The Smartest Growth Stock to Buy With $1,000 Right Now

Key Points

TSMC is a critical supplier to the major AI hardware companies.

Wall Street expects strong growth in 2026.

Data center buildouts are expected to last through at least 2030.

- 10 stocks we like better than Taiwan Semiconductor Manufacturing ›

Looking for smart investment opportunities is what every investor should be doing. These are often stocks that are participating in a massive trend, yet may not be fully appreciated for their participation.

In the AI realm, I think Taiwan Semiconductor Manufacturing (NYSE: TSM) falls into that category. TSMC is the largest chip foundry by revenue in the world by a large margin, and without its capabilities, the AI buildout wouldn't look the same.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

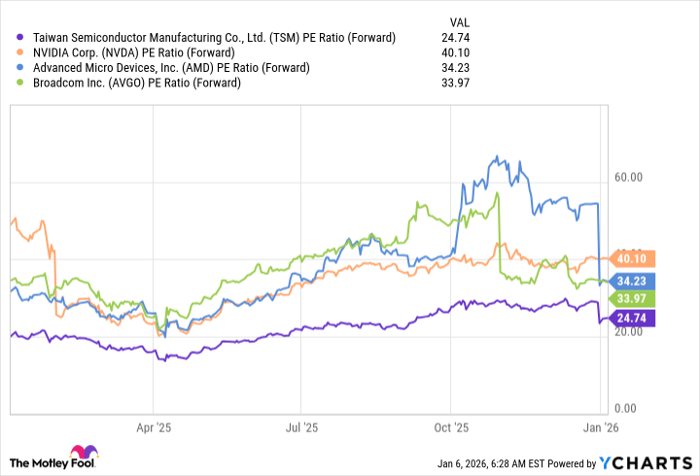

However, TSMC doesn't receive the same premium valuation as its peers, despite its superior growth. I think this makes the company one of the smartest stocks investors can buy today, as it's primed to soar throughout 2026.

Image source: Getty Images.

TSMC is a key part of the supply chain

Regardless of what artificial intelligence computing unit provider you're thinking of, it doesn't produce its own chips. Instead, they are all fabless design companies, meaning they design the chip but then outsource the assembly and production work to other companies. Nvidia, AMD, and Broadcom all do this, and their top chip foundry is easily TSMC.

This makes TSMC a neutral party in the AI buildout, as the company will make more money from this trend regardless of which supplier's computing unit is deployed. TSMC will never provide the highest growth in a group of stocks that includes itself and fabless chip designers, but it also won't have the slowest growth. This makes it a catch-all investment, which normally doesn't command the highest premium on the stock because it isn't doing as well as some others. However, TSMC is far cheaper than its peers.

TSM PE Ratio (Forward) data by YCharts. PE = price-to-earnings.

At 25 times forward earnings, TSMC is a great value in the market, especially for the growth it's expected to deliver. For 2026, Wall Street analysts expect the company's growth to be about 31% in New Taiwan dollars. The growth rate for U.S. currency could be higher or lower depending on exchange rates, but either way, Taiwan Semiconductor Manufacturing is expected to deliver strong growth in 2026.

As long as increased AI spending occurs, the company's stock will continue rising. Fortunately for TSMC, its major clients all believe there is massive growth ahead.

TSMC is ahead on the adoption curve

The data centers being constructed aren't happening overnight. When a data center is announced, there are years of planning and construction that occur, and then computing units must be procured from the preferred hardware vendor. Before that, those computing units must be assembled using chips from TSMC. So, the chip manufacturer's business is actually ahead of where the major computing players are.

If you see TSMC's revenue growth slowing significantly, it could be a sign that the AI computing unit businesses will struggle in the near future. However, that hasn't happened yet, and may not happen for some time.

AMD believes that the global data center compute market will reach $1 trillion by 2030. Nvidia offered a similar projection, with global data center capital expenditures expected to rise to $3 trillion to $4 trillion by 2030. Nvidia's figure includes all costs associated with data center construction, while AMD concentrates on just the compute market. Either way, there is most likely growth expected over the next few years from these computing providers.

Because they all source their chips primarily from TSMC, it's a great sign that the company is in a position to benefit from all this increased data center spending. I'm confident that TSMC will continue to be a top-tier stock pick, and I think it's one of the smartest stocks to buy right now.

Should you buy stock in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $488,222!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,134,333!*

Now, it’s worth noting Stock Advisor’s total average return is 969% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 10, 2026.

Keithen Drury has positions in Broadcom, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.