TradingKey’s The Week on Wall Street: Economic Resilience Triggers Sector Rotation

Previous Week’s Market Review & Analysis

Macroeconomic Landscape: The week of January 12-18, 2026, provided fresh insights into the U.S. macroeconomic landscape, with key inflation and retail sales data released. December's Consumer Price Index (CPI), released on Tuesday, January 13, indicated overall inflation rose 0.3% and core inflation 0.2% for the month, leading to an annualized inflation rate of 2.7%. Producer Price Index (PPI) figures for November were published on Wednesday, January 14, showing core PPI flat against an expected 0.2% increase, while overall PPI matched expectations with a 0.2% rise. Notably, December PPI data was not released, likely due to a government shutdown in late 2025. Retail sales for November also exceeded expectations, increasing 0.6% overall and 0.5% for core sales, released on Wednesday, January 14. The labor market showed resilience, with unemployment claims for the week ending around January 15 totaling 198,000, below the anticipated 215,000. Federal Reserve commentary included remarks from New York Fed President John C. Williams on January 12, stating monetary policy is well-positioned, anticipating inflation to peak in the first half of 2026 before declining, and projecting above-trend GDP growth. Geopolitical influences remained a factor, with oil prices rallying due to escalating protests in Iran.

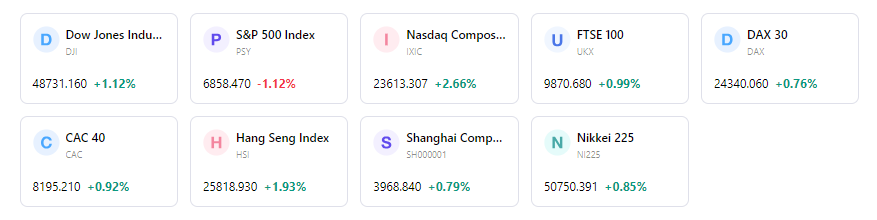

Market Performance Overview: U.S. equity markets exhibited mixed performance during the week. The Dow Jones Industrial Average concluded the week up 87 points at 49,359, having touched a high of 49,587 on Monday and a low of 48,879 on Wednesday. The S&P 500 was relatively flat, declining 0.14% (9.95 points) to close at 6,940, with its weekly high at 6,985 on Monday and low at 6,890 on Wednesday. The Nasdaq Composite finished at 25,529, down 145 points from its Monday opening, fluctuating between a high of 25,809 and a low of 25,280. Sector performance indicated a rotation, with investors shifting out of technology stocks into cyclicals, and defense stocks receiving a boost. The Utilities Select Sector SPDR gained 1.2%, and the Materials Select Sector SPDR rose 1.6%, as nine out of eleven S&P 500 sectors ended in positive territory.

Key Events Analysis: The fourth-quarter 2025 corporate earnings season officially commenced this week. Key financial institutions reported, including JPMorgan Chase on Tuesday, Bank of America, Wells Fargo, and Citigroup on Wednesday, and Blackrock, Goldman Sachs, and Morgan Stanley on Thursday. These reports were closely watched for insights into corporate performance and outlook. Several Federal Reserve officials had scheduled public appearances, contributing to market discourse on monetary policy.

Flows & Sentiment: Fund flows indicated caution, with total estimated outflows from long-term mutual funds and ETFs reaching $7.16 billion for the eight-day period ending January 7, 2026. Domestic equity funds alone experienced estimated outflows of $32.02 billion. Conversely, bond funds saw estimated inflows of $24.96 billion. Digital asset investment products recorded $454 million in outflows, with the U.S. market notably seeing $569 million in outflows, attributed to diminishing prospects of a Federal Reserve interest rate cut in March. The CBOE Volatility Index (VIX) fluctuated, starting the week at 15.12 on January 12 and closing at 15.86 on January 16, peaking at 16.75 on January 14. Market expectations for a January Fed rate cut significantly decreased during the week.

Overall Assessment: The market navigated a period of mixed sentiment, characterized by choppy trading in the S&P 500 and Nasdaq. Economic data provided nuanced signals regarding inflation and the labor market, leading to a recalibration of Fed rate cut expectations. The commencement of Q4 2025 earnings season, particularly from major banks, offered initial corporate insights, alongside notable sector rotation out of technology into more cyclical and defensive areas.

Next Week’s key market drivers & Investment Outlook

Upcoming Events: The upcoming week, January 20-24, will begin with U.S. markets closed on Monday for Martin Luther King Jr. Day. Major economic releases include China’s Q4 GDP, Industrial Production, and Retail Sales on Monday. Tuesday will feature the People's Bank of China’s interest rate decision, UK labor market data, and U.S. corporate earnings from companies like Johnson & Johnson. The UK CPI is due on Wednesday. Thursday's calendar includes Australia's labor market report, preliminary PMIs from key economies, U.S. Q3 GDP, and the crucial U.S. Personal Consumption Expenditures (PCE) index. The week concludes on Friday with the Bank of Japan’s interest rate decision, UK retail sales, and U.S. preliminary PMIs.

Market Logic Projection: Geopolitical risks and energy market volatility are expected to continue shaping early 2026 market dynamics. While inflation shows signs of easing, growth momentum appears uneven across sectors. Forward guidance from corporate earnings calls, particularly from technology and financial firms, will be crucial in outlining demand trends, cost pressures, and investment plans. Commentary from Federal Reserve officials will remain a focal point, influencing expectations for future monetary policy moves.

Strategy & Allocation Recommendations: We advise a balanced allocation across high-quality equities and selectively positioned fixed income. Large-cap equities are expected to serve as an anchor, while mid and small-cap segments warrant a more balanced, neutral stance, presenting opportunities for selective additions. Within equities, we currently favor the industrials sector over consumer discretionary. Investors should consider phased investments in mid and small-cap segments.

Risk Alerts: Key risks include persistent policy uncertainty from central banks, uneven economic growth, and ongoing geopolitical pressures that could impact energy prices and financial conditions. Elevated valuations, the narrow nature of recent market rallies, concentrated earnings, and open trade risks also deserve attention. Concerns regarding the independence of the Federal Reserve due to external pressures also remain a risk.

Markets Weekly

5-Day Index Performance