Will Nvidia Stock Crash in 2026?

Key Points

Nvidia is growing quickly, but is posting record profit margins that could reverse if AI infrastructure supply matches demand.

The stock trades at a high P/E ratio.

Nvidia stock is not guaranteed to crash, but risks do persist for the company if AI spending slows down in 2026.

- 10 stocks we like better than Nvidia ›

Shares of Nvidia (NASDAQ: NVDA) have begun to sputter. The stock is close to flat since this summer, with investors worried about peak spending on artificial intelligence (AI) computer chips. With a share price that has risen over 1,000% in the last five years, who can blame them? Nvidia is now the largest company by market cap in the world, and while it is growing its revenue and earnings at an incredible rate right now, that could come to a halt if the AI spending boom collapses.

Does that mean Nvidia stock is set to crash next year?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Massive current growth, cyclicality risks

There is no denying that Nvidia is growing rapidly right now. It has a lock on the AI computer chip market, meaning that virtually every large technology provider or start-up building AI models needs to buy its products. Last quarter, revenue grew 62% year over year to $57 billion, with data center revenue growing even faster.

Management says that its upcoming Blackwell computer chip is selling out of its upcoming supply, which is a good near-term determination of future growth. Profit margins are off the charts, with operating margin up to 63% last quarter.

If current growth rates continue, then Nvidia will do well for shareholders in 2026. But eventually, the AI computer chip supply will start to match demand, as it does in any spending supercycle. This will lower Nvidia's revenue growth rate, and could make it even turn negative for a short while. Profit margins are going to fall once the company loses its pricing power, especially if competition keeps rising from Alphabet's TPU chip and Amazon's Trainium chip.

A downside scenario such as this could risk Nvidia's earnings power being lower 12 months from now.

Image source: Nvidia.

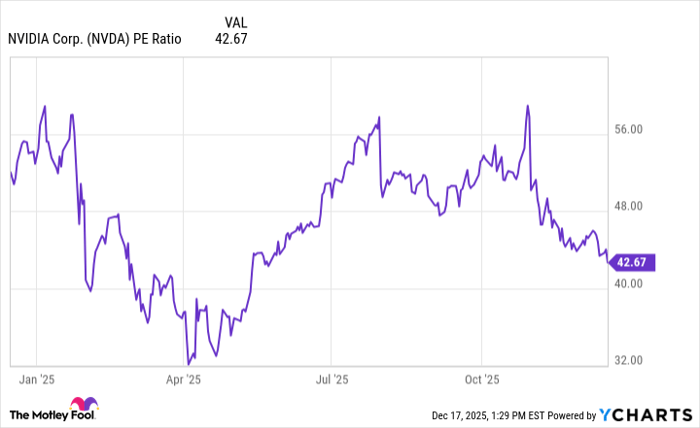

A valuation that is demanding

Another reason to be concerned about Nvidia's stock in 2026 is its demanding valuation. The stock currently has a price-to-earnings ratio (P/E) of 43, which is well above the market average at a time when the market's average P/E ratio is close to an all-time high.

What does this mean? Investors buying or holding Nvidia stock in 2026 need to expect strong earnings growth in the next few quarters. Nvidia is now one of the largest companies in the world by revenue, with incredibly strong profit margins. It cannot grow revenue at 62% year over year forever with over $50 billion in quarterly revenue; there is simply not that much capital in the world capable of making these large upfront investments into Nvidia computer chips.

Data by YCharts.

Will Nvidia stock crash next year?

It is impossible to have 100% certainty regarding Nvidia's stock price trajectory in 2026. If anyone did, they could become a millionaire rather quickly.

What an investor needs to analyze is how likely it is that Nvidia's stock crashes next year. Right now, spending on AI infrastructure is growing rapidly, which is leading to huge demand for Nvidia computer chips. But there are some signs of cracks showing up in the spending plans for players such as OpenAI, Microsoft, and Oracle. Microsoft is beginning to slow its plans for data center development. OpenAI is trying to spend hundreds of billions of dollars that it doesn't have today. Oracle is turning deeply free-cash-flow-negative to build out cloud computing data centers, and investors are not happy about it.

All of these variables point to risks for Nvidia's demand in 2026. Combined with its high P/E ratio and above-average profit margins, Nvidia stock could definitely crash in 2026. I'm not saying it is guaranteed to happen, but it is something that any Nvidia shareholder needs to consider as a possibility next year.

Should you buy stock in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $509,039!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,109,506!*

Now, it’s worth noting Stock Advisor’s total average return is 972% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 21, 2025.

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, Nvidia, and Oracle. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.