest in this type of fund because they're looking for stability, so it's a good idea to understand how the index's changing composition affects its risk profile.

A more stable alternative

S&P 500 ETFs can still be fantastic investments, and their tilt toward tech can make them more lucrative than in the past. But if you're seeking an S&P 500-focused fund that's not quite as tech-heavy, an equal-weighted S&P 500 ETF could be a better fit.

Take the Invesco S&P 500 Equal Weight ETF (NYSEMKT: RSP), for example. This fund still tracks the S&P 500, holding all of the stocks within the index. However, each stock makes up roughly 0.2% of the portfolio, regardless of its market cap.

The advantage of an equal-weight ETF is that large companies don't have a disproportionate sway on the fund's performance. This can work well in periods of volatility, as this type of fund is less likely to face serious fluctuations. The downside, though, is that it also may have limited earning potential.

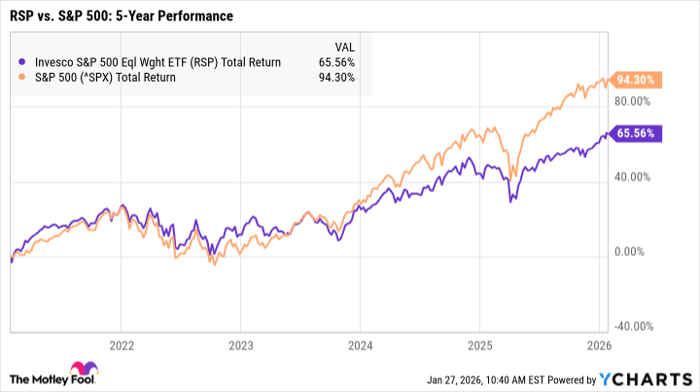

RSP Total Return Level data by YCharts

Over the last five years, for example, the S&P 500 has outperformed the Invesco S&P 500 Equal Weight ETF by a fairly significant margin. However, throughout the bear market in 2022, the Invesco ETF experienced milder drawdowns than the S&P 500 -- despite tracking the index.

If you're worried about potential market turbulence, an equal-weight S&P 500 ETF can help limit the volatility tech stocks are famous for. Just keep in mind that less exposure to tech stocks can sometimes lead to lower long-term performance, too.

Should you buy stock in Invesco S&P 500 Equal Weight ETF right now?

Before you buy stock in Invesco S&P 500 Equal Weight ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Invesco S&P 500 Equal Weight ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $461,527!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,155,666!*

Now, it’s worth noting Stock Advisor’s total average return is 950% — a market-crushing outperformance compared to 197% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 28, 2026.

Katie Brockman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool has a disclosure policy.