My Top 2 Artificial Intelligence Stocks for 2026

Key Points

The booming demand for AI data centers is proving to be a significant growth driver for Applied Digital.

SoundHound AI is helping its clients improve productivity, and its substantial revenue backlog suggests that its growth could be stronger than analysts expect.

- 10 stocks we like better than Applied Digital ›

Artificial intelligence (AI) stocks have played a central role in driving the stock market's rally in the past three years, and the trend is expected to continue in the new year as well.

Various Wall Street projections suggest that the S&P 500 index will head higher in 2026 on the back of robust AI infrastructure spending. Asset management company DWS anticipates that the S&P 500 -- currently around 6,964 -- will jump to 7,500 points by the end of the year on the back of AI-driven growth. Deutsche Bank has a rosier forecast, expecting the index to jump to 8,000 points by the end of 2026. It, too, cites AI as one of the key expected catalysts.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

With all that in mind, now would be a good time for investors to take a closer look at AI stocks that could help them capitalize on the sector's growth. Two that I believe could be among the best to buy for 2026 and beyond are Applied Digital (NASDAQ: APLD) and SoundHound AI (NASDAQ: SOUN).

Image source: Getty Images.

1. Applied Digital

Applied Digital is a key player in the AI hardware ecosystem. It designs, builds, and operates data centers capable of running high-performance computing applications and AI workloads.

The growth stock was in red-hot form last year, and it has gotten off to a terrific start in 2026. Applied Digital stock has already gained about 50% in the new year, as of this writing. The company's results for its fiscal 2026 second quarter (which ended on Nov. 30) sent its shares flying.

Applied Digital's revenue increased by a whopping 250% year over year to almost $127 million, well above the analysts' $88 million consensus estimate. That stunning growth was driven by the data center fit-out services it provides to tenants such as neocloud company CoreWeave, as well as various hyperscalers that have been tapping the company to build AI data center capacity.

What's more, Applied Digital has started recognizing lease revenue from CoreWeave for 100 megawatts (MW) of data center capacity that it deployed for the latter last quarter. What's worth noting is that Applied Digital has already inked lease contracts for 600 MW of data center capacity that it is building across its two campuses in North Dakota.

And now, it's in advanced talks with another hyperscaler to build data centers in multiple regions of the U.S. The company has a solid 15-year prospective lease revenue pipeline of $11 billion under its current contracts with CoreWeave and another hyperscale customer. The addition of a new hyperscaler could boost that pipeline.

Moreover, the construction of new facilities for the new customer that Applied Digital spoke about on the latest earnings call could boost its tenant fit-out revenue in 2026. Investors should also note that Applied Digital expects an acceleration in lease revenue over the next 18 to 24 months as it readies more data center capacity for service.

As such, the company seems to be in a solid position to exceed the 61% top-line jump to $347 million that analysts are expecting for the current fiscal year. Consensus estimates are projecting a 57% increase in its top line in the next fiscal year to $546 million, but Applied Digital could do better than that, considering that it seems to be on track to land a new hyperscaler customer.

In all, Applied Digital's business outperformance is likely to be rewarded with more share price gains in 2026.

2. SoundHound AI

SoundHound AI (NASDAQ: SOUN) had a terrible 2025, but it looks like investors have regained some optimism about the voice AI solutions provider in the new year. Shares have jumped by almost 11% already in 2026, and it won't be surprising to see them head higher as the year progresses.

SoundHound AI operates in a fast-growing market that's gaining solid traction on the back of the productivity gains that voice AI solutions offer. Venture capital firm Geodesic Capital points out that 75% of the new contact centers deployed by 2028 will be powered by generative AI. The firm also asserted that automating routine tasks with the help of voice AI could reduce those contact centers' operational costs by up to 60%.

Not surprisingly, SoundHound AI's offerings are witnessing healthy adoption from customers across multiple industries. For example, they are being integrated by automakers in their vehicles' infotainment systems to support voice commerce and AI-enabled chat. Restaurant chains have been tapping SoundHound as an interface for drive-thrus and smart ordering systems.

These are just some of the examples of how SoundHound's AI solutions, which enable customers to develop and deploy voice-enabled AI agents, create custom voice AI solutions, and voice-based chatbots, among other tools, are being used. It is worth noting that it is also serving the finance, insurance, retail, and healthcare markets, among others.

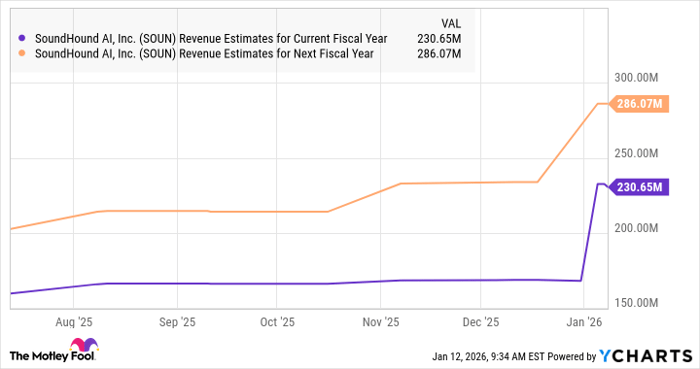

As a result, the company is clocking remarkable growth. Its revenue in the recently concluded year is estimated to have nearly doubled to $172.5 million, as per the midpoint of its guidance range. Analysts are expecting SoundHound's growth to remain solid in 2026 and 2027 as well.

SOUN Revenue Estimates for Current Fiscal Year data by YCharts.

However, the company's huge bookings backlog of $1.2 billion, last reported at the end of 2024, puts it in a nice position to exceed Wall Street's expectations in 2026 and 2027. That could help SoundHound stock jump impressively this year.

What's worth noting is that analysts' median 12-month price target of $15.50 for the stock points toward a jump of 32% from current levels. Don't be surprised if SoundHound does even better than that, though, as it has been growing at a phenomenal pace and has the ability to sustain it in the future.

Should you buy stock in Applied Digital right now?

Before you buy stock in Applied Digital, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Applied Digital wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $487,089!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,139,053!*

Now, it’s worth noting Stock Advisor’s total average return is 970% — a market-crushing outperformance compared to 197% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 15, 2026.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends SoundHound AI. The Motley Fool has a disclosure policy.