Why I Will Let This Mid-Cap ETF Ride for Decades

Key Points

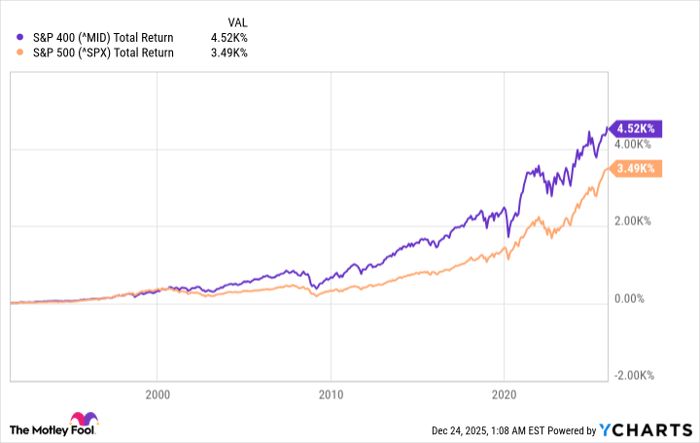

Mid-cap stocks boast a better long-term track record of performance than large caps.

This hasn’t been the case of late mostly because of a once-in-a-generation tech revolution.

Picking individual mid-cap tickers can be a lot of work, and so an ETF can be more sensible.

- 10 stocks we like better than Vanguard Index Funds - Vanguard Mid-Cap ETF ›

Anyone who has been in the stock market for long enough has likely heard the merits of index fund investing. They're simple to own and often produce better returns than picking individual stocks. And in most cases, an index fund like the Vanguard S&P 500 ETF or the SPDR S&P 500 ETF Trust -- built to mirror the S&P 500 -- is the go-to recommendation.

That's not your only option though. In fact, it's arguably not even your best option. Your portfolio may be far better served with a stake in the Vanguard Mid-Cap ETF (NYSEMKT: VO). Here's why.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

In the sweet spot

Just as the name suggests, Vanguard's Mid-Cap ETF holds a bunch of mid-cap stocks -- companies typically with market capitalizations of between $2 billion and $10 billion. While this particular fund is meant to reflect the performance of the 290 constituents of the cap-weighted CRSP US Mid Cap index, you'll likely see a similar performance from the S&P 400 MidCap index and any of the exchange-traded funds that mirror it.

More important to buy-and-hold investors, however, you should make a point of holding a position in this ETF. It's got a long track record of outperforming the S&P 500, after all. True, the S&P 500 has performed uncharacteristically well since 2020 thanks to small number of the world's already-biggest technology stocks becoming dramatically bigger by leading the artificial intelligence revolution.

Yet, going all the way back to its creation back in 1991 the S&P 400 MidCap index has easily outpaced its large cap counterpart.

^MID data by YCharts

This superior performance actually makes sense. Mid-sized companies are in the sweet spot of their existence. They're past their wobbly start-up years, but haven't yet reached their full growth stride that can only be achieved with scale. In most cases, their best growth lies ahead, often leveraged by being in the right place at the right time with the right product or service.

Artificial intelligence robotics outfit UiPath recently grew its way into the S&P 400, for instance, while Robinhood Markets and Carvana both recently outgrew the S&P 400 to become members of the S&P 500. In all three cases, their respective marketplaces were ready for something new.

The easiest way of adding such exposure

Not every mid-cap name that's part of the CRSP US Mid Cap index or in the Vanguard Mid-Cap ETF thrives, of course. Like the S&P 500, many of these stocks simply keep pace with their peers. Some of them even fail to keep up with their fellow constituents, and are subsequently kicked out of their respective indexes.

Enough of these names do perform well enough, however, to lift the entire group above all other groupings. And this has been the case for a while. It's likely to remain the case indefinitely too, given long enough timeframes.

Owning a broad basket of these stocks is certainly a much easier way of adding this performance to your portfolio, rather than trying to tackle the tricky task of researching and monitoring this often-undercovered group of tickers on an individual basis.

Should you buy stock in Vanguard Index Funds - Vanguard Mid-Cap ETF right now?

Before you buy stock in Vanguard Index Funds - Vanguard Mid-Cap ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Index Funds - Vanguard Mid-Cap ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $509,470!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,167,988!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 29, 2025.

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends UiPath and Vanguard Index Funds-Vanguard Mid-Cap ETF. The Motley Fool has a disclosure policy.