Gold rockets above $4,500, set for 4% weekly gain post US NFP

- Gold climbs as softer job gains outweigh falling unemployment, sustaining expectations for Fed easing.

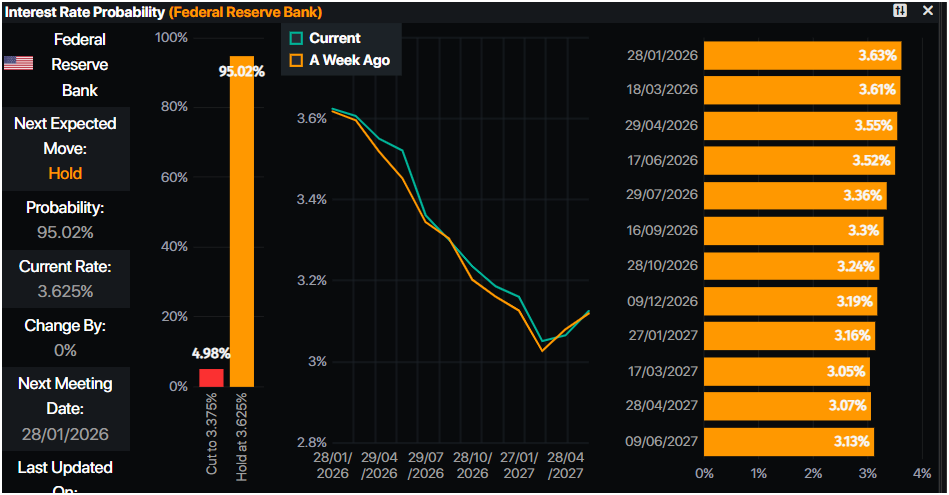

- Markets still price roughly 50 bps of rate cuts this year despite resilient wages and sentiment data.

- Traders eye US inflation and retail sales next week as Gold challenges record highs.

Gold price rises on Friday, poised to end with weekly gains of nearly 4% as an employment report in the US was mixed, with the economy adding fewer jobs than projected. Still, the Unemployment Rate ticked lower, yet investors are still betting the Federal Reserve (Fed) to cut rates this year. At the time of writing, XAU/USD trades at $4,507, up 0.65%.

Bullion rallies as weaker payrolls keep Fed cut bets alive

The US economic data weighed on investors’ expectations of lower interest rates in the short term. But for the whole year, traders seem confident that the Federal Reserve would lower rates by 50 basis points.

Digging into the data, Nonfarm Payrolls for December missed estimates and November’s print. Nonetheless, the Unemployment Rate fell, while Average Hourly Earnings came as expected.

Housing data revealed an ongoing slowdown as Building Permits and Housing Starts for October dipped compared to November’s data. Meanwhile, the University of Michigan Consumer Sentiment January preliminary release fared better than projected, even though US households showed worries about inflation in the mid-term.

After the data, the yellow metal fell towards $4,450 before assaulting the $4,500 mark, hitting a daily high of $4,517, shy of the record high of $4,549. The Greenback trimmed some of its earlier gains before reaccelerating higher, as depicted by the US Dollar Index (DXY).

The DXY, which measures the American currency performance against other six, is up 0.33% at 99.16.

Gold traders await next week’s US economic data, led by inflation figures, Retail Sales, regional manufacturing indices surveys, jobless claims and speeches by Fed officials.

Daily digest market movers: Gold rallies as US yields remain static

- Gold price soars as US Treasury yields remain flat, with the US 10-year note yield sitting at 4.171%.

- The US Bureau of Labor Statistics showed that the US economy added 50,000 jobs in December, undershooting forecasts of 60,000 and easing from the prior revised 56,000 increase. Despite a softer hiring pace, the Unemployment Rate slipped to 4.4% in December from 4.6%, coming in below expectations of 4.5%, tempering concerns about labor market deterioration.

- Housing data showed that Building Permits edged 0.2% lower in October, declining from 1.415 million to 1.412 million. Housing Starts also weakened, with privately owned starts falling 4.6% MoM to 1.246 million, down from 1.306 million in September.

- The University of Michigan Consumer Sentiment preliminary reading for January surprised to the upside, rising to 54 from November’s final 52.9, and beating forecasts of 53.5. Inflation expectations for one-year expectations held steady at 4.2%, while five-year expectations climbed to 3.4% from 3.2%.

- Following the US data releases, Atlanta Fed GDP Now for Q4 2025 stands at 5.1%, down 0.3% from a day ago.

- Given the backdrop, investors have priced 56 basis points of rate cuts by the Federal Reserve in 2026, according to Prime Market Terminal data.

Technical analysis: Gold price surges past $4,500, eyes on record high

The trend in Gold remains upward with buyers looking to finish Friday’s session above $4,500. The Relative Strength Index (RSI) is about to cross the latest cycle high, an indication of buyers gaining momentum and opening the door for higher prices. If XAU/USD climbs above the record high of $4,549, this clears the way towards $4,600.

Conversely, if XAU/USD finishes the session below $4,500, sellers could drive prices towards the daily low of $4,450 as they eye the $4,400 mark.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.