3 Phenomenal Stocks That Could Double in 2026

Key Points

Nebius expects rapid growth in 2026.

The Trade Desk trades at a deep discount to the market.

MercadoLibre is down 20% from its all-time high.

- 10 stocks we like better than Nebius Group ›

Pinpointing stocks that could double faster than the market is a great skill to have; the broader market usually takes about seven years to double, assuming an average 10% annual return. Finding stocks that can double in a year or less is very difficult, and there's usually a bit of luck involved.

However, I've identified three stocks that could achieve this through growth or multiple expansion, and each looks like an intriguing buy in the new year.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

1. Nebius

Nebius (NASDAQ: NBIS) was spun out of Yandex, which is essentially the Russian equivalent of Google. After sanctions came down amid Russia's invasion of Ukraine, Yandex decided to spin out its Russian and non-Russian businesses, and Nebius was formed. However, Nebius doesn't bear any resemblance to the search engine part of the business, but it is similar to Google Cloud, its cloud computing wing.

Nebius is focused on building out its data center footprint, both by building its own data centers and leasing space from others that have floor space. Then, it installs its computing units -- mostly graphics processing units (GPUs) from Nvidia (NASDAQ: NVDA) -- in these locations and rents out the computing capacity to its artificial intelligence (AI) customers to train or run workloads on.

With the huge demand for AI computing power, it should come as no surprise that Nebius expects monster growth in 2026. Although the stock tripled in 2025, don't be surprised to see it double again in 2026. Nebius expects an annual run rate (ARR) of $7 billion to $9 billion in revenue for 2026. For reference, Nebius' current ARR is $551 million.

That's unbelievable growth in a quick timeframe, and could be what the stock needs to double again in 2026.

2. The Trade Desk

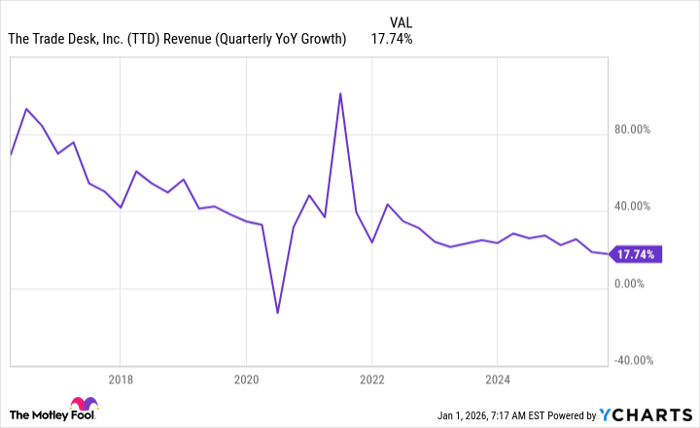

The Trade Desk (NASDAQ: TTD) is on the opposite end of the spectrum from Nebius. Its growth is shrinking, rather than accelerating. In Q3, The Trade Desk posted its slowest quarter of growth ever (outside of a single COVID-affected quarter).

TTD Revenue (Quarterly YoY Growth) data by YCharts

The Trade Desk operates a buy-side ad platform, which helps companies looking to advertise their products find the optimal location to place their ad. This industry is still growing, especially with the rise of connected TV. While The Trade Desk has had a few missteps along the way, it's still a promising business. It could accelerate its growth again in 2026, especially without the year-over-year comparison headwind of political spending that occurred in 2024 versus 2025.

Thanks to the market's loss of confidence in The Trade Desk, the stock trades for an attractive 18 times forward earnings. That's a steal for a solid business like The Trade Desk, and a return to growth plus a valuation increase could easily cause the stock to double in 2026.

3. MercadoLibre

MercadoLibre (NASDAQ: MELI) has built an incredible business in Latin America. It has the dominant e-commerce platform in the region, which offers many of the benefits that we enjoy as online shoppers in the U.S., such as same-day or next-day delivery. It also built its own fintech division to handle payments because access to digital spending technology isn't as prevalent in Latin America as in the U.S.

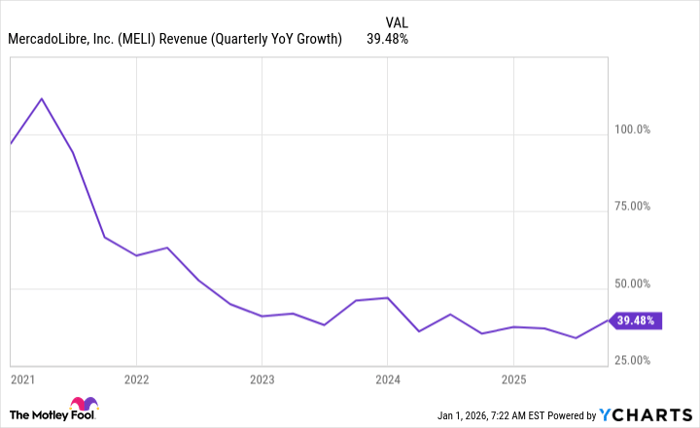

MercadoLibre's growth has been nothing short of incredible, and it continues to pump out quarter after quarter of rapid growth.

MELI Revenue (Quarterly YoY Growth) data by YCharts

Despite this record, MercadoLibre's stock is down about 20% from its all-time high and is expected to have another solid year in 2026. An average of 25 Wall Street analysts project MercadoLibre will deliver 29% revenue growth in 2026. MercadoLibre also consistently outperforms expectations, so a higher growth rate than this wouldn't surprise me, either.

Through a combination of MercadoLibre setting new all-time highs and the growth being priced into the stock once it occurs, I think there's a high chance MercadoLibre could double in 2026. However, it's far from a surefire bet. Still, I think MercadoLibre is a great pick for 2026, regardless of whether it doubles.

Should you buy stock in Nebius Group right now?

Before you buy stock in Nebius Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nebius Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $505,641!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,143,283!*

Now, it’s worth noting Stock Advisor’s total average return is 974% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 3, 2026.

Keithen Drury has positions in MercadoLibre, Nvidia, and The Trade Desk. The Motley Fool has positions in and recommends MercadoLibre, Nvidia, and The Trade Desk. The Motley Fool has a disclosure policy.