2 Trillion-Dollar Stocks That Could Beat the Market in 2026

Key Points

Amazon's cloud business is bouncing back, a wave the company could ride through 2026.

Apple's latest device is already a hit and could drive strong sales growth over the next 12 months.

Both stocks have buy-and-hold qualities, regardless of what happens in 2026.

- 10 stocks we like better than Amazon ›

Last year was an amazing one for several members of the "Magnificent Seven." Alphabet was the best-performing of them all, with its shares soaring more than 60%. Nvidia also continued to ride the artificial intelligence (AI) tailwind and had a strong showing.

However, some were not so lucky. Amazon (NASDAQ: AMZN) and Apple (NASDAQ: AAPL) both underperformed broader equities in 2025. Even so, both tech leaders could perform much better in 2026. More importantly, both remain excellent buy-and-hold options. Here's why.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

1. Amazon

Amazon has been losing market share to competitors in cloud computing. However, during the third quarter, the company showed that its Amazon Web Services (AWS) can still perform very well. The segment reported 20% year-over-year sales growth -- it increased faster than it had since 2022. Was that a one-off? Maybe not. Amazon is investing in expanding AWS capacity to position itself to capture the rising demand for cloud and AI services, which could help the segment maintain strong sales growth.

It's also worth noting that Amazon has signed a seven-year, $38 billion deal with OpenAI. By itself, this deal won't significantly boost Amazon's financial results. But it shows that Amazon remains highly competitive in the cloud market. Amazon's cloud backlog reached $200 billion as of the end of the third quarter, excluding additional deals signed in October. So, AWS has plenty of momentum entering 2026 and could help Amazon deliver stronger financial results and beat broader equities.

Of course, the company's business is more than just AWS. Its advertising unit is still performing well, for instance. It reported $17.7 billion in revenue for the third quarter, representing a 22% increase compared to the same period last year. Amazon has also made progress with its healthcare ambitions. The company's core e-commerce operations could face some headwinds due to macroeconomic factors, particularly tariffs. However, overall, the business is strong, and Amazon's prospects look even stronger.

Cloud computing, AI, advertising, and healthcare should all be significant long-term tailwinds for the company. With a wide moat stemming from several sources, including switching costs and network effects, Amazon is well positioned to remain a leader in these markets for a long time. So, even if it doesn't perform well in 2026, the stock is a buy for long-term investors.

2. Apple

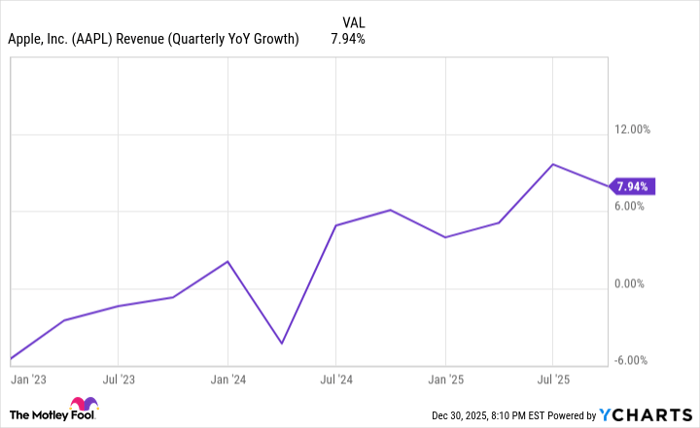

Apple's top-line growth has been slow to non-existent over the past three years. New iPhones haven't generated the kind of buzz investors had hoped for, while they have faced issues in some countries, including China. Furthermore, the threat of tariffs is very real for the company, as it manufactures most of its devices outside the U.S. However, note that sales growth has been on a northbound trajectory over the past three years.

AAPL Revenue (Quarterly YoY Growth) data by YCharts.

Could that trend continue next year? Apple is predicting revenue growth between 10% and 12% for its upcoming quarter. It hasn't had double-digit revenue growth in a while.

The company's iPhone 17 is largely responsible for the upbeat forecast. It is leading a strong cycle of renewals. Demand for the device remains high. If anything, Apple has not been able to meet it due to supply constraints, a problem it expects to fix next year.

Here's the bottom line: With its most important product driving excellent revenue growth, Apple could perform much better in 2026 than it did in 2025.

The stock remains attractive for long-term buy-and-hold investors. In addition to the strength of its iPhone business, Apple's services segment continues to gain momentum. This high-margin business boasts significant prospects as Apple paid subscriptions grow. This will ultimately boost the bottom line.

So, what's the verdict for Apple? It could have a strong 2026 and still deliver excellent returns over the long term, especially once investors factor in its robust dividend program.

Should you buy stock in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $490,703!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,157,689!*

Now, it’s worth noting Stock Advisor’s total average return is 966% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 5, 2026.

Prosper Junior Bakiny has positions in Alphabet, Amazon, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, and Nvidia. The Motley Fool has a disclosure policy.