Should You Invest $1,000 in Oklo Right Now?

Key Points

Oklo is designing small, compact reactors that can supply continuous power to data centers.

The company is pre-revenue, yet is a large-cap stock.

Investing $1,000 is a high-risk, high-reward bet on the future of energy.

- 10 stocks we like better than Oklo ›

Oklo (NYSE: OKLO) has crushed the market this year.

After a lackluster 2024, in which it dropped more than 50% at the end of its first day of trading (May 10), Oklo shares went nuclear (pun intended) in 2025. At one point, the stock was up well over 700% on the year.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Since hitting about $193 a share in October, Oklo has fallen to just $83, as worries over an AI bubble have soured sentiment toward nuclear stocks.

With a pullback like that, an investment of $1,000 in Oklo stock might seem like an opportunity. Before you consider this pre-revenue start-up, though, it's worth weighing the bull case against the bear case.

Image source: Getty Images.

Oklo: Hype, or tomorrow's power?

The bull case for Oklo is easy to understand: AI needs round-the-clock power, and nuclear energy has the potential to supply it.

It can do this through its microreactor design, the Aurora powerhouse. Smaller and cheaper to build than traditional nuclear power plants, these powerhouses are expected to deliver up to 75 megawatts of continuous power. The reactor will be factory-built and assembled on-site to cut down construction time.

Oklo is targeting clients who need off-grid power, like AI data center operators. It has announced collaborations with big names in the field, such as Equinix, Vertiv, and Liberty Energy.

The bear case for Oklo is just as easy to understand.

The company has no revenue. More importantly, it lacks regulatory approval to operate its powerhouses commercially. While it's been making progress on that front (thanks to the Pilot Reactor Program), the lack of commercial revenue makes its current $12 billion market valuation seem outlandish.

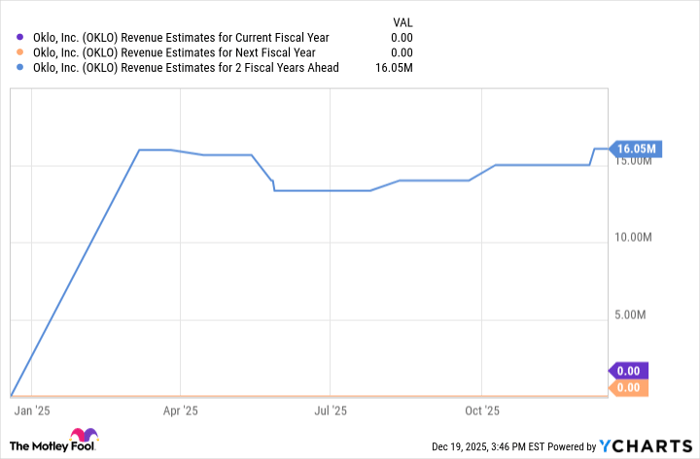

Sure, investors are betting on future cash flow in an era of AI. But with no revenue expected next year, and about $16 million projected for 2027, I'd expect Oklo to need a fresh cash injection (read: dilution) before it generates meaningful revenue.

OKLO Revenue Estimates for Current Fiscal Year data by YCharts

As such, a $1,000 investment in Oklo is best for money you can afford to lose.

Should you buy stock in Oklo right now?

Before you buy stock in Oklo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oklo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $509,039!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,109,506!*

Now, it’s worth noting Stock Advisor’s total average return is 972% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 21, 2025.

Steven Porrello has positions in Oklo. The Motley Fool has positions in and recommends Equinix. The Motley Fool has a disclosure policy.