1 No-Brainer Nuclear Energy Stock to Buy Now and Never Sell

Key Points

Constellation Energy operates the largest nuclear power fleet in the U.S.

The company is unregulated, but could face pricing constraints in a key market.

Investors looking for an AI energy play may like Constellation for its upside potential and its ability to generate power today.

- 10 stocks we like better than Constellation Energy ›

Nuclear energy is back.

After years of stagnation -- years, however, of quiet innovation -- nuclear companies have come roaring back to life. The reason isn't hard to see. Nuclear offers carbon-free electricity that can run continuously, something solar and wind can't promise on their own. And in a world facing rising electricity demands, especially from artificial intelligence (AI) data centers, the reliability of nuclear suddenly matters.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

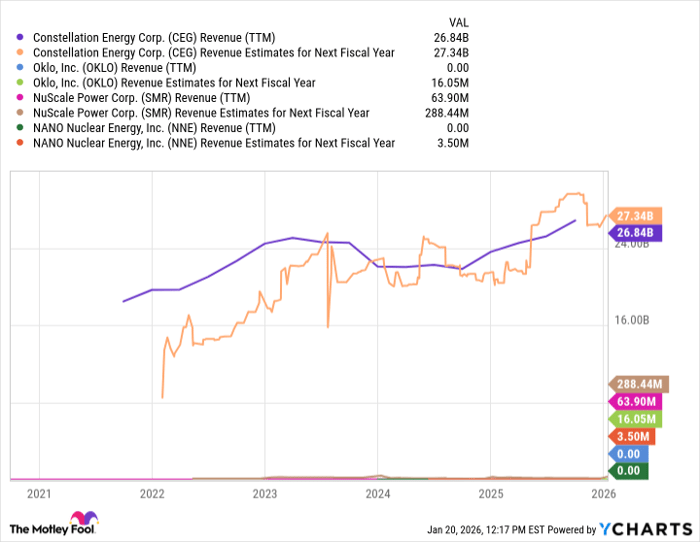

A number of nuclear start-ups have captured investors' attention with ambitious and innovative ideas. Think, for example, of the small reactor designs of NuScale Power (NYSE: SMR) and Oklo (NYSE: OKLO) or the portable reactors of Nano Nuclear Energy (NASDAQ: NNE).

These companies are working on some exciting technology, but none match the scale and earnings power of clean energy giant Constellation Energy (NASDAQ: CEG). Indeed, if you were to own just one nuclear energy stock, Constellation is a compelling first choice. Here's why.

Not a nuclear start-up, an established giant in nuclear energy

The nuclear start-ups mentioned above -- Oklo, NuScale, Nano -- are early-stage growth stocks. None are generating meaningful revenue. Only one -- NuScale -- has received approval from the Nuclear Regulatory Commission (NRC) for its reactor design, while Oklo and Nano are still in the thick of the licensing process.

Constellation, by contrast, already operates a large fleet of nuclear power plants. In fact, it operates the largest fleet of nuclear facilities in the U.S.

Image source: Constellation Energy.

The company has secured major deals with tech giants, including a 20-year contract from Meta Platforms for the full output of the Clinton nuclear plant and involvement from Microsoft in restoring the old Three Mile Island reactor to full functionality.

Constellation is profitable, with strong recent earnings growth. Its trailing-12-month revenue reflects a company that has clearly benefited from rising power demands, with future-12-month estimates that still dwarf revenue expectations for Oklo, Nano, and NuScale.

CEG Revenue (TTM) data by YCharts

Part of Constellation's strength lies in its business model. Unlike most utilities, which operate as regulated regional monopolies, Constellation functions primarily as an unregulated power supplier. This means it can sell electricity at market rates rather than abide by government-set prices.

In practice, this structure could allow for more upside opportunity when prices are strong, though, at the same time, it also introduces risk. While current trends in electricity are favorable, the power market can be volatile, and lower power prices in key regions could strain margins and lead to uneven quarterly results.

Constellation could also be facing a potential political risk in its mid-Atlantic market. President Donald Trump, along with local governors in that region, appear aligned on a plan that would cap prices on existing power sources. While details are still uncertain, a move in that direction could constrain Constellation's upside in that region.

Constellation stock trades at about 35 times trailing earnings and more than 7.5 times book value. Both of these signal a highly valued energy company with a lot of expectation already baked into the price.

Opportunity for growth remains, especially if electricity demands from AI accelerate over the next five years as many forecasts suggest. The stock isn't without risks, but it carries less execution risk than most nuclear start-ups, like Oklo. That said, investors who want nuclear exposure without the volatility of a single stock may be more interested in a nuclear energy exchange-traded fund (ETF) instead.

Should you buy stock in Constellation Energy right now?

Before you buy stock in Constellation Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Constellation Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $464,439!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,150,455!*

Now, it’s worth noting Stock Advisor’s total average return is 949% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 24, 2026.

Steven Porrello has positions in Microsoft and Oklo. The Motley Fool has positions in and recommends Constellation Energy, Meta Platforms, and Microsoft. The Motley Fool recommends NuScale Power and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.